Pfizer: Deep Dive Analysis

Priced for failure, paying 7% to wait: Is Pfizer’s hated moat value trap or comeback?

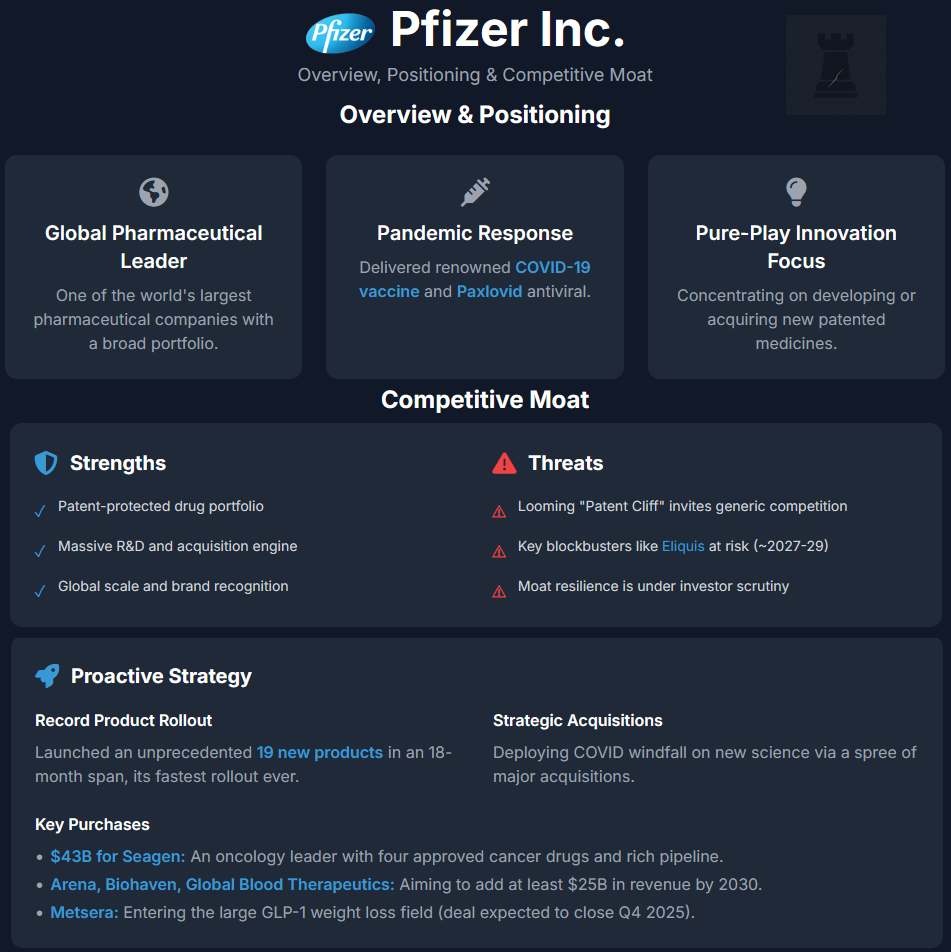

Overview, Positioning and Competitive Moat

Pfizer Inc. is one of the world’s largest pharmaceutical companies, with a broad portfolio ranging from vaccines and oncology to cardiology and immunology. It famously delivered a COVID-19 vaccine (Comirnaty, with BioNTech) and antiviral (Paxlovid) that drove revenues to record highs during the pandemic. Post-pandemic, Pfizer has refocused on its core innovative drug business after shedding non-core units (e.g. spinning off its off-patent drugs into Viatris in 2020). This positioning leaves Pfizer as a pure-play innovative pharma concentrating on developing or acquiring new patented medicines.

Pfizer’s competitive moat primarily stems from its patent-protected drug portfolio, R&D engine, and global scale. The company’s size and cash flows enable significant R&D investment (and acquisitions of smaller biotechs) to replenish its pipeline. Its global salesforce, manufacturing network, and brand recognition with regulators and physicians are difficult for smaller competitors to match. Pfizer’s moat is its ability to continually discover or obtain new drugs and leverage its scale to commercialise them worldwide. However, this moat is time-bound by patent expirations. A drug’s exclusivity eventually lapses, inviting generic competition. Pfizer faces a notable “patent cliff” later this decade. Key blockbusters like blood thinner Eliquis, breast cancer drug Ibrance, prostate cancer therapy Xtandi, and pneumococcal vaccine Prevnar 13 lose its “exclusivity” by ~2027–2029. This looming cliff has been a central investor concern, testing Pfizer’s moat resilience.

On the positive side, Pfizer has been proactive in fortifying its moat. It launched an unprecedented 19 new products in an 18-month span recently which notes its fastest rollout ever. The company also embarked on a series of acquisitions to bolster its pipeline. The company is deploying its COVID windfall toward new science. For example, the $43 billion acquisition of Seagen (an oncology leader) in 2023 brought Pfizer four approved cancer drugs and a rich pipeline of antibody-drug conjugates. Management projects that Seagen’s portfolio could grow from ~$2B in annual sales at purchase to $10B by 2030. Likewise, Pfizer’s purchases of Arena (immunology), Biohaven (migraine drug Nurtec), Global Blood Therapeutics (sickle-cell therapy), and others aim to add at least $25 billion in risk-adjusted revenue by 2030. Their latest spree of acquisitions ends with Metsera. This deal should close in Q4 2025 and it will allow Pfizer to enter the big GLP-1 weight loss field. This strategy underscores a classic approach of moat protection. The company is using excess capital to widen the moat via new franchises (particularly in oncology and rare diseases) while the legacy cash cows (like Eliquis and Prevnar) still generate income. Overall, Pfizer’s moat is wide but under scrutiny. It has the scale and know-how to remain a top-tier pharma, but it must prove that a new wave of drugs can replace the old proven guard.

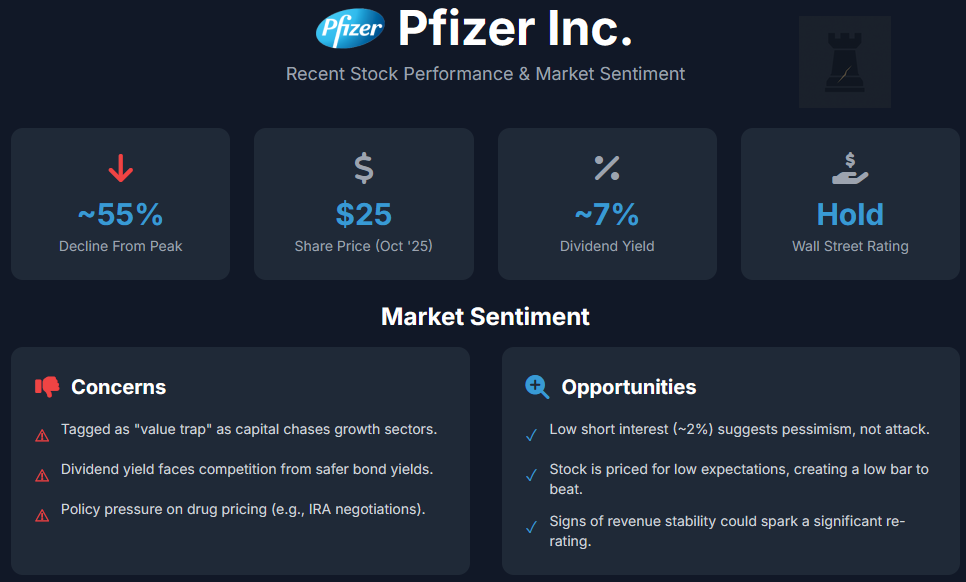

Recent Stock Performance & Market Sentiment

After reaching an all-time high near $60 in late 2021 on vaccine news, Pfizer’s stock has fallen quite significantly. As of October 7, 2025, it trades around $25–$27 per share, down ~55% from its peak. Over the past year, the stock “returned” about -10%. Year-to-date in 2025, it is slightly-negative-to-flat. In early October, shares jumped about 15% off multi-year lows on news of a potential drug pricing deal. Despite such bounces, Wall Street ratings are mostly Hold, reflecting a guarded attitude. Pfizer is currently out of favour with investors. With the 10-year U.S. Treasury yield above 4%, Pfizer’s ~7% dividend yield faces competition from safer returns. In 2023–2024, the Health Care sector underperformed as capital chased AI and growth sectors. The stock is often tagged as a “value trap.”

