ASML: Deep Dive Analysis

An Opportunity to Own The Monopoly That Powers Every Chip on Earth

Quick Summary & Investment Thesis

ASML is the indispensable "toll collector" for the global semiconductor industry, holding a virtual monopoly on the EUV lithography machines required to make the world's most advanced chips. The investment thesis is straightforward. A significant stock pullback has created a rare opportunity to buy this generational, wide-moat company at a fair price. While near-term headwinds from cyclical and geopolitical risks have created moderate pessimism, the long-term secular demand for advanced computing makes ASML a compelling "Growth At a Reasonable Price" (GARP) investment.

Key Investment Drivers

Unrivaled Moat (10/10). ASML has an absolute monopoly in EUV technology with almost-impossible barriers to entry, giving it immense pricing power and a durable competitive advantage that is arguably one of the strongest in the world.

Secular Growth Engine. As the key enabler of long-term mega-trends like AI, cloud computing, and advanced automotive, ASML is projected to grow faster (7-15% CAGR) than the overall semiconductor market (~6-7% CAGR) through 2030.

Financial Fortress. The company boasts stellar profitability (50%+ gross margins, ~30% net margins), extraordinary returns on capital (ROE ~58%), and a rock-solid, low-debt balance sheet.

Attractive Valuation. The recent correction has de-risked the stock, bringing its P/E ratio down to a reasonable ~26x (well below its historical average) offering a fair entry point for a premier asset.

Primary Risks

Geopolitical & Trade Tensions. This is the most significant risk. U.S.-led export controls to China (a market representing ~27% of recent sales) and the threat of new tariffs create major uncertainty and could cap near-term growth.

Industry Cyclicality. Despite long-term growth, the semiconductor industry is cyclical. A severe global recession could cause customers to slash spending, leading to a flat or down year for ASML, as management has already cautioned is possible for 2026.

Execution & Supply Chain. ASML's success depends on flawlessly executing its technology roadmap (especially for new High-NA EUV systems) and its reliance on critical single-source suppliers like Zeiss, making it vulnerable to disruption.

Hated Moats Verdict

Our Verdict: A confident "BUY" for patient investors with a 3-5+ year horizon.

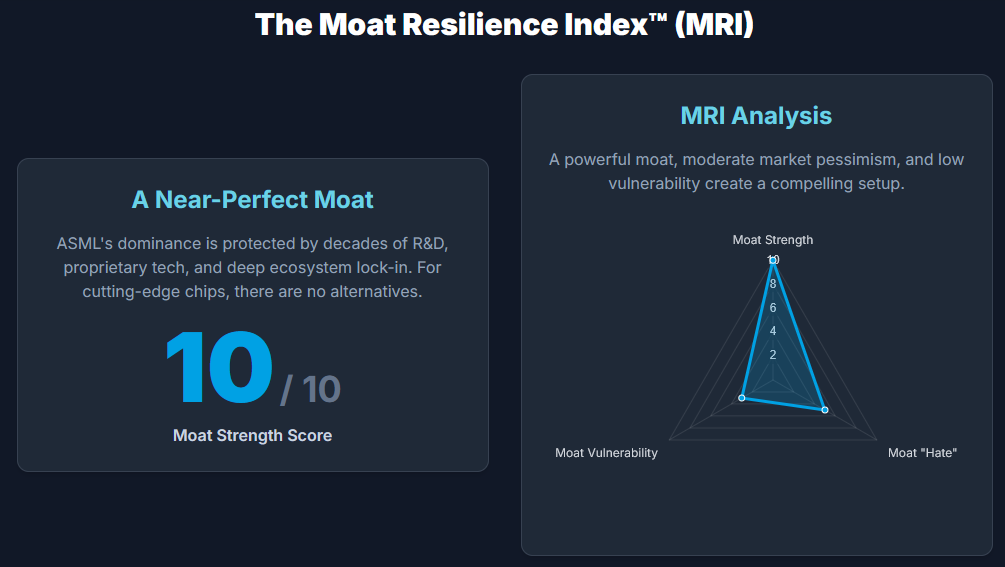

Our Market Resilience Index™ analysis (which scores Moat Strength, market 'Hate' (pessimism), and Moat Vulnerability) reveals a perfect 10/10 Moat Strengh, moderate “Hate" (5/10), and low Moat Vulnerability (3/10)—a highly attractive setup. ASML is the definition of a "wonderful company at a fair price."

Action: Our gameplan is to Initiate a position and Accumulate on any further weakness.

Price Target: Our base case scenario suggests a plausible price target of $900+ within 3-5 years.

