Quick Summary & Investment Thesis

Key Investment Drivers

Massive Growth Runway. Riding the powerful secular tailwind of e-commerce and digital payments adoption across emerging markets, with revenue growth re-accelerating to ~50% YoY.

Exceptional Profitability. Unlike many cash-burning fintechs, dLocal is a cash-generating machine with mid-teens net margins, strong free cash flow, and a solid balance sheet.

Durable Moat. A moderately strong moat built on network effects, high switching costs for enterprise clients, and deep, hard-to-replicate local regulatory and payment integrations.

Aligned & Strengthened Management. High insider ownership, significant open-market buys from founders, and credible leadership from CEO Pedro Arnt (ex-MercadoLibre CFO) inspire confidence.

Primary Risks

Emerging Market Volatility. The business is fundamentally tied to the volatile political, regulatory, and currency environments of its 40+ operating countries. A crisis in a key market is the single biggest risk.

Reputation Fragility. Lingering market skepticism from past allegations, evidenced by a high short interest (~26% of float), makes the stock highly sensitive to any new negative headlines, whether true or not.

Intense Competition. The global payments space is highly competitive. Increased focus from giants like Stripe and Adyen or regional specialists could pressure dLocal's growth and take-rates over time.

Hated Moats Verdict

dLocal is a quintessential "Hated Moat" investment. The company possesses a durable competitive advantage (Moat Strength: 7/10) that is currently obscured by a significant degree of market fear and skepticism (Moat Hate: 6/10). We believe the disconnect between the company's powerful fundamentals and the market's lingering caution creates the opportunity. With a Moat Score of 65% (estimated probability of outperforming the S&P 500 over the next 5 years), our verdict is a BUY for patient, long-term investors who can tolerate the inevitable volatility.

The Deep Dive

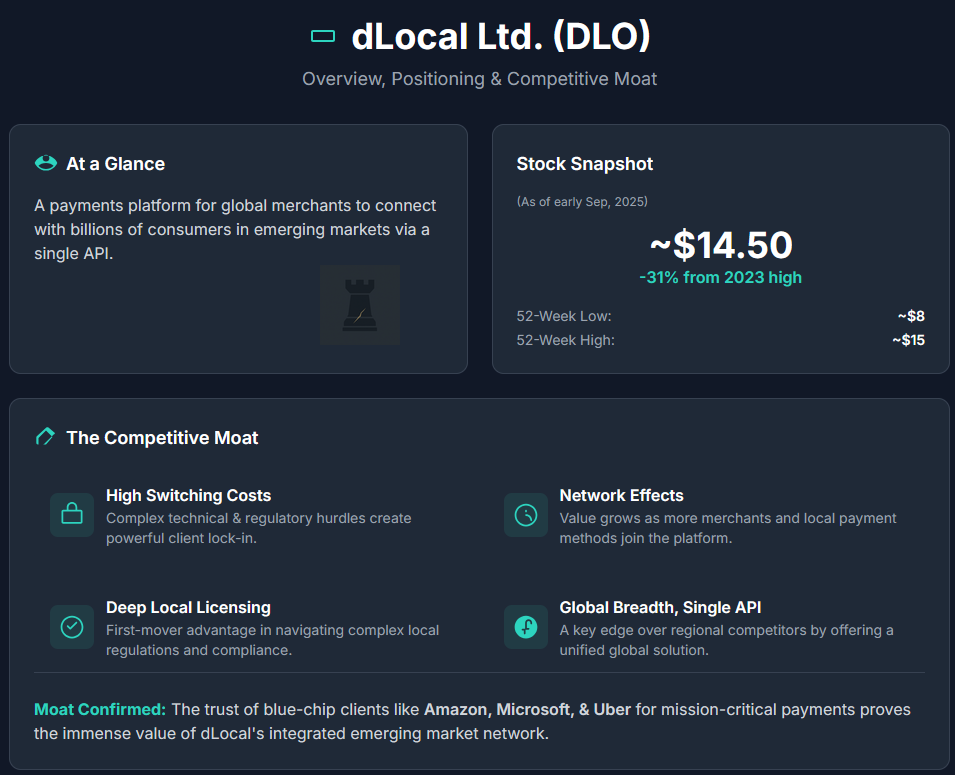

Overview, Positioning and Competitive Moat

DLocal Limited (“dLocal”, DLO 0.00%↑ ) is a payments platform enabling global merchants to connect with consumers in emerging markets. Founded in 2016 and now operating in over 40 countries across Latin America, Asia-Pacific, the Middle East, and Africa, dLocal provides a one-stop solution (“One dLocal” concept) so that enterprise clients like Amazon, Microsoft, Uber, Spotify, and others can accept local payment methods and send payouts via a single API and contract. This simplifies the complexity of dealing with myriad local processors, regulations, and currencies in each market, giving dLocal an interesting value proposition for large online businesses expanding in emerging economies.

Competitive Moat

DLocal’s moat stems mainly from its network and integration advantages. By aggregating “billions of emerging market consumers” and dozens of local payment options onto one platform, dLocal achieves scale and network effects that make its service increasingly valuable as more merchants and payment methods join. The switching costs for a global merchant to replicate dLocal’s local connections (e.g. integrating separate acquirers and complying with each country’s rules) are high, which reinforces client stickiness. Moreover, dLocal’s deep local licensing (recently adding licenses in UAE, Turkey, and the Philippines - all large markets) and product innovations (like Brazil’s SmartPix, BNPL integrations, stablecoin on/off ramps) indicate a focus on staying ahead of the competition, especially technologically. While the payments industry is competitive (with players like Adyen, Stripe, and regional processors), dLocal’s first-mover reach in underserved markets and its portfolio of blue-chip clients suggest a meaningful and strong moat. The company is positioning itself as the go-to gateway for emerging market transactions, a niche that competitors may find difficult to penetrate at the same breadth and depth.