News has been dominated by declining COVID sales and cost-cutting. On a positive note, short interest is only ~2% of float, indicating the stock’s decline is from pessimism, not a short attack. Market sentiment also reflects policy concerns. Investors worry about the Inflation Reduction Act (IRA) and political pressure on drug pricing. Pfizer’s Eliquis is among the first drugs up for Medicare price negotiation in 2026, which could reduce its sales. The 2025 political climate has featured tough talk on drug prices, and the company received direct pressure from President Trump in mid-2025 to lower prices. In summary, Pfizer’s stock performance has been disappointing since 2022, and the mood is cautious. This creates a potential opportunity due to low expectations. Any sign that Pfizer can stabilise revenues could spark a re-rating. While near-term execution is solid, long-term growth concerns dominate the discussion. The stock is currently priced as if the company’s best days are behind it.

Fundamental Analysis

Growth & Profitability

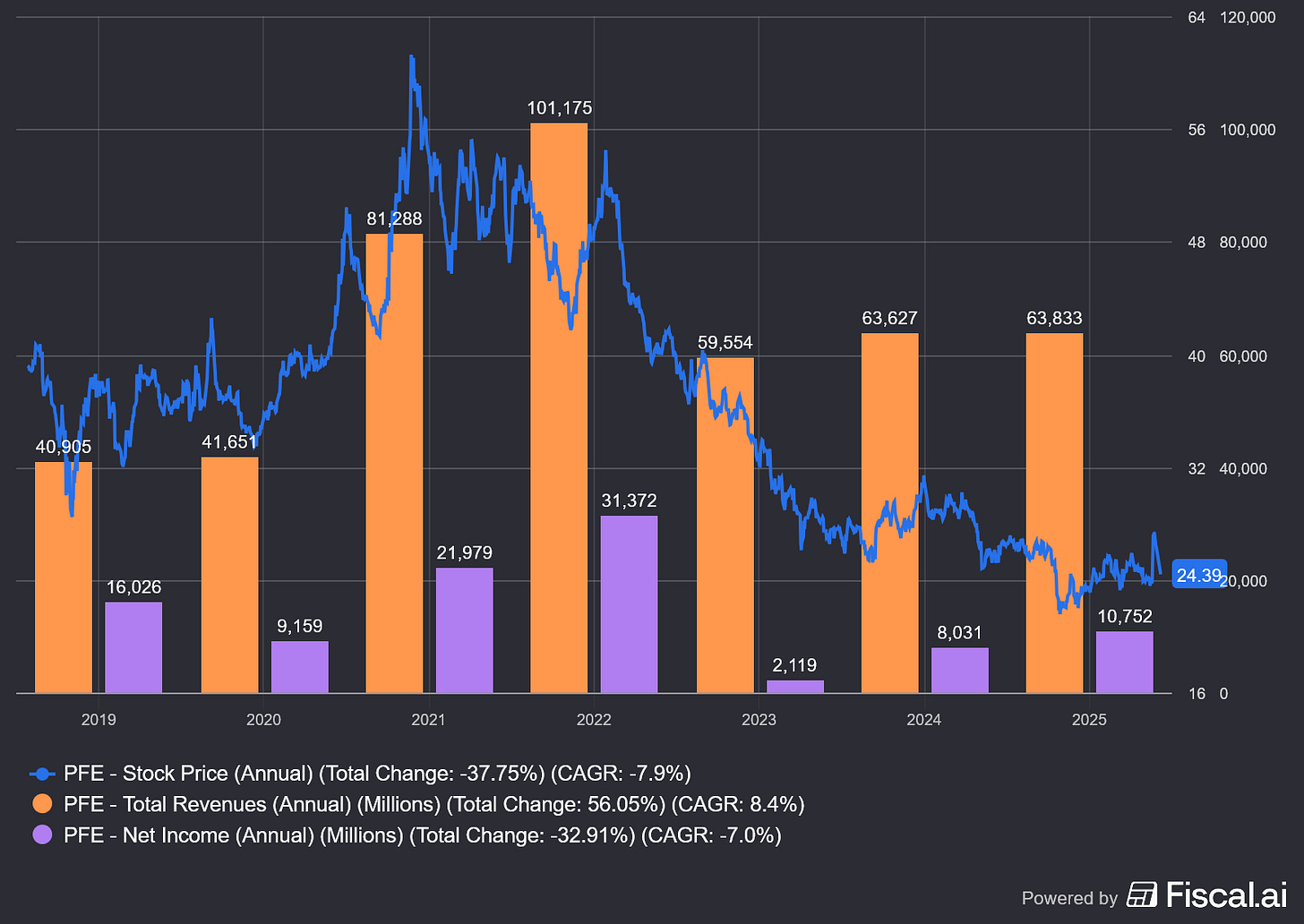

Pfizer’s financial results over the last 5 years resemble a tale of two eras. The COVID surge and the post-COVID reset. In 2021 and 2022, Pfizer’s revenue and profit skyrocketed to record levels thanks to its COVID vaccine and antiviral. Full-year 2021 revenue hit $81.3 billion (92% operational growth) and 2022 revenue exceeded $100 billion – an all-time high. Net income in 2022 was a staggering $31.4 billion, up ~43% from 2021’s $22.0 billion. Pfizer’s net profit margin at that peak was on the order of ~30%. This period greatly bolstered Pfizer’s cash reserves and equity base (shareholders’ equity swelled to over $100B by early 2023, from around $65B in 2020).

However, as the pandemic demand faded, Pfizer’s growth flipped to contraction. In 2023, COVID vaccine demand plunged and Pfizer also took large write-downs on inventory and intangible assets. Full-year 2023 revenue crumpled to $58.5B (roughly half the prior year) and GAAP net income was almost wiped out (only $2.2B, down 93% YoY!). Adjusted earnings were better ($1.84 adjusted EPS in 2023), but clearly the company faced a hard landing from the COVID highs. By 2024, Pfizer began a rebound. It delivered $63.6B in revenue (7% operational growth ex-COVID products), aided by new product launches and normalisation of non-COVID demand. 2024 GAAP EPS came in at $1.41, and importantly management guided 2025 revenues to $61–64B with adjusted EPS $2.80–3.00. In August 2025, on strong Q2 results, Pfizer even nudged up its 2025 EPS forecast to $2.90–3.10 (though it held revenue guidance steady, suggesting flat to slightly down sales vs 2024). This implies that the worst of the revenue decline is likely over. Pfizer’s top line is stabilising in the low $60B range, roughly the pre-pandemic level plus contributions from acquisitions.

Pfizer’s profitability metrics show significant volatility. Pfizer’s gross margin was ~66% in 2022 and ~59% in 2023 as mix shifted and it improved again in 2024. Operating margins swung more dramatically, from ~26% in 2020 to mid 30s% at their peak (in 2022), before dropping significantly in 2023. They have now recovered to ~28–30% following cost cuts. A cost-cutting program targeting $7+ billion in annual savings should boost these figures further. Net margins are also improving, on a GAAP basis, 2024 net margin was ~12.6% ($8.0B on $63.6B). TTM mid-2025 profit margin screens around ~16–17%, establishing a “new normal” well below the ~30%+ margins seen during the COVID peak, but reflecting a more stable business without that windfall.