The Deep Dive

Overview, Positioning and Competitive Moat

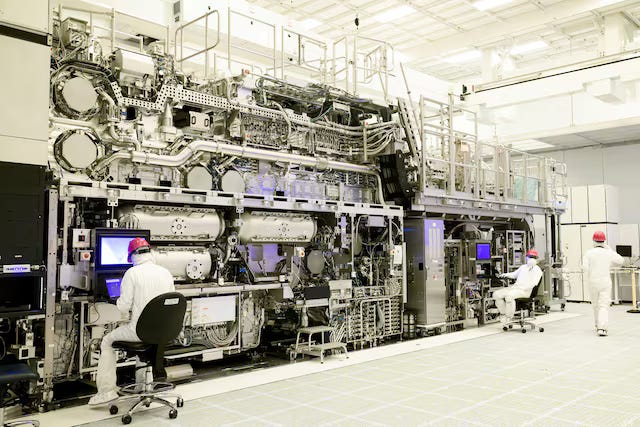

ASML is the world’s leading provider of photolithography systems – the machines that use light to etch microscopic circuits onto silicon wafers. Notably, it is the only company currently capable of producing EUV lithography tools for cutting-edge chipmaking. This near-monopoly on EUV technology is the cornerstone of ASML’s moat. EUV tools are extraordinarily complex (costing over $150 million each) and took decades of thorough R&D and tight collaboration with suppliers (like Germany’s Zeiss for ultra-precise optics) to realize. Competitors such as Nikon, Canon, due to its complexity, essentially gave up on EUV years ago, leaving the most advanced segment of the market for ASML to have it all. Even in the older deep-UV (DUV) lithography market, ASML holds a leading share. This technological lead and the massive barriers to entry confer ASML a world-class moat: high switching costs (chipmakers are deeply reliant on ASML’s equipment and support), network effects (an installed base of machines and ecosystem of resist/automation tuned to ASML’s tools), and a scale/R&D advantage that any new entrant would find nearly impossible to match. In short, ASML is the “toll collector” for any chip manufacturer trying to make the latest chips – a position few companies in any industry enjoy.

Positioning

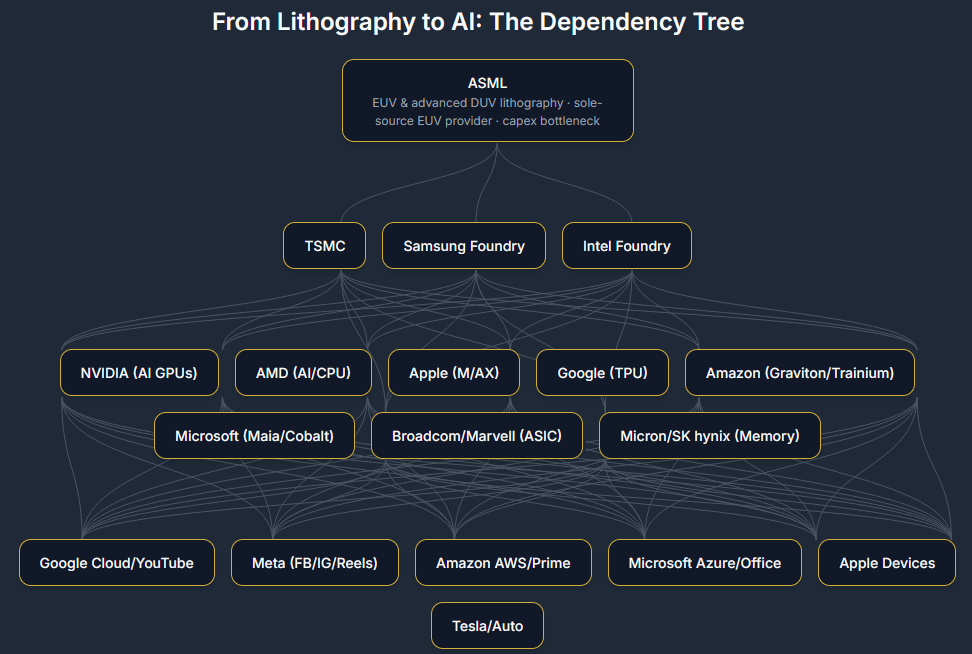

ASML sits at the apex of the silicon food chain, the non-substitutable gatekeeper for leading-edge lithography. Its EUV/advanced DUV tools are the bottleneck inputs TSMC, Samsung (and Intel Foundry) need to print the smallest nodes. From there, wafers become the chips that power AI and cloud: TSMC/Samsung fabricate NVIDIA/AMD accelerators and Apple/Google/Amazon custom silicon (TPU, Graviton/Trainium), which flow into hyperscalers (Google, Meta, Amazon, Microsoft) then on to the end apps you and I touch (Search, Reels, YouTube, Prime, Azure AI, ChatGPT,…). In short: ASML → foundries → chip designers/custom silicon → hyperscalers/platforms → end-user experiences. ASML is the irreplaceable “picks & shovels” toll collector enabling the entire stack and the entire AI gold rush.