While global giants like Stripe and Adyen are formidable, their platforms are primarily optimised for developed markets. Their expansion into emerging economies often lacks the deep, hyper-local focus on the long tail of alternative payment methods (like cash vouchers or specific local bank transfers) that dLocal specialises in. A more direct competitor, particularly in Latin America, is EBANX. While EBANX has deep regional expertise, dLocal’s key differentiator is its global breadth under a single API. For a merchant like Microsoft, using dLocal provides a unified solution for Latin America, Africa, and Asia, whereas a regional specialist would only solve one piece of the puzzle.

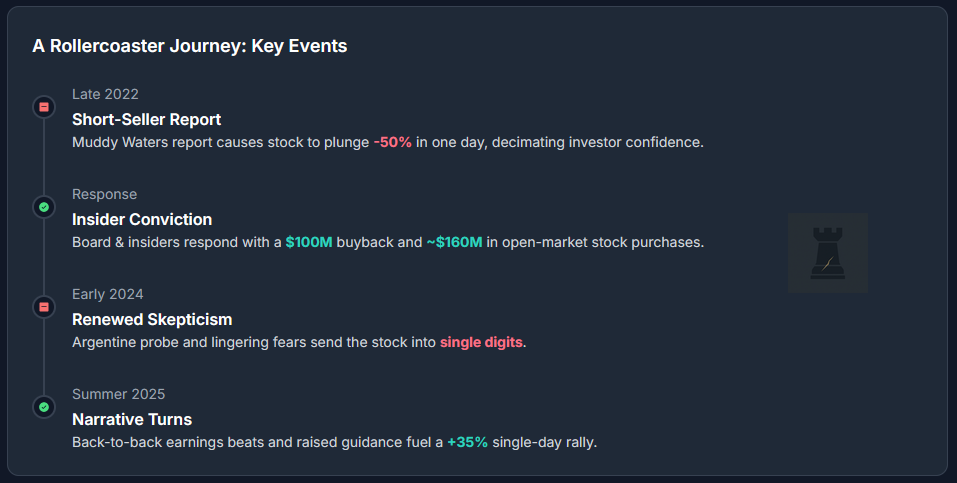

Recent Stock Performance & Market Sentiment

There’s no other way to put it but plainly - volatility has been extreme. DLocal’s Nasdaq-listed shares have seesawed in response to both fundamentals and controversy. In late 2022, when the stock was already down over 60% from its all-time-highs, it plunged over 50% in one day after short-seller Muddy Waters published a report accusing dLocal of being “likely a fraud” and questioning its growth and handling of client funds. This collapse (to around ~$10 from the high teens/low 20s) decimated investor confidence. In response, dLocal’s board and major investors took bold steps. They announced a $100 million share buyback and insiders (including General Atlantic and the co-founders) buying ~$160 million of stock on the open market to show conviction. These actions, along with dLocal’s continual posting of strong growth, fueled a dramatic rebound. By August 2023, the stock surged 30%+ in one day to over $20 on news that dLocal hired respected ex-MercadoLibre executive Pedro Arnt as co-CEO, on top of posting 59% YoY revenue growth that quarter.

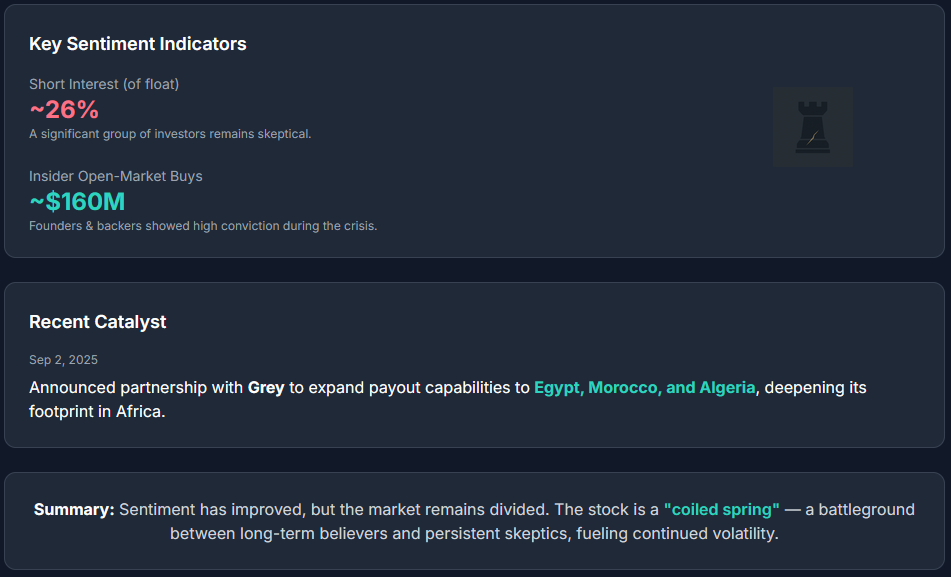

However, this exuberance didn’t last too long. In late 2023 and early 2024, shares tumbled again. This time after an Argentine regulator opened a probe into dLocal (related to foreign exchange controls) and amid broader investor skepticism. The stock fell into single digits (~$7–8 by Q1 2024), reflecting lingering fears about emerging-market risks and the overhang of the short-seller allegations. Market sentiment was plainly skittish, as dLocal was an “unloved” growth stock with heavy short interest betting against it. Indeed, to this day short interest comprises ~26% of the public float, indicating that a significant group of investors remains skeptical (or is positioning for a potential short-squeeze, depending on whom you ask). Some contrarian analysts have pointed to dLocal’s combination of high growth and high short-interest as a recipe for a squeeze-driven rally - essentially, a coiled spring if the company can continue proving the naysayers wrong.

Recent rally

In the summer of 2025, a year after hitting its lows, dLocal’s narrative appeared to turn a corner. The company delivered back-to-back earnings beats, culminating in Q2 2025 results that smashed expectations. Revenue grew ~50% YoY to an all-time high $256.5 million (beating consensus by ~$30 million), with EPS of $0.14 edging past estimates. This momentum, plus an outlook raise, sent the stock up ~35% in a single day to ~$15, its sharpest intraday gain in four years. As of late August 2025/early September 2025, dLocal trades around $14–15/share, up roughly 80% from its lows earlier in the year, yet still well below its post-IPO highs.