Pfizer’s earnings have been volatile, making growth tricky to assess. Excluding the COVID boom, the core business is resuming growth, evidenced by a 7% operational increase in non-COVID revenue in 2024. New and acquired products added $4.7 billion in sales that year, helping offset declines in older drugs. While short-term stability is low, analysts expect a return to steady EPS growth from the 2024–2025 trough. From an expected EPS of ~$2.95 in 2025, Pfizer could see a high single-digit compound annual growth rate over the next five years, though this would be from a depressed base.

A significant negative for Pfizer has been that it missed the obesity drug boom. The company discontinued its oral GLP-1 candidate in 2023 due to safety issues, ceding a potential multi-billion dollar market to rivals. This has become a central debate for the stock and it changed recently. In September 2025, Pfizer made a deal to acquire Metsera aiming to close the deal by Q4 2025, thus re-entering into the obesity race. The bear case has been arguing that without such a mega-blockbuster, growth will remain anaemic. The bull case countered that Pfizer’s pipeline and acquisitions in other areas, such as oncology and rare diseases, will be sufficient to compensate and now it gets strengthented by this particular aquisition.

Free Cash Flow & Capital Allocation

Pfizer’s free cash flow (FCF) has mirrored its earnings volatility. FCF peaked at over $29 billion in 2021 before plunging to $4.8 billion in 2023 due to the earnings collapse and working capital issues.

FCF has since rebounded significantly, with implied annual generation now around $13–$14 billion. This recovery results in an attractive Price-to-FCF ratio of ~11 and a high FCF yield of ~9.2%. This yield is comfortably above the S&P 500 average and its own historical norms, suggesting potential undervaluation if the cash flows are sustainable.

Pfizer prioritises its cash for growth (through R&D and acquisitions) over share buybacks. The company deployed its COVID cash hoard on major deals and invests over $10 billion annually in R&D. While this strategy targets future growth, some investors would have preferred buybacks as the stock fell, leaving the share count flat. The other cornerstone of its capital allocation is a generous dividend. The stock yields 6.5-7.0%, among the highest in big pharma, and the company has a 16-year streak of increases. Although the current payout ratio is elevated at 60-80% of adjusted earnings, it is covered by free cash flow. Management appears committed to the dividend, effectively paying shareholders to wait for its growth investments to mature.

Pfizer’s balance sheet remains solid but is more leveraged due to recent acquisitions, with a debt-to-equity ratio of ~0.69. This leverage is moderate for the sector, supported by a comfortable debt/EBITDA ratio of ~1.9x and high investment-grade credit ratings. While the company can easily service its debt and fund operations, further large-scale M&A is likely on hold. Management’s stated focus is now on debt paydown and integrating its recent purchases. Smaller bolt-on acquisitions may still occur, and share buybacks could resume after 2026 if cash flow improves. The current capital allocation stance is to protect the dividend, invest in the pipeline, realise synergies, and maintain a solid credit profile.

Valuation & Key Financial Metrics

By traditional metrics, Pfizer’s stock appears cheap. Its trailing Price/Earnings (P/E) ratio is ~13.3, while its forward P/E is just ~8.2. This ~8x forward multiple is significantly below the S&P 500’s ~18x and most pharma peers’ 10–14x range. While this suggests market pessimism, Pfizer has beaten EPS estimates in 3 of the last 4 quarters and targets ~10% operational EPS growth in 2025.

Other metrics support the value case. The Price-to-Book (P/B) ratio is ~1.5x on a book value of $17–$18 per share. Its Price/Sales ratio is a low 2.3x (based on $62B sales vs. a $142B market cap) for a company with ~17% net margins. EV/EBITDA is also around 8–9x. The dividend yield is a key valuation signal at ~6.5-7%, well above its 3-year average of ~5.8% and attractive compared to a 4% bond. The PEG ratio also appears favourable. Using a forward P/E of ~8 and a ~5% growth rate gives a PEG of ~1.6. However, factoring in the 2023–2025 earnings rebound results in a PEG of <1. On a normalised basis, Pfizer’s PEG is arguably at or below 1.

WE find it instructive to compare Pfizer’s valuation to peers. Pfizer’s forward P/E of 8x is an outlier compared to peers like Merck (~11x), Johnson & Johnson (~15x), and Eli Lilly (>30x), suggesting the market is pricing in no growth. This creates the core investment question: Is it “deep value or a falling knife/value trap?” Ratios suggest deep value, with a forward earnings yield of ~12%, a dividend yield near 7%, and a Price-to-Book ratio near 1, implying pessimism is already priced in.

Return on equity (ROE) has been volatile, peaking above 30% during the COVID boom, cratering to ~2–3% in 2023, then recovering to ~9% in 2024. The current trailing ROE is ~12–13%, with projections for adjusted ROE to reach ~15%+ for 2025. A key metric to watch will be the return on invested capital (ROIC) from the $70B+ deployed in acquisitions.

The balance sheet adds support, with debt-to-EBITDA under 2x providing financial optionality. Furthermore, ~68% institutional ownership creates a stable holder base. In summary, Pfizer’s low valuation reflects pessimism. The key question is whether this is justified by fundamental challenges or if the market is overly discounting its potential to reignite growth.

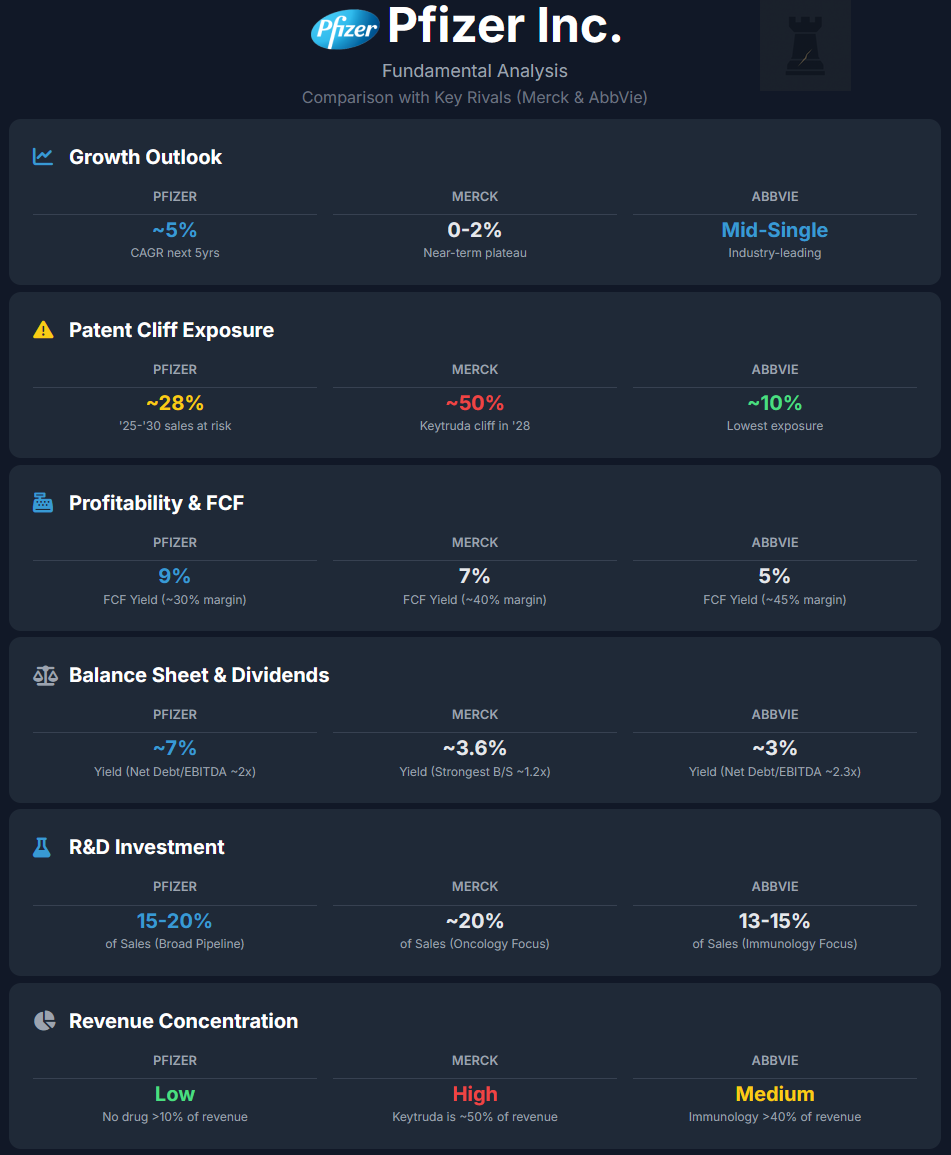

Comparison with Key Rivals (Merck & AbbVie)