Moat Strength

We would characterize ASML’s moat as extremely strong. On a scale of 1 to 10, it’s close to 10/10 in our “moat score” (more on this in the “MRI” section later). There are very few companies whose dominance in a critical technology is as absolute as ASML’s in EUV. Terms you most likely have heard of in connection with the AI boom - CPU, GPU, AI accelerator. They’re all made with technology by ASML. Every leading logic chip made at 5nm or below today has essentially “paid tribute” to ASML, since an EUV step was needed to manufacture it. This privileged position is protected by patents, trade secrets, and sheer engineering complexity – making it unlikely that hate or imitation could erode its moat in the foreseeable future.

Recent Stock Performance and Market Sentiment

The Glorious Days

ASML’s stock has experienced a roller-coaster in the past couple of years. It rode the semiconductor surge of 2020-2021 and the AI hype of 2023 to reach an all-time high of around $1,110 per share in mid-2024 (for context, this peak coincided with intense enthusiasm for anything AI-related). However, from that point on, the stock has undergone a significant correction. Over the 12 months leading up to April 2025, ASML shares had fallen roughly 33% from their four digits highs. By April 17, 2025, the stock was around $640, and even after a rebound, it remained well below the peak. This was time when I conducted majority of this analysis but our project Hated Moats didn’t exist just yet. All the text here comes from this time, revised and updated for what happened from that point on up until August 2025.

The July 2025 Shock

The most striking recent move came in July 2025, when the stock plunged nearly 7% (and the intraday drop was even more severe) in a single day following its Q2 2025 earnings release. So, what triggered this sell-off? The headline numbers of the quarter were solid (even better than expected actually) but management issued a cautious outlook that spooked investors. The company warned that it “cannot confirm” growth in 2026 due to increasing uncertainties, including macroeconomic factors and geopolitics (specifically the specter of renewed U.S. tariffs). ASML effectively retracted its prior growth forecast for 2026, introducing the possibility that sales could plateau that year, which was a negative surprise to a market used to steady growth. CEO Christophe Fouquet’s said: “While we still prepare for growth in 2026, we cannot confirm it at this stage.” In other words, after years of multi-year growth visibility, ASML was signaling a potential speed bump ahead.

It’s important to note that the quarter itself was quite strong: Q2 2025 saw net sales of €7.7 billion (up +23% YoY) and net income €2.3 billion (up +45% YoY), with gross margin reaching 53.7%. New bookings came in at €5.5 billion (well above expectations) and ASML maintained its full-year 2025 guidance of ~15% revenue growth (pointing to ~€30–€35B sales for 2025). Despite a strong Q2 2025, investors were spooked by a slightly weak Q3 forecast and uncertainty for 2026. Fears of renewed U.S.-China trade tariffs overshadowed the robust results, causing the market to focus on future risks instead of current performance.

Investor sentiment

The current sentiment could be described as nervous, with a cautious market quick to sell (or even over-react) on concerns over interest rates and geopolitics. However, many long-term investors and analysts (myself included) viewed the recent price dip as an overreaction and a buying opportunity in the spirit of our niche - Hated Moats - distinguishing short-term narrative fears from the company's strong fundamentals. This long-term confidence is supported by data. Short interest remains low, and major institutional holders have largely maintained their positions. The consensus among serious investors is that ASML is a solid, even if currently (but temporarily) out-of-favor, long-term asset.

In summary, market sentiment on ASML in mid-2025 can be characterized as: respectful of its quality but cautious about its near-term trajectory.

Fundamental Analysis

Growth and Profitability

Earnings Growth and Revenue

If we look past the quarterly noise, we can see the real story of ASML. It is one of a relentless growth machine that doesn't have an off-switch. While other tech companies ride the chip cycle rollercoaster, ASML just keeps printing money.

The numbers don't lie: sales jumped from €21.2 billion in 2022 to €27.6 billion in 2023 and €28.3 billion in 2024. Even in a tougher 2025, they're guiding for another 15% growth. How? Their backlog is a fortress and their moat is a 10/10. Customers order their irreplaceable tools years in advance, making ASML immune to the short-term panics that plague the rest of the industry. They grew through the 2019 downturn and the 2020 pandemic. And again, I wouldn’t call that cyclical strenght. That's MOAT.

Profitability & Memory Segment

The true test of a moat isn't just revenue growth. It's also the pricing power. And ASML's margins are a masterclass in it. Gross margins consistently sit in the 50%+ range (53.7% in Q2 2025), while net margins have expanded from ~26% in 2022 to a rock-solid ~30% nowadays. This isn’t a coincidence or luck, it’s the direct result of selling a mission-critical, monopolistic product. Customers pay high prices because the value an ASML machine unlocks is exponentially greater than its cost. That’s real, durable pricing power.