Bolstering this positive narrative, dLocal announced a significant strategic expansion on September 2nd, 2025. The company has partnered with fintech platform Grey to enhance its payout capabilities across North Africa, specifically targeting Egypt, Morocco, and Algeria. This move allows global merchants using dLocal to send payments directly to local bank accounts and mobile money wallets in these key markets. The partnership shows dLocal's continued execution on its geographic expansion strategy and deepens its footprint in Africa, a critical high-growth region.

In summary, sentiment has improved from the darkest days. The market is rewarding dLocal’s execution, but caution persists. The stock’s rollercoaster over the past three years (from market darling, to embattled target, to recovering contender) means investors remain divided, with a contingent of shorts and skeptics on one side and long-term believers (including insider-owners) on the other. This dynamic could continue to fuel elevated volatility in the near term, as each new data point (earnings beat or miss, new investigation or exoneration, macro news, etc.) swings the pendulum of sentiment.

Fundamental Analysis

Growth & Profitability

DLocal’s growth profile is outstanding. The company has compounded revenue at a high level, even amid the turbulence. In the latest quarter, Total Payment Volume (TPV) grew +53% YoY (to a record $9.2 billion in Q2 2025) and revenue grew +50% YoY (to $256 million). This marks the third consecutive quarter of 50%+ YoY revenue growth, signaling a re-acceleration after a dip in 2024. Growth is the result of the key markets Brazil and Mexico rebounding strongly, while “the rest of geographies” grew even faster, indicating diversification is improving. For full-year 2024, revenue was $746 million (up ~15% YoY), and the company’s updated 2025 guidance goes for $970 million–$1.0 billion in, which implies ~30% YoY growth at the midpoint, likely a conservative figure given the recent 50% pace (possibly allowing for macro uncertainties and tough comps).

Profitability has likewise been impressive for a high-growth fintech. DLocal operates a high-margin model, taking a cut (take-rate) of TPV with relatively low incremental cost. Gross profit margins are ~39% as of Q2 2025, and importantly, the company has managed to expand its adjusted EBITDA margin for five consecutive quarters. In Q2, Adjusted EBITDA was 71% of gross profit – meaning roughly 28% of revenue flowed through to adj. EBITDA. This indicates that as volumes scale, their expenses (personnel, tech, compliance) grow much more slowly. Net income has been a healthy proportion of sales as well, though with some quarterly noise. In Q2 2025, GAAP net income was $43 million, which was actually down from the prior year due to an $10 million hit from the Argentine peso’s devaluation (the company holds some ARS-denominated bonds as required local collateral; excluding that currency loss, net income would have been ~$53 million).. On a normalized basis, dLocal’s net profit margin is in the mid-teens (trailing twelve-month net margin ~16–17%. Such margins are enviable for a company growing this fast. To us, this speaks to a scalable platform with disciplined cost management.

Also notable is the consistency of earnings. Despite the volatile external events, dLocal has remained profitable every quarter. Earnings per share (EPS) over the last four quarters sum to $0.48. While EPS growth paused in 2024 (due to higher investments and some FX hits), analysts expect earnings to resume an upward trajectory. Consensus sees EPS rising ~21% to $0.57 in 2025. DLocal’s management emphasises that their model is “high growth, expanding margin, and healthy free cash flow”. So far, objectively, the numbers are backing that up.