Growth Outlook

Pfizer’s revenue is projected to grow around ~5% annually over the next 5 years (recovering from the post-COVID trough), aiming for ~$80B by 2030. In contrast, Merck faces a near-term plateau where its growth is expected to be minimal (~0–2% CAGR) as Keytruda’s patent expiry in 2028 will likely offset gains from other products. AbbVie anticipates industry-leading growth in the mid-single digits, buoyed by new immunology and neuroscience drugs (e.g. Skyrizi, Rinvoq) more than replacing Humira’s decline. In fact, AbbVie predicts a strong rebound in 2025 (revenues ~$60B, +~15% vs 2023) and sustained growth thereafter.

Patent Cliff Exposure

Pfizer faces an estimated $17–18B revenue at risk from loss of exclusivity (LOE) between 2025 and 2030 (about ~25–30% of 2024 sales). Key upcoming LOEs include anticoagulant Eliquis and breast cancer drug Ibrance. Merck is far more exposed. Its blockbuster Keytruda (~45–50% of Merck’s sales) loses exclusivity in 2028, putting roughly half of Merck’s revenue in jeopardy. By 2025, Keytruda is expected to contribute ~$30B (nearly half of total sales), underscoring the magnitude of Merck’s patent cliff. AbbVie, having already absorbed Humira’s LOE in 2023, now has one of the lowest LOE exposures among big pharma for the rest of the decade. Only ~10% of AbbVie’s 2025–2030 sales are at LOE risk (e.g. cancer therapy Imbruvica late in the decade), a fraction of peers’ exposure. This headstart post-Humira gives AbbVie a smoother runway for growth.

Profitability & Cash Flow

Pfizer’s operating margin is ~30% in 2024 with a free cash flow (FCF) yield of ~9%. After ~$7B in cost cuts, its Q2 2025 operating margin reached ~28%. Merck has a ~40% operating margin and a ~7% FCF yield. AbbVie leads with a ~45% adjusted operating margin but has a lower FCF yield of ~5% due to its higher stock multiple. While all three are strong cash generators, Pfizer and Merck appear cheaper based on FCF yield.

Balance Sheet & Dividends

Pfizer and AbbVie have moderate leverage from acquisitions, with net debt-to-EBITDA ratios of ~2x and ~2.3x, respectively. AbbVie has paid down ~$34B in debt since its Allergan merger. Merck has the strongest balance sheet with a ~1.2x ratio. For dividends, Pfizer offers the highest yield at ~6.5–7%, with a 16-year streak of increases and a ~70% payout ratio. Merck yields ~3.6%, growing it ~5–6% annually with a ~50% payout ratio. AbbVie yields ~3%, has raised its dividend ~270% since 2013, and maintains a ~50% payout ratio.

R&D Investment & Pipeline

Pfizer invests 15–20% of sales in R&D (~$10.8B in 2024), which rose to ~27% in 2023. Its pipeline is broad, covering vaccines, oncology, and immunology. Merck’s 2023 R&D spend was 51% of sales (~$30.5B) due to deals like the $11B Prometheus acquisition, with an underlying rate of ~20%. Its pipeline is dominated by 20+ oncology programs. AbbVie spends 13–15% on R&D (15.1% in 2024, plus 10% on acquired R&D). Its pipeline is focused on immunology, where Skyrizi and Rinvoq are set to exceed Humira’s peak sales by 2027, and neuroscience, with multiple drugs aiming for $1B+ peaks.

Revenue Concentration

Pfizer is highly diversified, with no single drug making up >10% of revenue in 2024. Its COVID vaccine fell from ~45% of sales in 2021 to ~13% in 2023. In contrast, Merck is highly concentrated, with Keytruda alone accounting for ~45–50% of sales, while Gardasil contributes ~12–15%. AbbVie is in the middle of them. Its immunology franchise is over 40% of revenue. Humira was 36% of sales in 2022, but by 2025, Skyrizi and Rinvoq are expected to generate a combined >$17.5B. AbbVie has other pillars at ~10% each, including oncology, aesthetics, and neuroscience.

To sum it up, Pfizer, Merck, and AbbVie each face the same industry headwinds but approach them from distinct positions. Pfizer is the most diversified, least expensive, and highest-yielding of the three, but carries execution risk as it works to replace ~$18B in revenues at risk of patent expiry through 2030. Merck is highly concentrated in Keytruda (~50% of sales), making its post-2028 growth hinge on successful oncology and cardiology pipeline execution. AbbVie, having already digested Humira’s LOE, now leads in post-cliff growth with expanding immunology and neuroscience franchises, though its stock reflects that de-risking. While Pfizer’s valuation implies deep scepticism, its diversified revenue base and high free cash flow yield may offer asymmetric upside if management delivers.

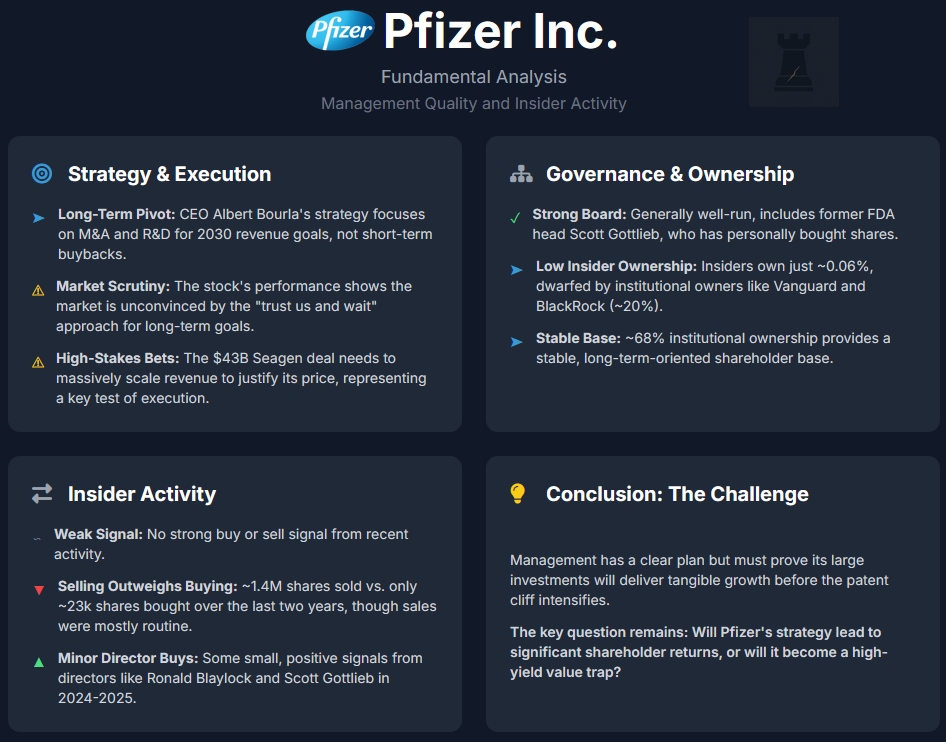

Management Quality and Insider Activity

CEO Albert Bourla, who took the helm in 2019, successfully guided Pfizer through the pandemic. His current strategy is a long-term pivot focused on building a new revenue base for 2030 through major acquisitions and cost-cutting, rather than chasing short-term gains with buybacks.