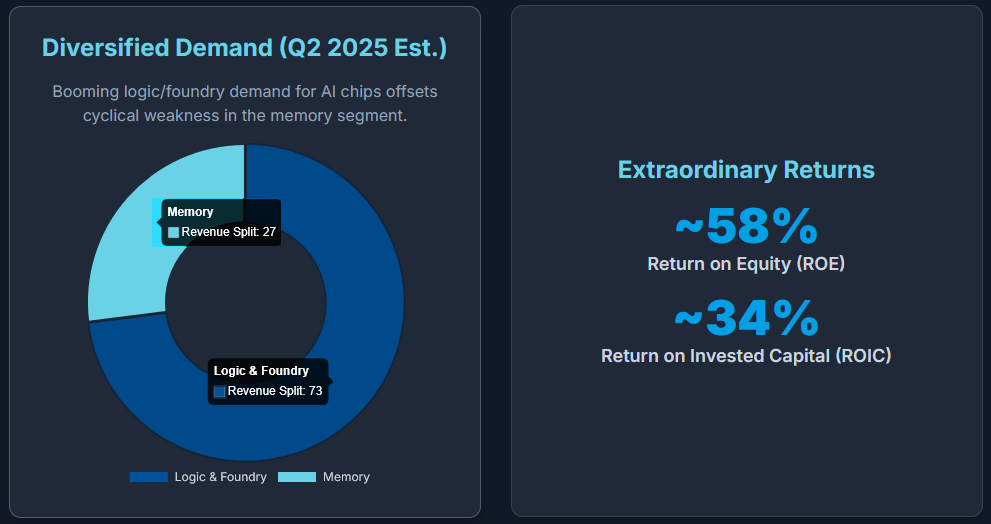

As far as stability goes, the headlines will scream about the memory segment, where sales cratered 41% YoY in Q2 as customers like Micron pulled back. But this is precisely where the moat's resilience is revealed. The downturn in memory was almost completely offset by booming demand from logic and foundry customers (TSMC and Intel) fueling the AI revolution. This diversification across different types of chipmakers acts as a built-in shock absorber, insulating the business from cyclical weakness in any single end-market.

Any lingering doubt about future demand is erased by the order book. New bookings of €5.5 billion in Q2, beating expectations, prove the long-term pipeline is as strong as ever. While one segment pauses, the others are already placing their orders for the future.

Long-Term Growth Outlook

ASML's long-term outlook signals compounding dominance. By 2030, the company targets €44 to €60 billion in annual revenue with gross margins expanding into the high 50s. This projected 7-15% annual growth rate is set to outpace the broader semiconductor industry's ~6-7% growth, proving its expanding moat and the pricing power of its next-generation tools. The forecast range simply bakes in different scenarios, from rapid tech adoption (e.g. of High-NA EUV) to potential geopolitical headwinds (loss of some China business or slower overall industry growth).

Profitability Metrics & FCF

ASML's return metrics are in a class of their own, significantly outperforming even strong peers like TSMC. This is driven by high profit margins and an efficient capital structure.

Return on Equity (ROE): An extraordinary ~58%.

Return on Invested Capital (ROIC): A very high ~34%.

Return on Assets (ROA): A strong ~16% for a manufacturer.

Over the long term, ASML's ability to generate cash is robust, though it can be inconsistent year-to-year due to the timing of payments and investments.

For instance, Free Cash Flow (FCF) hit a 5-year low in 2023 due to high capital expenditures and inventory buildups. However, it has since normalized, with the current FCF yield at a healthy 3.7% (implying a much-improved Price-to-FCF ratio of ~27).

The key takeaway is that over a full cycle (where an investor must be ready for discrepancies in timing of when customers pay and when inventory is procured and potential “shocking headlines”), ASML's high earnings reliably convert into free cash.

Valuation and Key Financial Ratios

As of mid-August 2025, following the stock’s pullback, ASML’s valuation multiples have come down to levels that, for a company of its caliber, could be considered fair to slightly high, but not excessive. Let’s break down the key ratios:

Price-to-Earnings (P/E): Currently at ~26x, which is near a five-year low and well below its historical average of ~40x. This suggests the speculative layer has been removed, placing its valuation on par with peers like TSMC.

PEG Ratio: At ~1.5, the stock is reasonably valued relative to its high growth prospects. While not a deep bargain, it indicates you're paying a sensible premium for a high-quality, high-moat business.

Price-to-Book (P/B): The ratio is high at ~14x, but this is a direct result of its extraordinarily high Return on Equity (ROE) of ~58%. The market rewards this incredible productivity with a premium book value.

Price-to-Sales (P/S): Currently ~7.7x, which is much more grounded than its peak of over 15x. The premium compared to peers (who trade at 4-6x) is justified by ASML's superior 50%+ gross margins and monopoly status.

Free Cash Flow (FCF) Yield: Now normalized to a healthy 3.7% (a P/FCF ratio of ~27), after a temporary dip in 2023. This yield is competitive with risk-free rates, implying the market expects strong future growth to justify the equity risk.