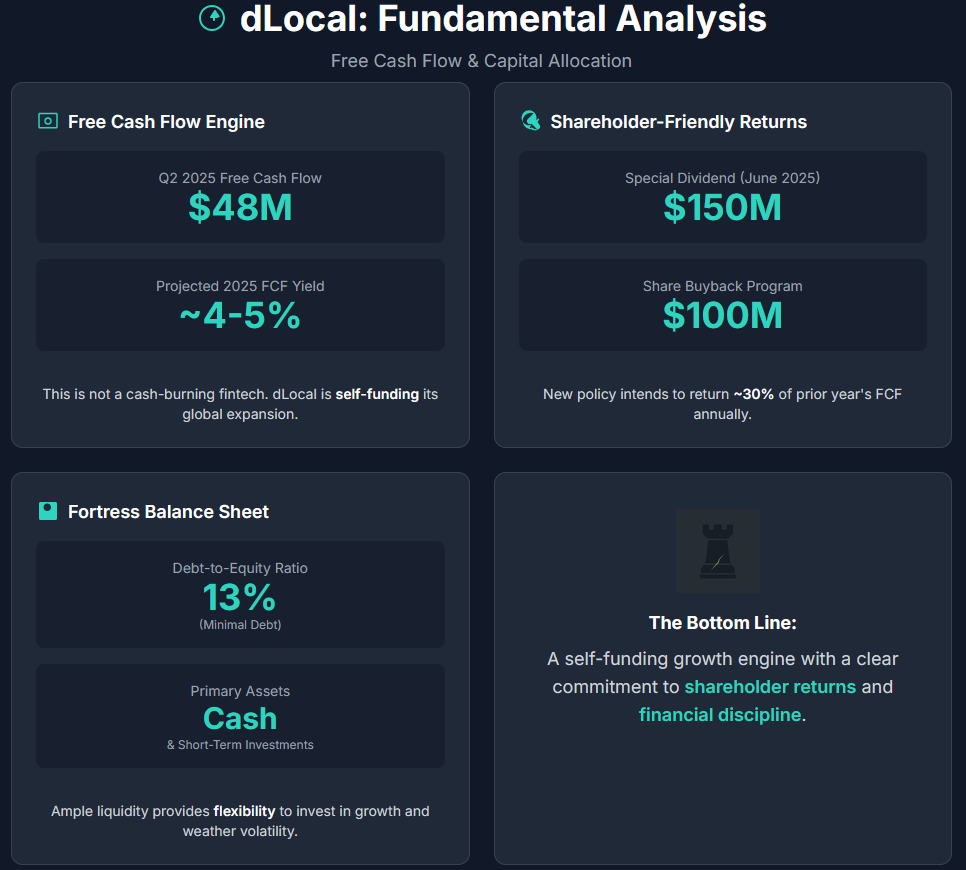

Free Cash Flow & Capital Allocation

Free Cash Flow (FCF) generation is strong and increasingly a focus for management. In Q2 2025, dLocal produced $48 million in free cash flow, roughly matching its GAAP net income, which indicates high earnings quality (low working capital drag and modest capex). For the full year 2024, operating cash flow was similarly robust, and with low capital expenditure needs (dLocal’s business is asset-light, mainly cloud infrastructure and R&D), the company converts a significant portion of EBITDA to FCF. FCF yield at the current market cap (~$4.3 billion) is around 4–5% (projecting ~$180–200M FCF for 2025), which is quite attractive given the ~50% topline growth rate. This combination of growth and cash generation is a key part of the bull case (see below). This is not a cash-burning fintech. dLocal is self-funding its expansion and preserving healthy financials on its way.

dLocal's approach to capital allocation has taken a shareholder-friendly turn. In a move that defies the typical growth company playbook, the company initiated a dividend with a significant $150 million payout in June 2025. Management also intents to return approximately 30% of the prior year's FCF to shareholders annually. This policy, combined with a $100 million share buyback authorized in late 2022, projects strong confidence in future cash generation. Critically, it also serves as a direct rebuttal to detractors who had questioned the company's cash management, proving dLocal is committed to balancing disciplined growth investment with tangible shareholder returns.

The balance sheet is very solid. DLocal carries minimal debt – approximately only 13% debt-to-equity. The company’s asset base is largely cash and short-term investments (some of which are held to meet regulatory requirements in certain countries). With ample cash on hand and consistent FCF, liquidity is not a concern. This financial strength gives dLocal flexibility to invest in R&D and geographic expansion, while also weathering any emerging-market volatility (e.g. currency swings or working capital timing issues) without needing external capital.

Valuation & Key Financial Metrics

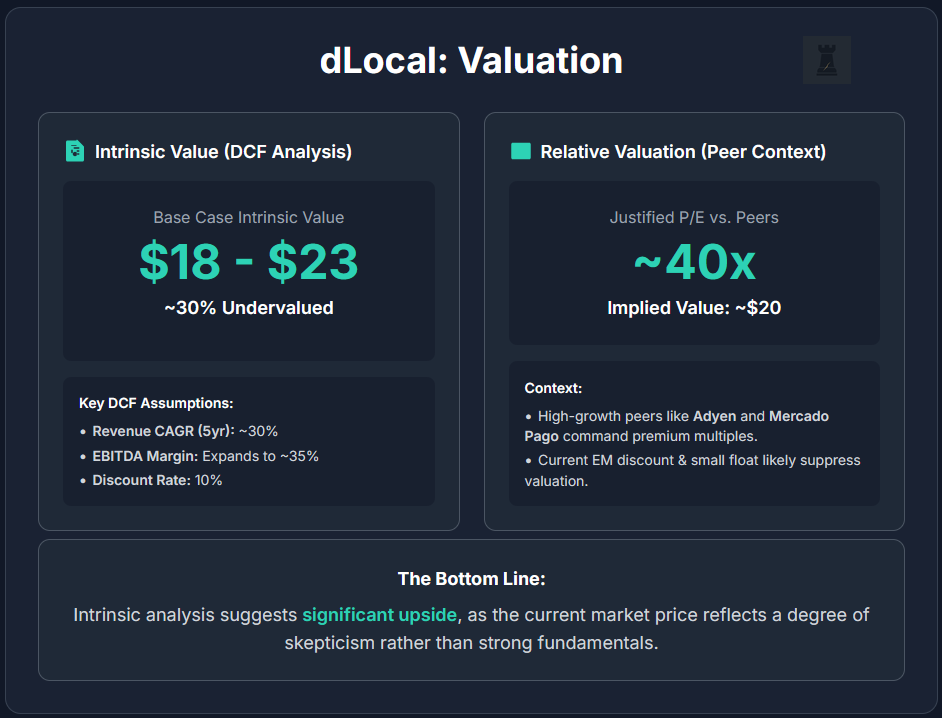

Intrinsic Value & DCF

To assess dLocal’s intrinsic value, let’s consider a discounted cash flow (DCF) approach alongside a multiples view. Given the company’s guidance and market opportunity, a plausible Base-case scenario could be: revenue grows at ~30% CAGR for the next 5 years (starting from ~$1B in 2025 to ~$3.7B by 2030), gradually decelerating thereafter. Adjusted EBITDA margins expand from ~28% of revenue currently to ~35% in five years (as scale reduces cost ratios), and dLocal continues to convert ~80-90% of net income to free cash flow. Using a 10% discount rate (reflecting somewhat higher risk premium for emerging-market exposure) and a terminal growth of ~4%, this DCF yields an intrinsic equity value in the high-teens to low-$20s per share. That suggests the stock is undervalued by roughly 30% at present time.

Even a more conservative DCF (assuming 25% growth and slight margin expansion) tends to produce a value around $15–$17, basically around or above the current price. The upside optionality is significant. if dLocal can sustain near-50% growth for a few more years (the Bull case scenario), or if it achieves a higher steady-state margin (given the platform economics, EBITDA margins could potentially reach 40%+ long term), the DCF valuation moves much higher – possibly mid-$20s or beyond. On the flip side, key DCF sensitivities include the discount rate (if one uses a very high required return due to country risk, say 12%, the present value comes down a few dollars per share) and growth longevity (if growth were to suddenly drop to 10% in a few years, the valuation would compress). We will discuss such risk cases shortly.