The execution of this strategy is under scrutiny. For instance, in the Seagen deal, Pfizer paid $43 billion for a company with ~$2 billion in revenue. That’s a bet that will only pay off if they can significantly expand its output. While management provides regular updates and generally meets its financial guidance, the stock’s poor performance shows the market is not yet convinced. The consistent focus on distant goals, like achieving over $80 billion in non-COVID revenue by 2030, creates a “trust us and wait” message that many investors are reluctant to accept without seeing more interim proof.

On governance, Pfizer is generally well-run with a strong board that includes former FDA head Scott Gottlieb, who personally bought shares on the open market in 2024 at ~$28. Insider ownership is very low at ~0.06%, dwarfed by the ~20% held by the top three institutional owners (Vanguard, BlackRock, State Street). Insider activity does not send a strong signal. Over the last two years, insiders bought only ~23,457 shares (worth ~$600k), while selling ~1.4 million shares in the past year, mostly for routine diversification. The lack of significant open-market buys from top executives is notable. However, some directors made small purchases, including Ronald Blaylock (19,000 shares in Feb 2025 at ~$25) and Scott Gottlieb (1,000 shares in Oct 2024 at ~$28). Separately, some U.S. Congress members also traded PFE shares in 2025 in the $22–$26 range.

In conclusion, management is executing its plan but has a lot to prove to rebuild investor trust. The key challenge is showing that its large investments will translate into tangible growth before the patent cliff hits. If they succeed, shareholders stand to benefit greatly. If they stumble, Pfizer could become a high-yield value trap.

Intrinsic Value & DCF

To assess Pfizer’s intrinsic value, we perform a Discounted Cash Flow (DCF) analysis, incorporating the company’s post-pandemic reset and future growth prospects. The goal is to triangulate what Pfizer’s stock could be worth based on fundamentals (rather than fickle sentiment). We consider a 5-year forecast (2025–2029) plus a terminal value in 2030 and discount back to present (end-2025). Key DCF assumptions are as follows:

Revenue

Start with ~$62 billion in 2025. We assume a modest dip in 2026 (patent cliffs begin and lingering COVID sales fall off), then new product growth accelerates. By 2030, we project revenue around ~$80 billion, consistent with management’s goal of “>$80B non-COVID sales by 2030”. This implies a ~5% CAGR from 2025 to 2030.

Profitability

We assume Pfizer gradually improves its operating margin from ~30% in 2025 to ~33% by 2030 (cost cuts and richer product mix offsetting price pressures). This yields net margins rising from ~18% to ~22% by 2030. In dollar terms, 2030 net income would be roughly $17–18B in this scenario.

Free Cash Flow

Pfizer’s conversion of net income to FCF is high (typically >100% due to depreciation add-backs exceeding capex, but acquisitions can dent FCF in deal years). We take FCF as ~100% of net income in normal years. Thus, FCF starts around $11B in 2025 and grows to ~$18B by 2030 in the base case.

Discount Rate

Using a weighted average cost of capital (WACC) ~8% (a blend of low-cost debt and equity, Pfizer’s beta is low and it’s defensive, so a relatively low WACC is reasonable).

Terminal Growth

Assume a low terminal growth of 2% beyond 2030 (conservative given pharma’s need to continuously replace revenue - essentially inflation-level perpetual growth).

Results

Our DCF analysis indicates a fair value in the mid-$30s per share, with a range of $34–$36. Even our conservative base case suggests a value in the low $30s. Compared to the current price of ~$25, this provides a margin of safety of roughly 25%.

This valuation is supported by other metrics. At ~$25, the dividend yield is a high ~6.8%. Furthermore, if the P/E ratio were to mean-revert to a modest 12x on our 2025 EPS estimate of ~$3, the implied stock price would be $36.

Of course, valuations are sensitive to assumptions. Let’s briefly consider Bull and Bear intrinsic values:

Bull Case DCF

Assume Pfizer beats expectations, e.g. new drugs drive 8% annual growth, revenue hits ~$90B by 2030, and margins expand to 25% net. This could yield >$25B in net income by 2030. Such a scenario (lofty, but not impossible if a few blockbusters hit) could justify a DCF value north of $50/share. In a bull scenario, one might also assign a lower WACC due to higher confidence and better growth, boosting the DCF. The bull DCF basically says if Pfizer’s pipeline produces one or two mega-winners (think another Lipitor or a successful obesity drug via mentioned acquisition), the upside is significant.

Bear Case DCF

Assume pipeline underwhelms and patent cliffs bite harder, i.e. revenue stagnates or declines to ~$55B by 2030, margins slip due to pricing pressure, and FCF stays flat or even dips. With minimal growth and perhaps a higher perceived risk (WACC 9-10%), the DCF value might drop to the low $20s or even teens. In a downside scenario, if Pfizer were to shrink, the market might only value it at 6-7x earnings with a high dividend yield, implying a stock in the $15–$20 range (essentially pricing in a sustained decline).

While a sum-of-the-parts valuation might be higher, a further breakup of Pfizer is unlikely given recent spin-offs (Haleon, Viatris). Therefore, value must be realised by improving the company as a whole. Our intrinsic value estimate suggests Pfizer is undervalued, with the current price reflecting a near bear-case scenario. Our analysis indicates the stock could be worth ~30-50% more than its market price if the company executes moderately well. At ~$25, significant bad news is priced in, and an investor gets the future pipeline at a steep discount.

Though valuation is an approximation, Pfizer appears to offer upside asymmetry from a value investing perspective. By numbers, there’s limited downside (supported by its dividend and assets) and meaningful upside if its strategy succeeds.

Risk Factors

Like any pharmaceutical giant, Pfizer faces a variety of risks that could impair its business and investment thesis. Here we highlight the major risk factors:

Patent Expiration (“Cliff”) Risk

Pfizer faces a significant patent cliff between 2025 and 2030. The most notable loss will be Eliquis in the U.S. in 2028, which generates $8–$10 billion annually (shared with BMS). Other key drugs like Ibrance, Xeljanz, and Xtandi also face expiration. When patents expire, generic competition can erode over 80% of a drug’s sales within a couple of years. The primary risk is that new product launches will not ramp up fast enough to offset these losses, potentially causing revenue to stagnate or dip, especially in the 2026–2028 window. To mitigate this, Pfizer is aggressively launching new products (19 in 18 months) and acquiring assets, but there is execution risk in achieving its forecast of $20 billion from these launches by 2030.

Pipeline and R&D Risk

Developing new drugs is a high-risk, high-reward endeavour. Pfizer’s pipeline spans oncology, vaccines (e.g. RSV, flu mRNA), inflammation, rare diseases, etc. Not all candidates will succeed. Clinical trials can fail due to safety or lack of efficacy. For example, Pfizer’s failure with the oral GLP-1 drug (danuglipron) shows how a promising project can be derailed. The risk is that several pipeline programs flop or get delayed, which would shrink future revenue potential. Also, the heavy reliance on acquisitions means Pfizer is betting on assets that came at a high price. Any underperformance there (e.g. if Seagen’s drugs don’t grow as expected, or if safety issues arise) would mean Pfizer overpaid. The company does have a broad pipeline (over 100 programs in various stages), which provides diversification, but statistically, only a fraction will become blockbusters. There is also regulatory risk in pipeline. Approvals may face delays or rejections by the FDA or EMA, especially for novel technologies (like gene therapy) where regulators are cautious.