Dividend Yield: A modest but growing yield of ~1.0%. With a low payout ratio of just 22%, there is significant room for future dividend growth. The total shareholder yield (dividends + buybacks) is ~1.5%.

Debt & Balance Sheet: The balance sheet is a fortress. Debt is very low, with a Debt-to-Equity ratio of just 0.21 and a Debt/EBITDA ratio of ~0.3x. The company is conservatively financed, funding its growth internally rather than with leverage.

Margins: Best-in-class for an equipment maker. Gross margins are ~52%, and net margins are a robust ~30%, underscoring ASML's immense pricing power.

Efficiency Ratios: All metrics are healthy. The Current Ratio of 1.4 shows strong liquidity, while turnover ratios are normal for a business with long production cycles. No red flags are present from my point of view.

In short, ASML is currently valued as a high-quality growth company, not a speculative one. Its P/E ratio of ~26x is reasonable (below many US tech megacaps) suggesting the market has already priced in some of the near-term risk.

The investment thesis hinges on a simple duality: if you believe ASML can sustain its ~15% long-term growth, the current valuation is attractive. If you believe the fears for 2026 will materialize and growth falters, the multiple could fall further. This duality is what we’ll explore in out scenarios later.

Cash Flow and Capital Allocation

ASML's cash flow generation is strong, but its timing, as mentioned above, can be volatile due to significant swings in working capital. A key signal of its strength is its ability to operate with near-zero or even negative working capital on average. This means customers, through deposits and advance payments, often fund a portion of ASML's operations. That’s a powerful business advantage.

ASML's capital expenditure (capex) is manageable and highly efficient. While capex has risen recently to expand capacity for next-generation tools, it remains low relative to sales (under 10%). This is a key advantage over foundries like TSMC, whose capex can be up to 50% of revenue. ASML's lower capital intensity means more of its operating cash flow converts directly into free cash flow.

ASML also maintains a shareholder-friendly approach, balancing high R&D spending with significant cash returns. The company is executing a €12 billion multi-year buyback program, viewing repurchases as an opportunistic way to return capital.

In summary, ASML's financial foundation is rock-solid, ticking all the boxes of a premier company: high growth, high margins, strong cash generation, and a prudent balance sheet. The trade-off has always been its premium price. However, the recent decline has shifted the stock's valuation from "expensive growth" into a more attractive "Growth At a Reasonable Price" (GARP) territory. Did someone say “wonderful comapany at a fair price?”

Risk Factors

Delving into company filings (annual reports, 20-Fs, etc.), we find ASML’s management is candid about risks. Some key themes in the Risk Factors include:

Geopolitical & Trade Risks

The primary risk is the ongoing U.S.-China trade tension and the resulting export controls. The Dutch government has already restricted some advanced tool sales to China, a significant market that accounted for 27% of machine revenue in Q2 2025. The current uncertainty around potential new U.S. tariffs and Chinese retaliation could lead to painful and disruptive order deferrals.

Cyclical Semiconductor Demand

Despite strong long-term trends, ASML is not immune to the semiconductor industry's cyclical nature. A downturn in end-markets for chips (like PCs or memory) inevitably leads to decreased equipment orders. This creates volatility in growth rates, and management's current caution about 2026 is a direct acknowledgment that a "pause" or even a flat year is possible after a period of heavy customer investment.

Customer Concentration

ASML is heavily reliant on its top three customers: TSMC, Samsung, and Intel. A significant spending cut from any one of them would hurt quite a lot, creating uneven order patterns. This risk is partly mitigated, as a cut from one leading-edge player is often offset by a competitor stepping up to capture market share. That’s where ASML’s moat plays the strong part - “don’t really care who you are, if you need this, you come to me” kind of approach. It’s important to note though that it remains a source of volatility.

Supply Chain & Execution Risk

The company's intricate supply chain depends on single-source suppliers for critical components, most notably Zeiss for its advanced optics. Any disruption at a key supplier could halt ASML's production. Furthermore, with manufacturing concentrated in the Netherlands, operational incidents like a factory fire pose a tangible risk to meeting delivery schedules, especially as the company ramps up its new, more complex High-NA systems.

Technological Risk

The primary technological risk is not an external competitor, but the successful execution of its own roadmap. While a disruptive replacement for lithography is not on the horizon, ASML must flawlessly launch its next-generation High-NA EUV platform. Any significant delays or performance issues with this new technology could cause customers to defer purchases and impact future growth.

Intellectual Property (IP) & Competition

Competition from peers like Canon and Nikon is minimal, as ASML dominates advanced lithography with a ~90% market share. The primary risk is IP theft, which the company defends aggressively through legal action. ASML maintains its massive lead with heavy R&D spending of ~€3 billion annually. In potential competition, we cannot forget nor underestimate China and their rapid expanding of lithography development. While this is definitely something to keep an eye on, the estimates project the competition from China to be viable in tme horizon anywhere from 5 to 15 years from now.