Cross-checking with comparables

If dLocal was valued at multiples similar to high-growth payment peers, there is room for expansion. For instance, Adyen (after its recent crash) trades around 10x sales for mid-20s growth. MercadoLibre’s payments segment (Mercado Pago) is embedded in MELI’s valuation at high multiples due to its growth. If dLocal continues executing, one could argue for a P/E in the 40s given 30%+ growth and 20%+ ROE – which would put the stock around $20 (40x $0.50 EPS). Blended analyst models that factor in a bit of DCF and a bit of multiple comparisons seem to land in the high-teens as a fair value. It’s also worth noting that the small float and emerging-market discount have likely kept valuation in check. Should dLocal prove its resilience and perhaps seek a U.S. domestic listing or larger float over time, that discount could narrow.

In summary, our intrinsic valuation analysis indicates meaningful upside from today’s price, provided the company delivers on expected growth. The current market price reflects a degree of skepticism (understandable given the past), but if dLocal’s fundamentals continue on the current trajectory, the valuation could re-rate higher. Long-term investors with a 3-5 year horizon might find substantial value creation as earnings compound. (In fact, if one extrapolates 5-year EPS growth of ~25% and a terminal P/E ~20x, the stock could roughly double over that period in a Base case.) On balance, the risk/reward skews favorably for value-conscious growth investors.

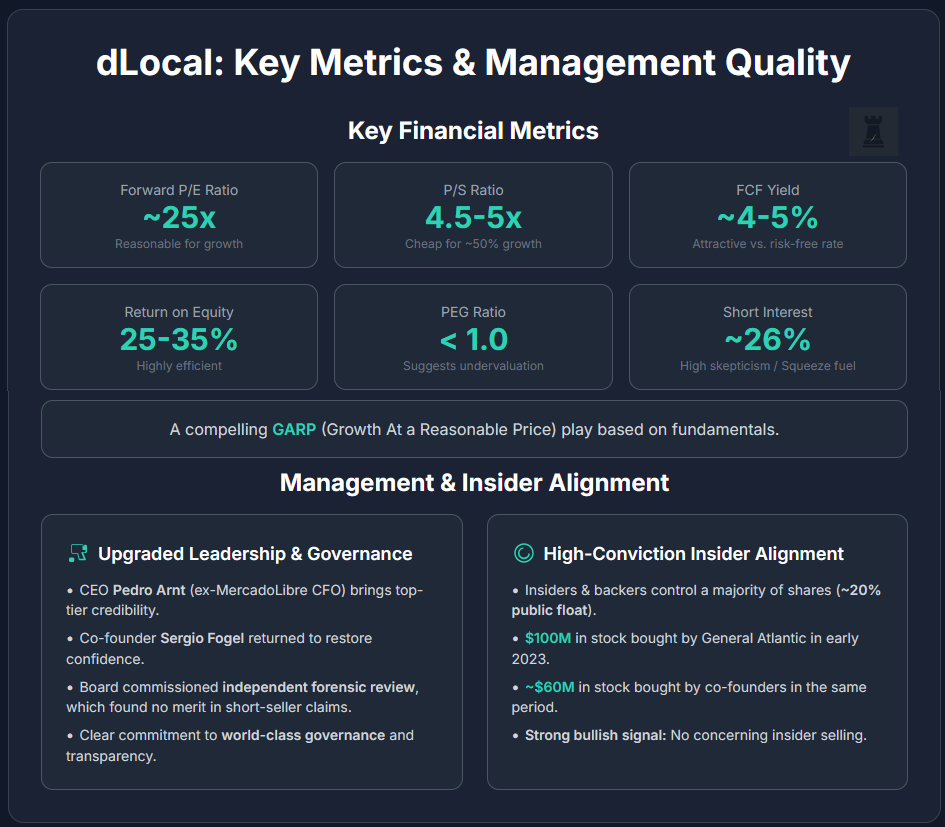

Key Financial Metrics

Even after the recent rally, dLocal’s valuation appears reasonable relative to its growth. At ~$14.5 per share, the stock's trailing P/E is ~30x (based on ~$0.48 TTM EPS) and its forward P/E is ~25x (on ~$0.57 FY2025 estimated EPS), comparable to peers like Visa (~31x), Mastercard (~38x), and Adyen (in the 20s). The price-to-sales ratio is 4.5–5x (on ~$746M LTM revenue and a ~$4.3B market cap), which is arguably cheap for its ~50% growth rate, especially when slower-growing firms like Block or PayPal trade at 2–4x sales. While its price-to-book ratio is high at ~6x (book value ~$450–500M), this is justified by its asset-light model and a robust ROE of 25–35%. Capital efficiency is further demonstrated by its ROA of ~9–10% and a net margin of ~17%.

Looking at some other metrics: the stock carries no dividend yield on a recurring basis yet (the 2025 special was one-time, with future annual payouts to be determined). PEG ratio (P/E to growth) depends on what growth rate one assumes – using the consensus of ~20% EPS growth gives PEG ~1.3–1.5, but if one believes dLocal can sustain closer to 30–40% earnings growth (more in line with revenue trajectory), the PEG would be well under 1, suggesting undervaluation. Free cash flow yield is ~4% as noted, which is quite attractive versus a 10-year Treasury yield (~4% in 2025) given dLocal’s growth (the equity risk premium here seems favorable).

Short interest of ~26% of float also effectively means the market has a sizable built-in “short position” that could unwind if fundamentals stay strong. This could serve as a valuation catalyst: a gradual short-covering can boost the stock (basically a moderate short squeeze), or conversely, persistent shorting can cap the multiple.

In summary, valuation appears undemanding for a business with dLocal’s growth, margins, and moat. Our intrinsic value estimate (via a standard DCF model) implies ~30–40% upside from current levels. This assumes continued high growth and margin expansion – which, while not guaranteed, is aligned with management’s outlook and recent performance. Thus, from a fundamentals perspective, dLocal offers a blend of growth and profitability that is seldom found at a sub-30x earnings multiple, making it a potentially compelling GARP (growth at a reasonable price) play.