Commercial & Competition Risk

Pfizer operates in highly competitive markets and faces significant branded competition. For instance, in oncology, it competes with dominant players like Merck and Bristol, its new RSV vaccine Abrysvo launched against a GSK rival and its migraine drug Nurtec competes with AbbVie’s Ubrelvy. This creates a risk that Pfizer’s new launches may underperform. A major opportunity cost risk has been the company’s absence from the booming GLP-1 weight-loss drug market, where competitors are gaining outsized profits. Pfizer is now trying to enter this space by the acquisition mentioned above, though the head-start is in hands of Novo Nordisk and Eli Lilly. Down the line, the success of these treatments could even reduce demand for traditional drugs in areas like cardiovascular health. Pfizer must also contend with future biosimilar competition for its key biologic drugs once their patents expire.

Drug Pricing and Regulatory Risk

Drug pricing is under intense global pressure, a key risk for Pfizer. In the U.S., the Inflation Reduction Act will allow Medicare to negotiate drug prices starting in 2026. This will likely force price cuts for that segment and sets a precedent for broader government controls. Other regulatory risks include faster generic approvals, drug importation, and changes to patent law. Geopolitics also pose a threat; for instance, a 2025 threat by President Trump to impose tariffs on European drugs highlights how trade policy can impact Pfizer’s global supply chain and pricing.

Litigation and Liability Risk

As a large pharmaceutical company, Pfizer is frequently subject to lawsuits, including product liability, patent challenges, and class actions. While there are no major headline legal battles currently, this could change. One looming issue is that as Pfizer’s COVID vaccine moves from emergency to standard approval, it could face product liability lawsuits, despite initial liability protections. Patent litigation is another key risk. Competitors may challenge Pfizer’s patents to achieve earlier generic entry, and an unfavourable court ruling on a key drug could accelerate a patent cliff. For example, while Pfizer and Bristol have successfully defended patents on Eliquis so far, this remains a significant issue to watch.

Manufacturing and Supply Chain Risk

Pfizer’s products, especially biologics and vaccines, rely on complex manufacturing that requires maintaining high quality to avoid disruptions. The company is exposed to supply chain constraints for raw materials and specialised components. While risk has been mitigated by onshoring manufacturing to 10 U.S. sites, some ingredients still come from abroad, creating geopolitical vulnerabilities. Also, any major plant shutdown or quality lapse, such as an FDA warning letter, could disrupt the supply of a high-margin product, impacting both financials and reputation. Additionally, as Pfizer integrates acquisitions like Seagen, it must successfully harmonise their distinct manufacturing processes and supply chains.

Macroeconomic and FX Risk

Although healthcare is relatively defensive, global economic conditions can affect Pfizer. Budget constraints in economies (especially emerging markets) can slow drug sales or lead governments to seek price cuts. A strong U.S. dollar can reduce the translated value of Pfizer’s international sales (roughly half of sales are international). For instance, a strengthening dollar in 2022–2023 was a headwind. Any further currency swings pose a risk (and conversely, dollar weakening could be a tailwind). Also, inflation in costs (raw materials, labour) can pressure margins if not offset by price increases. Pfizer has been cutting costs to fight inflation impacts, but sustained high inflation in manufacturing or logistics is a risk.

Pandemic-specific Risk

While COVID was a boon, it’s now a wildcard. There’s a risk that new COVID variants or other pandemics emerge. Paradoxically, if a new COVID wave came, Pfizer could see a temporary sales bump (booster shots, etc.), but it could also face public pushback on vaccine pricing or government interventions (like waiving IP rights, which was discussed for COVID vaccines). On the flip side, if COVID completely fades or competitors dominate the booster market, Pfizer might not even achieve the conservative sales it expects from COVID products (management is cautious on 2025 COVID sales). Essentially, COVID products are now a swing factor that could be either an upside or downside risk depending on the trajectory of the virus and vaccine uptake, and there’s no easy way to determine which one is more likely.

ESG and Reputational Risk

Pfizer must maintain trust given it sells products that affect health. Any ethical missteps (e.g., accusations of hiding trial data, aggressive marketing beyond guidelines, environmental issues at factories) could hurt its reputation and invite regulatory penalties. The company is also under pressure to ensure equitable access to medicines (especially after making hefty profits on vaccines). While not immediately financial, reputational hits can eventually translate to tighter regulations or loss of business.

Innovation/Technology Disruption

Medicine is evolving with new technologies like mRNA, gene editing, and AI. While Pfizer was at the forefront of mRNA with its BioNTech partnership, it risks falling behind if it fails to keep up with new modalities. A disruptive therapy, like a one-time gene therapy curing a disease that Pfizer treats with chronic pills, could lead to significant lost revenue. Although the company invests in these cutting-edge areas, the long-term risk of technological disruption in pharma remains significant.

Overall, the highest-impact near-term risks are the patent cliff and drug pricing pressures, which are the main issues currently weighing on the stock. Pfizer’s ability to mitigate them (through new product growth for the patent cliff and through volume growth or cost control for pricing pressures) will determine if the investment works out. Investors should monitor pipeline updates, FDA approvals, early generic launches or legal rulings, and policy developments like Medicare negotiation specifics. If multiple risks materialise negatively, such as a major pipeline failure, the bear case could play out. Conversely, if Pfizer manages these risks well, current fears may prove overblown.

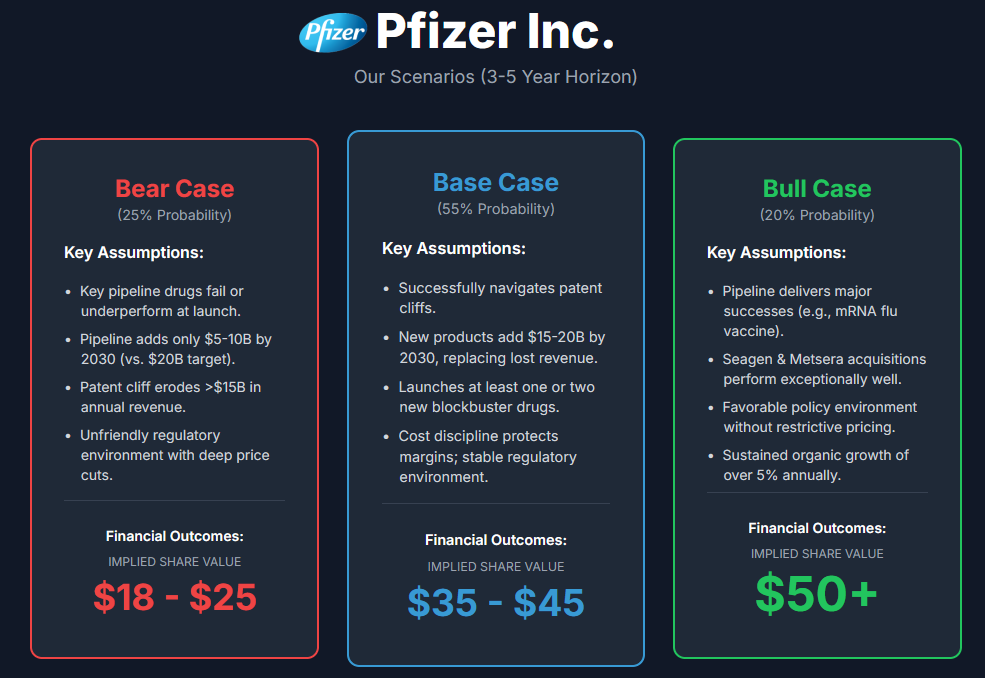

Our Scenarios (3-5 Year Horizon)

Bull Case (20% Probability)

Key Assumptions

In this “Renewed Growth Engine” scenario, Pfizer’s pipeline delivers major successes, such as a superior mRNA flu vaccine or a first-in-class therapy. The Seagen acquisition performs exceptionally well, with its portfolio growing to $10 billion by 2030 and establishing Pfizer’s oncology franchise as a global leader. Acquisition of Metsera yields successful entry into the obesity treatment. This bull case requires a favourable policy environment that doesn’t impede innovation with restrictive pricing rules. The company must also demonstrate a high R&D success rate, achieving sustained organic growth of over 5% annually, driven by one or two new hit products.