Other

From my finings, I can recall possible currency fluctuation, as the company reports in euros but earns revenue globally. Other risks like interest rates and customer credit are minor due to a strong balance sheet and a blue-chip customer base. Legal and litigation risk is low. Aside from pursuing IP theft cases where it is the plaintiff, ASML has no major ongoing litigation and is considered a legally clean company.

Overall Risk Profile

ASML's management shows a clear awareness of its risks, which are primarily external (geopolitical, cyclical) or execution-based. The company is not financially fragile. Instead, it has a fortress balance sheet surrounded by a massive moat, both designed to withstand the unavoidable shocks of the industry. These are acceptable risks for an otherwise outstanding business.

Intrinsic Valuation and DCF-Based Perspective

Estimating ASML's intrinsic value using Discounted Cash Flow (DCF) models reveals a wide range, highly dependent on growth and risk assumptions:

Base-Case DCF Scenario:

Assume revenue grows at ~12% CAGR for the next 5 years (this is within ASML’s own long-term guidance range, and perhaps a tad conservative considering 2025 is +15% and AI could boost demand – but we account for a potential flat year in 2026, then reacceleration). This would take revenue from ~€30B in 2025 to ~€52.8B by 2030, which is near the midpoint of ASML’s €44–60B 2030 range.

Assume gross margins gradually rise to ~56% and operating margin to ~40% by 2030 (reflecting scale and high-NA EUV’s rich margins). Net margin could reach ~33-35%. For simplicity, say net income grows slightly faster than revenue, ~13-14% CAGR, due to margin expansion.

That would put 2030 net income around €15B+. Convert to free cash flow: ASML doesn’t require heavy incremental capex beyond depreciation (capex will grow but not as fast as revenue). So FCF could track net income closely. We’ll say FCF margin in steady state ~30%. That yields 2030 FCF perhaps ~€15B (on the optimistic side).

Discount rate: ASML is a large-cap with a beta somewhat above 1 (it moves more than the market at times). A reasonable cost of equity might be ~8–9% (assuming risk-free ~4%, equity risk premium ~5%, beta ~0.9–1.0 – ASML’s beta might be around 1 but its quality could arguably justify a lower risk premium). Let’s use 8.5% as a middle-ground discount rate.

Using a DCF, the sum of discounted FCF from 2025-2029 plus a terminal value (assuming after 2030 growth slows to, say, 3% and using that to compute terminal value at ~12× 2030 FCF, which is conservative) would give us the present intrinsic value.

Such a model would likely come out in the ballpark of $700–800 per share. Conservative models place fair value as low as ~$540, suggesting the stock is currently overvalued. If one assumes only moderate growth and a high discount rate, you’d get a fair value notably below the current price. But if you believe in ASML’s stronger growth trajectory (towards the higher end of its guidance) and consider that interest rates may not rise forever (thus discount rates could ease or at least not jump), then intrinsic value could be at or above the current price. The average analyst price target is more bullish at $863, implying significant upside from the current price.

The stock's current P/E ratio of ~26x is not demanding heroic growth;. It implies the market expects sustained, moderate earnings growth to continue. If ASML delivers on its long-term targets, the current valuation is justified. If growth stagnates, the stock is overpriced.

Valuation Summary

At its current price of ~$740, ASML trades between the conservative and optimistic valuation estimates. It is not a deep bargain but rather "a wonderful company at a fair price."

For a long-term investor, the stock appears to be near fair value or slightly undervalued, with the current price already factoring in a healthy dose of the known risks for 2026.

Our Scenarios (3–5 Year Horizon): Bull, Base, Bear Case

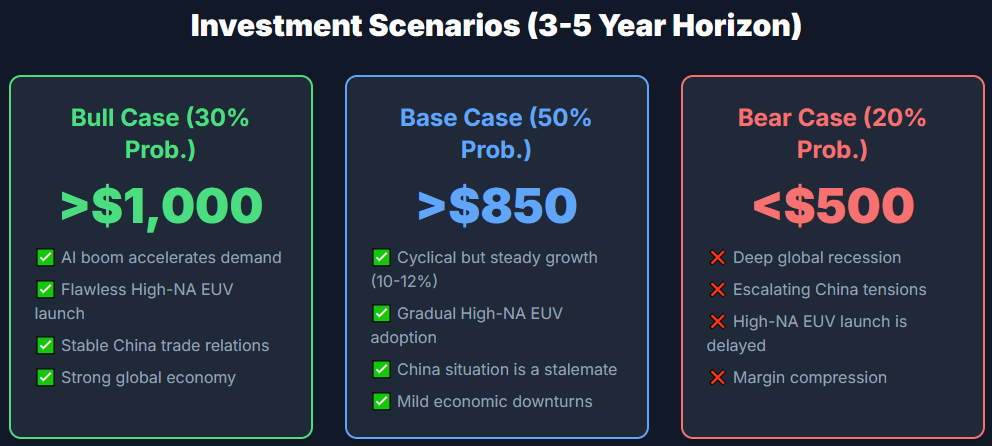

Predicting the future is always uncertain, but scenario analysis helps frame what has to happen for ASML to outperform or underperform. Below are our three scenarios – Bull, Base, Bear – with rough probability assignments and the conditions required for each to materialize. These scenarios consider a 3-5 year horizon (around 2028-2030), aligning with ASML’s strategic timeline (e.g., 2030 targets).