Management Quality and Insider Activity

dLocal has made substantial upgrades to its management and governance. The appointment of Pedro Arnt, the former CFO of MercadoLibre, as CEO in 2023 brought in top-tier fintech experience, leading to improved transparency and shareholder communication. His leadership was complemented by the return of co-founder Sergio Fogel as co-President and Chief Strategy Officer, a move designed to restore investor confidence. This blend of a seasoned outsider and a committed founder strengthens the company and its vision. Critically, the board addressed past short-seller allegations head-on, commissioning an independent forensic review that ultimately found the claims to be without merit. By taking these steps, adding independent directors, and adhering to U.S. SEC reporting standards, dLocal is demonstrating a clear commitment to maturing its corporate governance to a world-class level.

One could say management learned some hard lessons from the short-seller episode – since then, they’ve been more proactive in communications and risk management (for example, providing more clarity on client fund segregation and cohort reporting methodology). The interim CFO (as of Q2 2025, a new permanent CFO search is likely underway) and the investor relations team have been fairly transparent about challenges (like the ARS currency hit). All told, current management seems high caliber and shareholder-conscious, which bodes well for executing the growth plan and navigating risks ahead.

Insider ownership at dLocal is high, strongly aligning management with shareholders. Co-founders and early backers like General Atlantic control a majority of the company, leaving a small public float of only ~20%. While a low float can increase volatility, the alignment of incentives has been powerfully demonstrated. Following the stock's collapse, key insiders made significant open-market purchases in early 2023. General Atlantic bought $100M of stock, while co-founders and the chairman collectively purchased an additional ~$60M. This high-conviction buying, coupled with a lack of any concerning insider selling, provides a strongly bullish signal.

Risk Factors

Despite its attractive growth story, dLocal faces several risk factors that investors should weigh:

Regulatory and Political Risk (Emerging Markets)

Operating in 40+ countries requires navigating a minefield of regulations, from currency controls to data localisation and licensing. Argentina serves as a vivid example, where economic turmoil led to an investigation into dLocal's compliance with FX rules and a financial hit from peso devaluation. Many countries in its portfolio have histories of sudden regulatory shifts or capital controls. Any adverse action (such as fee limits, license revocation, or high compliance costs) in a major market could damage dLocal’s growth and margins. Furthermore, political instability or economic crises like hyperinflation can directly impair consumer spending and payment volumes. The business is fundamentally tied to the volatile macro fortunes of emerging markets which we consider to be the single biggest risk factor in potential consideration of investment. While diversification helps, it doesn’t eliminate the risk that a shock in a key country like Brazil or Mexico could significantly slow growth.

Currency and Inflation Risk

Relatedly, dLocal earns revenue in many local currencies (while reporting in USD). Rapid currency devaluations (as seen in Argentina, Turkey, etc.) can reduce the USD value of its revenue and profits. High inflation can also complicate the picture (though perhaps increasing nominal payment volumes). The company does attempt to manage FX risk, but it can’t fully avoid it. For instance, the Q2 hit from ARS bonds was a reminder that emerging market fintechs often must hold some local assets (it’s the price of the business) that can depreciate. Currency fluctuations could make financial results less predictable and introduce non-cash volatility in earnings.

Competitive and Technological Risk

The payments processing space is highly competitive, and dLocal’s success will surely attract increased competition. Global giants like Stripe, Adyen, and PayPal could intensify efforts in dLocal’s niche (either building or acquiring local connections in emerging markets). Regional players (e.g. EBANX in LatAm, or PayU in certain regions) are also seeking for enterprise clients. If a competitor provides a similarly seamless solution with better pricing or terms, dLocal could face pressure on its take-rates or lose clients. Additionally, technological disruption is always a risk. For example, new payment methods (cryptocurrencies, central-bank digital currencies, etc.) or new fintech architectures might reduce the need for an intermediary like dLocal. So far, dLocal has stayed ahead by integrating things like stablecoins, but the pace of fintech innovation means the company must continuously adapt to avoid obsolescence.

Client Concentration and Business Model Risk

DLocal’s revenue is spread across hundreds of merchants, but it’s possible that a relatively small number of large customers (like an Amazon or Uber) account for a significant share of TPV. If any top customer were to switch away (say, if they build their own local payments infrastructure or partner with a competitor), dLocal’s growth could stumble. Also, as a B2B service provider, dLocal’s fortunes are tied to the success of its merchants – if global e-commerce or ride-hailing or other sectors slow down, dLocal’s volumes will too. The company also faces fraud and security risks inherent in payments. A major fraud incident, data breach, or system outage could lead to financial losses and reputational damage.

Reputation and Governance Risk

While dLocal successfully rebutted past short-seller allegations, the episode highlighted a reputational fragility. Any future hint of accounting irregularity or mismanagement (even if, as was previously the case, they are untrue) could severely impact the stock again. The company’s complex operations, headquartered far from many investors, require a high degree of trust that can only be maintained through sustained transparency and strong governance. A hefty short interest suggests some market participants remain bearish and believe there are still weak points. We as investors should therefore monitor key areas like receivables quality, client fund handling, and any new regulatory inquiries. Ultimately, dLocal still has to prove it can sustain its growth "cleanly," as any perceived lapse could be highly punitive to its valuation.

Macro and Market Risk

Broader macro factors also impact dLocal. For example, global interest rate increases can compress valuations for growth stocks like DLO (higher discount rates make future cash flows less valuable). A surge in the US dollar’s strength could weigh on reported results. Additionally, if global risk aversion spikes (say due to a recession or geopolitical issue), emerging market-focused companies might see capital outflows and stock price pressure regardless of their individual performance. DLocal’s beta is around 1.1, indicating it moves slightly more than the market. Its small-cap nature (market cap ~$4B) means it can be more volatile than larger peers.

Summary

dLocal’s key risks revolve around the fact that it is a high-growth EM fintech. This carries extra layers of uncertainty (EM economics, currency, regulatory) compared to a U.S.-centric business. The company mitigates these by diversifying markets, maintaining a strong balance sheet, and being proactive with regulators. We as investors should expect volatility and potentially uneven quarters, and size the positions accordingly. If dLocal successfully navigates these risks, the rewards could be significant. However, the path will not likely be smooth, and downside scenarios (such as a sharp EM downturn or regulatory crackdowns) could materially impair the investment case.