Financial Outcomes

This strong performance would accelerate revenue growth into the high-single or even double digits by 2027, with total revenues potentially reaching $80–$90 billion by 2030. A shift towards higher-margin therapies could push net margins back into the mid-20% range. Consequently, at $90B and 25% net margin, NI ≈ $22.5B, EPS could reach $3.9–$4.1 on ~5.7B shares. Investors would re-rate the stock as a growth pharma company, with a P/E in the mid-teens, driving the share price north of $50. The dividend would be easily covered and could see accelerated growth, leading to excellent total shareholder returns.

Base Case (55% Probability)

Key Assumptions

This “Stabilisation and Moderate Growth” scenario assumes Pfizer successfully navigates its patent cliffs. It relies on the company replacing lost revenue by realising $15–$20 billion from new products by 2030, driven by growth in oncology, vaccines, and other specialty areas. A key part of this is launching at least one or two new blockbuster drugs. The scenario also depends on steady execution, disciplined cost management to protect margins, and a stable regulatory environment without major negative surprises. While patent losses will occur, Pfizer is expected to mitigate the impact through strategies like launching authorised generics or shifting patients to new formulations.

Financial Outcomes

Under this base case, revenue is projected to remain flat around $60 billion through 2026 before growing toward $70 billion by 2029. Cost-cutting measures are expected to keep operating margins stable near 30%. By 2028, adjusted EPS could reach approximately $3.50. The dividend is maintained, with potential for modest annual increases. As market confidence returns, the P/E multiple could normalise to around 12x, supporting a stock price in the mid $30s range. If 2030 FCF would be $21B, terminal growth 2.5% or there would be shares buybycks reduction by ~8%, we would be looking at $40-$45 range. This would provide a solid total annual return in the low-to-mid-teens, combining the dividend yield with stock price appreciation.

Bear Case (25% Probability)

Key Assumptions

This “Value Trap” scenario is triggered by a combination of internal and external failures. Key pipeline drugs disappoint in trials or underperform at launch due to intense competition. The drug pipeline contributes only $5–$10 billion by 2030, far short of the $20 billion target. Simultaneously, the patent cliff hits hard, with generic rivals for Eliquis and other key products causing over $15 billion in annual revenue loss. COVID-related sales become negligible post-2026. An unfriendly regulatory environment, including deep price cuts from IRA negotiations, further pressures the business, and cost-cutting measures prove insufficient to offset lost profits.

Financial Outcomes

Under this scenario, revenue stagnates or falls into the mid-$50 billion range by 2028. Net margins contract to around 15% due to lower volumes and pricing pressure, causing EPS to flatten or fall to $1.6 or less. The dividend would likely be frozen or even cut. The market would view Pfizer as a shrinking company, assigning it a low valuation multiple (e.g., 8x earnings). Consequently, the stock price would languish in the $18–$25 range or lower (an 8× multiple on $1.5 is ~$12, but large-cap pharmas often trade on dividend yield floors in stress, so $18–$25 bear price is still reasonable if the market leans on yield/asset support rather than pure P/E), making it a value trap where total returns are limited to a potentially reduced dividend.

To summarise the scenarios, the Base Case (most likely) sees Pfizer muddling through the next 5 years with modest growth and income stability - a satisfactory outcome that would likely make the stock a market performer or slight outperformer (especially thanks to the dividend). The Bear Case sees Pfizer not solving its growth gap, leading to stagnation and poor stock performance (though even then, the dividend might cushion total returns slightly). The Bull Case envisions Pfizer rekindling a robust growth narrative, which could drive significant stock re-rating and outperformance.

Given the current information, our bias leans slightly positive that Pfizer can achieve at least the base case. The company has navigated patent cliffs before (in the late 2000s post-Lipitor it went through a tough time, but then recovered with new launches). It has also shown an ability to course-correct (e.g., undertaking huge cost cuts now to preserve earnings). The probabilities reflect that while a resurgent Pfizer (bull case) is possible, it’s not prudent to count on it. Conversely, a disastrous outcome (bear) is also less likely given Pfizer’s diversification and cash cows. Most likely, we’ll get something in-between = a Pfizer that is a stable, cash-rich pharma with pockets of growth.

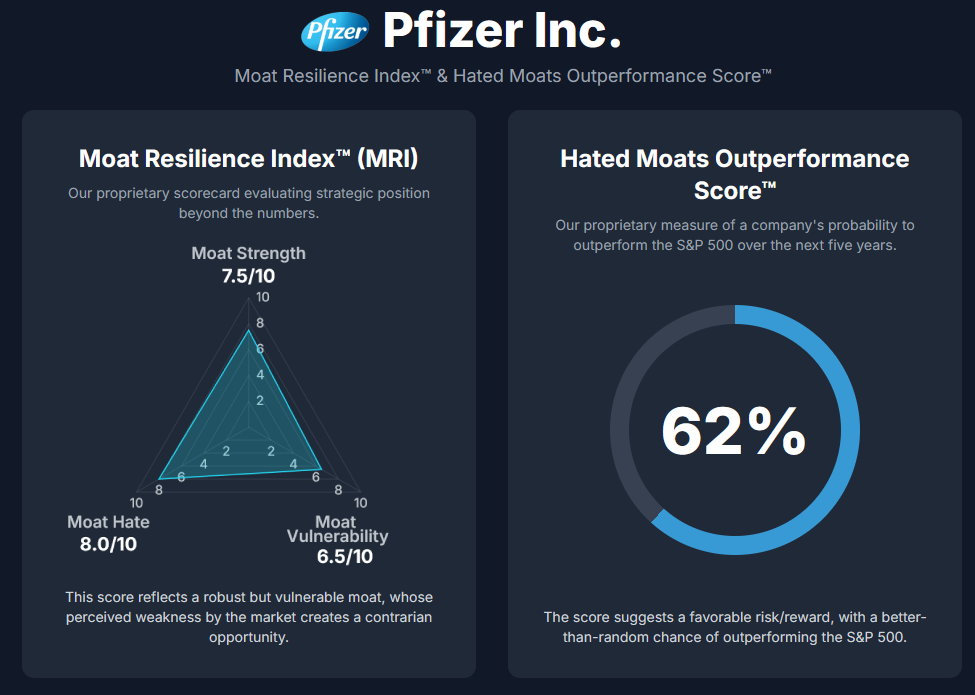

Moat Resilience Index™ (MRI)

We evaluate Pfizer’s “moat” through three sub-indicators (Moat Strength, Moat Vulnerability, and Moat Hate) each on a 1 (worst or lowest) to 10 (best or highest) scale, and then derive a “Hated Moats Outperformance Score” indicating the probability Pfizer outperforms the market in 5 years.

Moat Strength: 7.5/10

Pfizer’s strong moat is anchored by its intellectual property (patents), extensive drug development know-how, operational scale, and entrenched market presence. The company’s powerful R&D engine and deep pockets allow it to continually refresh its product lineup, evidenced by its 19 product launches in 18 months. High barriers to entry are created by its global distribution network and regulatory expertise, exemplified by the rapid COVID vaccine rollout. The Pfizer brand also carries significant trust among physicians. However, the moat is dynamic and not impregnable. Patents expire, meaning it requires constant maintenance through innovation and acquisition. While not a permanent fortress like a consumer tech ecosystem, Pfizer’s moat ranks in the top tier of the pharma industry for its breadth and resources.