Bull Case (~30% Probability)

In the bull scenario, essentially everything goes right for ASML and the industry. This scenario assumes a sustained semiconductor supercycle where strong demand and flawless execution align, cementing ASML's position as an unbridled growth stock.

Key Assumptions

The positive outlook hinges on four main factors:

The AI revolution, alongside growth in cloud, EVs, and IoT, creates accelerated demand. Chipmakers aggressively expand capacity, pushing ASML’s annual sales growth into the high-teens or even 20%.

ASML's next-generation, high-priced machines (High-NA EUV, ~$300M each) are a smash hit upon their 2025/26 debut. This cements its technological monopoly through 2030 and significantly boosts profit margins. The launch needs to be flawless.

Trade tensions with China stabilize. While EUV sales remain restricted, ASML continues to generate substantial revenue by selling its other DUV systems to this crucial market without new tariffs or impediments. In other words, geopolitical envinroment will be stable.

The global economy avoids any severe recessions, interest rates stabilize, and the cyclical memory chip market recovers strongly, adding another tailwind to growth.

Financial Outcome

The financial result of this scenario would be phenomenal. ASML would likely achieve the high end of its 2030 guidance: €60 billion in revenue with gross margins expanding towards 60%. Our estimate is that in this scenario, price target could be well above $1,000 in the coming years.

Bottom Line: This scenario requires believing that the AI boom is a long-term supercycle, ASML can execute its technology roadmap flawlessly, and major geopolitical or economic disruptions are avoided.

Base Case (~50% Probability)

The base case is essentially ASML’s own expected trajectory with some ups and downs on the way, reflecting a balanced outcome. Here:

Key Assumptions

Growth is not linear bu rather cyclical. After a potential flat year in 2026, it resumes, averaging a solid 10-12% annually over the long term.

The next-generation High-NA EUV systems are adopted gradually as tech progresses steadily, without major hitches, and ASML maintains its technological dominance.

The situation with China remains a stalemate. Restrictions continue, but ASML successfully compensates for a declining China revenue share by increasing sales to the US, Europe, and other emerging regions.

The global economy experiences only mild, temporary downturns and moderate interest rates, while the long-term trend of chip demand remains firmly intact.

Financial Outcome

In this scenario, ASML would reach the midpoint of its 2030 guidance (around €45-50 billion in revenue) with low double-digit average EPS growth.

The stock would perform as a solid compounder, delivering an estimated 10-15% annualized return. This is driven by the steady earnings growth, partially offset by a stable or even slightly contracting P/E multiple (e.g., from 26x down to 22x). This path could see the stock price reach the $850-$950 range in the next 3-5 years.

Bottom Line: This outcome assumes ASML continues to execute well in a moderately growing but cyclical industry, making it a satisfying long-term holding without the explosive returns of the bull case.

Bear Case (~20% Probability)

This scenario envisions a "perfect storm" where multiple negative factors hit simultaneously, breaking ASML's growth story and causing a severe re-rating of its stock. This isn’t a doomsday (ASML is not likely to crater given its entrenched position), but it’s a scenario where the stock significantly underperforms expectations.

Key Assumptions

A deep economic downturn in 2025-26 results in gobal recession and causes chipmakers to slash capital expenditures. This leads to a halt in ASML's new orders and potentially declining revenue for a year or two.

Tensions with China escalate dramatically, resulting in the near-total loss of that market (historically ~20-25% of sales), a gap that other regions cannot immediately fill.

The launch of the next-generation High-NA EUV systems faces significant technical delays. The tougher economic environment also forces price concessions, causing gross margins to fall into the 40s%, crushing profitability.

Financial Outcome

The result of this perfect storm would be a broken growth story. Revenue could stagnate for years, barely reaching €35 billion by 2030. With earnings declining, the market would no longer see ASML as a growth stalwart but as a low-growth cyclical, causing a severe P/E multiple compression down to 15-20x.

This could drive the stock price down into the $500s or even a worst-case trough near $360. While the company itself would survive due to its moat, the stock would significantly underperform the market for years.

Bottom Line: This scenario requires a combination of a major global recession and a severe geopolitical shock. It would transform ASML from a growth darling into an out-of-favor cyclical stock.