Our Scenarios (3–5 Year Horizon): Bull, Base, Bear Case

Bull Case (25% Probability)

In the "Emerging Markets Champion" scenario, dLocal continues its torrid growth with only minor hiccups. Fueled by both existing client expansion and the steady onboarding of new marquee merchants, the company fully capitalises on booming e-commerce in key geographies. Essentially, dLocal becomes the undisputed, Visa-like payments platform for global companies operating in emerging economies.

Key Assumptions

This outlook requires that emerging market consumption remains strong and that the company avoids any catastrophic FX or political events in its key markets. Additionally, it assumes dLocal faces no major regulatory roadblocks and that competitors fail to significantly erode its economic moat, while the company's own execution on innovation remains flawless.

Financial Outcomes

The resulting financial performance would be impressive, with revenue growing at 40%+ annually for several years. This growth would drive significant margin expansion as the company scales, with gross margins reaching approximately 45% and EBITDA margins hitting 35% or more. By 2028, this trajectory could lead to revenues of over $2 billion with $600–$700M in EBITDA. The market would likely reward this with a premium forward P/E ratio in the 30–35x range, potentially driving the stock price into the $30–$40 range.

Base Case (60% Probability)

In the "Steady Growth Fintech" scenario, dLocal grows at a healthy, but not heady, pace to become a solid mid-cap company. The path includes occasional bumps, such as temporary market setbacks or minor fee compressions, but the company continues its strategic expansion by entering more countries and broadening its product suite. This case represents a "growth at a reasonable scale" story, which is less spectacular than the bull case but still very rewarding for long-term investors as the company prudently matures.

Key Assumptions

This scenario assumes that emerging markets continue to digitise payments and dLocal successfully retains a fair share of that growth. It allows for the presence of serious competitors but posits that the market is large enough for multiple winners, enabling dLocal to expand at a slightly slower clip. Critically, this case assumes no new major governance issues or short-seller events arise and that macroeconomic conditions, such as interest rates and FX, are neutral to mildly favorable.

Financial Outcomes

Under these conditions, revenue growth would moderate to 25–30% annually before tapering to ~20%. Profitability would remain strong, with EBITDA margins holding steady around 30% or improving slightly toward one-third of revenue. By 2030, dLocal could achieve revenue of $1.5–$1.8 billion with solid earnings growth. This would likely translate to moderate stock appreciation of around 15% annually, with a share price reaching the low-to-mid $20s within 3–5 years, supported by a stable P/E ratio in the mid-20s.

Bear Case (15% Probability)

In the "Stall and Skepticism" scenario, dLocal stumbles on one or more fronts, causing growth to decelerate significantly and the market to re-rate the stock downward. This could be triggered by an economic implosion in a key market, the loss of a major client to a rival, or a resurgence of trust issues stemming from a regulatory problem. In this outcome, dLocal’s growth unravels, it loses investor confidence, and becomes just another small fintech struggling against the tides.

Key Assumptions

This pessimistic case assumes that one or more of the company's major risk factors materialise. This could include a significant regulatory hit, such as a large fine or lost license, a macroeconomic crisis in core markets, a major competitive incursion from a deep-pocketed rival or a critical internal misstep like a technology failure or fraud that severely harms its reputation.

Financial Outcomes

The financial impact would be severe, with revenue growth falling to 10% or less. Margins would likely compress as the company is forced to spend more on compliance or marketing to regain business. The market, remembering past allegations, would punish the stock with a low valuation, potentially sending the P/E ratio to below 15x. In this scenario, the stock could languish in the single digits ($5–$10 range) within 3–5 years.

(Note: The base case is given the highest probability as it represents a continuation of current trends with normal execution, while bull and bear are more extreme deviations.)

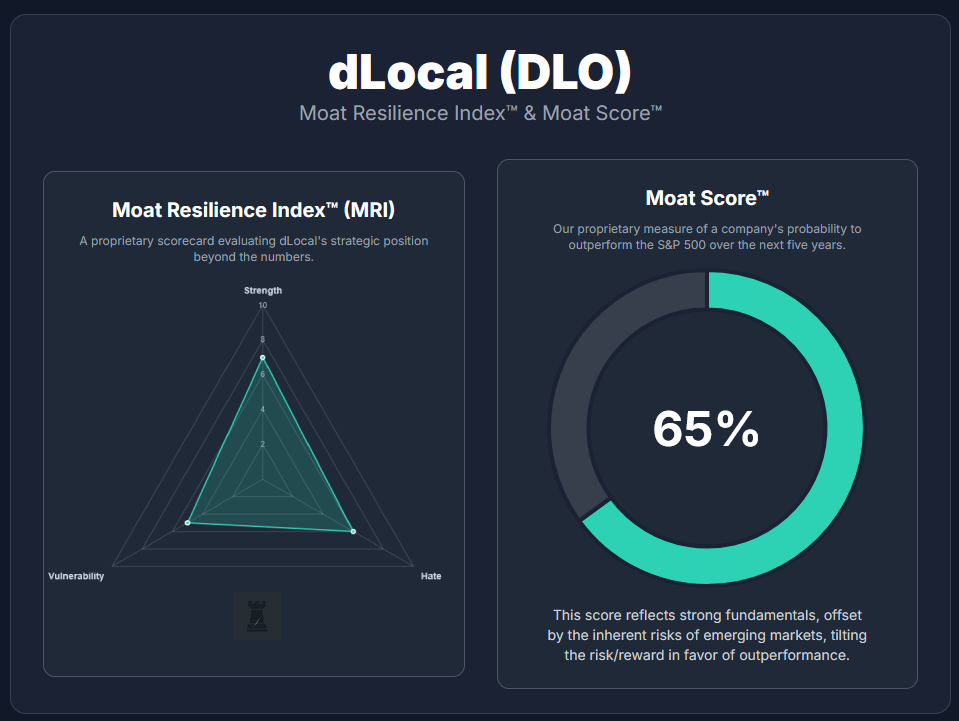

Moat Resilience Index™ (MRI)