Summary of Our Scenarios

The bull and bear cases are kind of bookends. One has ASML doubling its earnings by 2030 and stock well past $1000, the other has earnings flatlining and stock maybe half of current. The base case is somewhere in the middle, leaning closer to bull than bear because of ASML’s strengths.

Now, how should an investor position given these scenarios? That comes down to one’s confidence in ASML’s moat enduring (which is high) versus short-term external risks (which are real but manageable). This leads us to examine the Moat Resilience Index (“MRI”) of the company.

Moat Resilience Index™ (MRI) Analysis: Moat Strength, Hate & Vulnerability

The MRI framework here refers to evaluating a company’s Moat (sustainable competitive advantage), the degree of Hate or pessimism the stock faces (contrarian opportunity), and its Vulnerability (exposure to factors that could erode the moat or performance). Here’s our ASML’s MRI diagnosis:

Moat Strength: 10/10 (Extraordinarily Strong)

ASML's moat is a near-perfect 10. The company operates as a virtual monopoly in EUV lithography, protected by insurmountable barriers to entry. This advantage is rooted in decades of cumulative R&D, proprietary technology, and a deep ecosystem lock-in with both customers and suppliers.

ASML’s moat is like a critical toll bridge for the entire semiconductor industry, its strength is proven by its immense pricing power and the fact that for the leading edge, there are no viable alternatives. The moat has only expanded as the industry has advanced into the EUV era.

"Moat Hate" (Sentiment): 5/10 (Moderate)

Market sentiment has shifted from universal love to healthy skepticism. A year ago, this score would have been near zero. However, after a significant stock pullback and rising concerns about 2026 growth, athe sentiment experienced a shift.

The market still deeply respects the moat and no one doubts the company's dominance. But it's no longer willing to pay any extra price for it. This is, even though it might seem otherwise, a healthy middle ground. The stock isn't dangerously euphoric, providing a more reasonable entry point for long-term investors to capitalize on the moderate, short-term pessimism.

Moat Vulnerability: 3/10 (Low)

The moat is robust, but not invulnerable. While direct competition is a non-threat, there are three low-probability but notable vulnerabilities:

Geopolitical Intervention: Governments can wall off major markets (as seen with China), which doesn't break the moat but limits its reach and profitability. Geopolitical intervention thus can pose a vulnerability not of the moat itself, but t its execution.

A distant, long-term risk is a technological paradigm shift where a new technology (like advanced chip stacking) could reduce the need for the absolute most advanced lithography.

ASML's success is tied to a few key customers (like TSMC) concentrated in a geopolitically sensitive region so the whole ecosystem can be rather fragile. A crisis impacting them would inevitably impact ASML.

Summary

ASML's MRI profile is highly attractive. A powerful moat provides a foundation of quality, moderate market skepticism offers a reasonable price, and its vulnerabilities are low-probability. This creates a compelling setup where a great company can be bought at a fair price while others are moderately fearful.

Conclusion

Investment Verdict

Our final verdict is a confident "BUY" for long-term, patient investors with a 3+ year time horizon.

Taking all factors into account (fundamentals, valuation, risks, and scenarios) our stance is that ASML is a high-quality business trading at a fair (and possibly slightly attractive) price, making it a Buy for long-term investors. This is aligned with a Warren Buffett style view:

“It’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price.”

ASML is indeed a wonderful company, and while its price isn’t deeply discounted, the recent decline has removed a lot of overvaluation.

Disclaimer & Our Investment

Please note that this is not a financial advice and our disclaimer in holding position is as follows: Owning shares since April 22nd 2025 at avg. price of $639.43.

Since our April buy ASML is ~17% higher around $747–748 as of date of publishing this article, with the multiple back to mid-20s (TTM P/E ~26.6 vs ~25 then), and the story is now dominated by July’s “can’t confirm 2026 growth” warning tied to tariff/geopolitical uncertainty, despite a strong Q2 print. April, when we entered a position, offered the better margin of safety (cheaper entry, fewer known landmines), so it screened closer to a “strong buy” back then. Today’s set-up is still quality at a fair price, but with added macro/policy overhang that tempers near-term upside. In other words, April was the better risk-reward, now it’s a patient Buy/Hold play.

Final words

ASML represents a unique blend of quality and growth. For patient investors, the recent moderation in price presents an attractive opportunity to own a piece of the critical infrastructure powering the future of technology. This is not a short-term trade. Our verdict (and gameplan) is to initiate a position and accumulate on any further weakness. For those who already own it, this is a firm Hold & Buy during dips (depending on one’s avg. price) with confidence that its intrinsic value and moat will compound and eventually be recognized by the market.

Price Target: Our base case scenario suggests a plausible price target of $900+ within 3-5 years, offering solid returns from the current price, complemented by a growing dividend.