We rate dLocal on our proprietary Moat Resilience Index, examining the strength of its competitive moat, the level of external negativity (“hate”) towards it, and its vulnerability to disruption. Each category is scored 1 (worst) to 10 (best):

Moat Strength: 7/10

DLocal has a moderately strong moat built on network effects, one-stop integration, and hard-to-replicate local connections. The fact that global giants trust dLocal for mission-critical payment flows in emerging markets attests to its value proposition. The moat is not a 10/10 “impregnable fortress” simply because payments is an inherently replicable tech over time – well-funded competitors could develop similar networks. But dLocal’s head start and deep focus in diverse emerging markets give it a solid moat that new entrants would take years to match. The switching costs for enterprise clients (technical integration, compliance comfort) further strengthen it. We give 7/10 reflecting a durable competitive advantage, though one that requires continuous reinforcement through innovation and quality service.

Moat Hate: 6/10

This measures how much negativity or skepticism surrounds the company’s moat. DLocal gets a somewhat mixed score here. On one hand, customers and merchants generally appreciate its service. We don’t see notable hate from the user base. If anything, merchants “love” having a simplified solution. However, in the investment community, dLocal has been a bit of a controversial stock. The short-seller saga and high short interest show that a faction of market participants “hates” or distrusts dLocal’s story. This negative sentiment isn’t universal, but it’s significant. We score it 6/10. There is objective above-average skepticism (higher “moat hate”) compared to a typical growth stock, but that has been receding as the company performs. In our Hated Moats terms, dLocal might be a case of “durable quality, temporary fear.” The fear/haters are there – which, paradoxically, is a good thing for contrarians if the quality shines through.

Moat Vulnerability: 5/10

This reflects how susceptible the moat is to being eroded. DLocal’s vulnerability is moderate. It operates in a fast-evolving industry. New fintech innovations or a determined big competitor (think, if Stripe were to aggressively target all of dLocal’s regions) could nibble at its moat. Additionally, reliance on external factors (like banking partners in each country, or regulations) means parts of its moat are outside its direct control, introducing vulnerability. On the flip side, dLocal has shown adaptability (quickly launching new products and obtaining licenses), which lowers vulnerability. A rating of 5/10 thus indicates that while the company’s moat is real, it’s not invincible. The payments landscape can shift, and dLocal must constantly defend and fortify its position to maintain its edge.

Moat Score™

We estimate a 65% probability that dLocal outperforms the S&P 500 over the next 5 years. This relatively high score is based on our view that the company’s fundamentals (growth, profitability) are significantly stronger than the average S&P constituent, and the current market pricing does not fully reflect that strength due to lingering skepticism. The “hate” surrounding the stock (reflected in the heavy short interest and cautious consensus) actually contributes to the upside potential if proved wrong. However, we temper it to 65% (not higher) to acknowledge that execution and EM risks are present – it’s not a slam dunk guarantee. Overall, the risk-reward tilts in favor of long-term outperformance, making dLocal a great “hated moat” candidate where a solid business that some investors shun could end up delivering superior returns.

Conclusion

Short-Term Outlook (< 1 Year)

Over the next year, dLocal’s stock will likely remain volatile but with an upward bias. Strong operating momentum and positive earnings should provide fundamental support. However, after a significant run-up from its lows, the stock is susceptible to swings based on earnings reports or macro news. The heavy short interest presents a double-edged sword. It could either fuel a short squeeze on good news, or it may amplify selling on any stumbles. Investors should watch the November Q3 2025 results for the next major catalyst. The overall outlook is constructive, with the stock potentially testing resistance in the high teens, but expect a bumpy ride.

Long-Term Outlook (3-5 Years)

We are optimistic about dLocal’s long-term prospects. The secular trend of digital payments penetration in emerging markets is a powerful tailwind that should persist for years, and dLocal is extremely well positioned to harness that. If management continues to execute and no thesis-breaking event occurs, dLocal in 5 years could be a much larger and more mature company, potentially generating over $1.5 billion in revenue with robust cash flows. By then, we’d expect the market to either fully value its cash generation (perhaps via a combination of dividends and growth, giving both income and capital appreciation) or even consider it an acquisition target (the likes of a PayPal or a Stripe might find dLocal a compelling way to instantly gain EM reach, though, at this point, that’s speculative). In our base outlook, we see the stock appreciating at a solid clip over 3–5 years, likely outperforming broader indices.

Final Verdict

Our Investment Verdict: BUY.

We conclude that DLO is a Buy for investors with a medium to long-term horizon. This rating reflects our conviction in dLocal’s strong fundamentals (exceptional growth, rising profitability, high returns on capital) and a valuation that remains reasonable (if not undervalued) relative to those fundamentals. Moreover, the management’s recent moves to increase transparency and return cash inspire confidence. While not without risks (which we’ve detailed), we believe the current stock price offers an attractive entry point for a quality business that has endured a trial by fire and emerged stronger. The stock may not yet warrant a “Strong Buy” due to the above-average risk profile (emerging market and execution risks), but it is clearly more than a hold in our view at this point in time. Hence a solid Buy. Investors should size positions according to their risk tolerance and be prepared for volatility, but on a 3–5 year view, dLocal looks poised to deliver market-beating performance, making it a compelling investment for those seeking growth with a side of dividends in the fintech space.

Disclaimer & Our Investment

Please note that no part of this article is meant as a financial advice. Our disclaimer in holding position is as follows: owning shares since August 29th 2025, with an average purchase price of $14.47.

Final words

Ultimately, dLocal represents a classic contrarian opportunity. It is a high-growth, profitable enterprise navigating the turbulent but rewarding waters of emerging markets. The company has been tested by storms of skepticism and has emerged more resilient, with stronger governance and a clearer path forward. The ride will not be smooth, but for patient investors, we believe the disconnect between the market's lingering fear, the ‘hated moat’, and the company's fundamental strength presents a compelling journey towards significant long-term value creation.