Moat Hate: 8/10

We assign a 8/10 for how “hated” the company’s moat is by the market, which currently acts as if Pfizer has no competitive advantage at all. The stock’s low valuation (forward P/E of ~8) and high dividend yield (nearly 7%) signal deep investor scepticism. While companies with secure moats typically trade at a premium, Pfizer is at a discount. This is a textbook “hated moat” scenario, i.e. a fundamentally sound, cash-generating business that investors are avoiding due to short-term worries. This sentiment is reflected in lukewarm analyst “Hold” ratings and negative public perception. The rating isn’t higher only because some value and income investors have started showing interest, meaning the stock isn’t completely abandoned. This significant divergence between the moat’s quality and market sentiment possibly creates a contrarian opportunity.

Moat Vulnerability: 6.5/10

We rate Pfizer’s moat vulnerability 6.5/10. There are real, though not extreme, vulnerabilities. The primary threat is the nature of the pharmaceutical industry. The moat is constantly breached on a drug-by-drug basis as patents expire and generics appear. The upcoming patent cliff is a clear example, where competitors are ready to take market share from multiple blockbusters. While Pfizer’s diversified portfolio reduces reliance on any single product, this succession of losses is a key vulnerability. Another weak point is the pace of innovation. Rivals could discover the “next big thing” first, and Pfizer has sometimes been a fast follower rather than an innovator. If its R&D falters, the moat could weaken relative to competitors. Finally, regulatory changes, such as government price negotiations or easier biosimilar approvals, can poke holes in the moat by reducing the rewards of innovation.

Hated Moats Outperformance Score™ (HMOS): 62%

Combining the strong moat (7.5/10), high market disdain (8.5/10), and rather moderate vulnerabilities (6.5/10), we arrive at a Hated Moats Outperformance Score™ of 62%.

This score represents an estimated 55% probability that Pfizer will outperform the S&P 500 over the next 5 years. We believe this is a slightly favourable probability, considering the vast research above. The reasoning is that Pfizer’s dividend yield alone is triple the market’s and even if the stock only matches the S&P in price appreciation, the income could push its total return ahead. Furthermore, if Pfizer executes its base case or better, the combination of multiple expansion and renewed growth could deliver outsized returns, especially while the broader market faces potential headwinds.

There is a 38% chance that Pfizer underperforms if our bear scenario occurs or equals the market performance with uninspiring base scenario (i.e., it will have been not a good investment for market-like returns with a single-stock risk). However, on a risk-adjusted basis, Pfizer’s margin of safety and unloved status give it a chance to outperform.

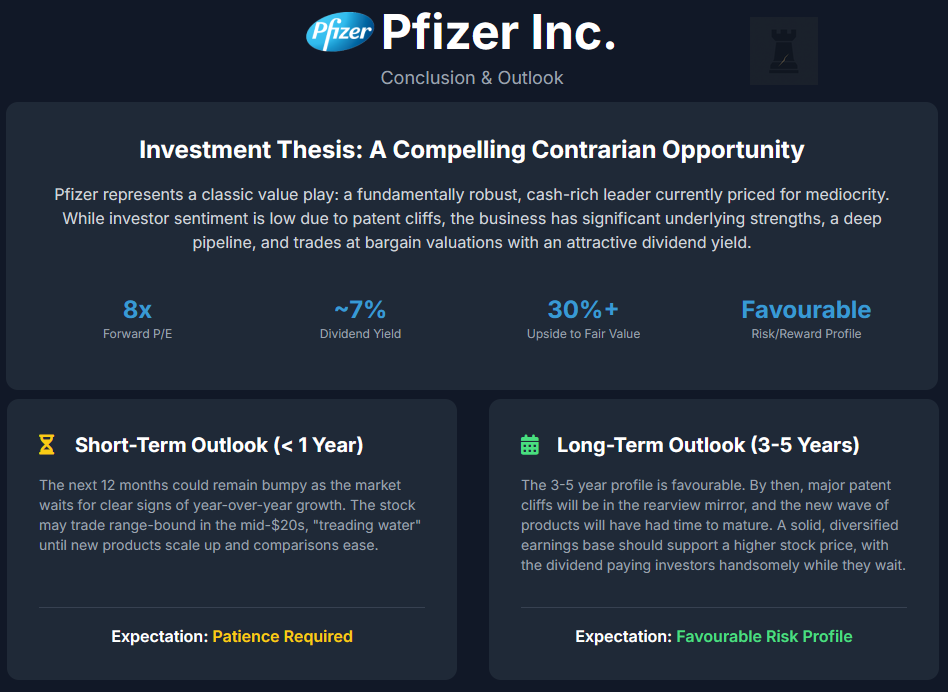

Conclusion

Pfizer today offers a compelling contrarian opportunity. A fundamentally robust, cash-rich pharmaceutical leader that is currently priced for mediocrity (or worse). The company’s recent challenges (a comedown from pandemic highs and looming patent expirations) have cast a long shadow on investor sentiment, driving the stock to multi-year lows. Yet, beneath the market’s pessimism lies a business with significant strengths. There’s a broad and deep drug portfolio, one of the industry’s most ambitious pipelines, disciplined cost management, and a fortress balance sheet.

From a value and income standpoint, Pfizer checks many boxes. It trades at bargain valuations (8x forward earnings, ~2x sales) while paying an alluring ~7% dividend yield. That’s the kind of setup that value investors appreciate when the underlying business is sound. Our analysis indicates that Pfizer’s core earnings power is poised to improve from the 2023 post-COVID period, and the market is underestimating its pipeline potential and resilience. Even factoring in conservative assumptions, the stock appears to have 30%+ upside to fair value over the next couple of years. The risk/reward skews favourably. The downside seems limited by the dividend support and the sheer scale of Pfizer’s cash flows (in a worst-case, it’s hard to see the stock falling far below the low $20s without an unforeseen catastrophe), whereas upside could be unlocked by any number of catalysts. A positive trial result, a lucrative new drug approval, or simply a few quarters of stable earnings dispelling the “falling knife” narrative might just be enough.

That said, investors need to be patient and aware of the execution risks. Pfizer is not a “shoot-the-lights-out” growth stock. It’s a classic value play where you’re betting on gradual improvement and mean reversion.

Short-Term Outlook (< 1 Year)

The next year (<12 months) could remain bumpy. In the short term, we expect the stock might continue trading range-bound in the mid-$20s, with volatility around earnings updates and macro news. Until Pfizer can demonstrate actual year-over-year growth (likely by late 2024 or 2025 when comparisons ease and new products scale up), the market could keep the stock on a short leash. High interest rates also mean there’s competition for income investors’ dollars, which could cap near-term multiple expansion. So, one shouldn’t be surprised if Pfizer stock “treads water” for a few quarters longer or has to retest lows if, say, next guidance comes in soft. Short-term traders might find better momentum elsewhere.

Long-Term Outlook (3-5 Years)

However, looking out 3–5 years, we see a favourable risk profile. By that time frame, Pfizer’s major patent storms will either have passed or be well telegraphed, and its wave of launches and acquisitions will have had time to bear fruit. We anticipate that Pfizer will find a new footing. Perhaps not the sky-high COVID-era profits, but a solid, diversified earnings base that supports a higher stock price than today’s. The dividend will pay investors handsomely while they wait (and likely grow modestly). Furthermore, any improvement in market sentiment toward defensive or healthcare stocks could act as a tailwind. If the overall market leadership rotates, high-yield value stocks like PFE could come back in vogue.

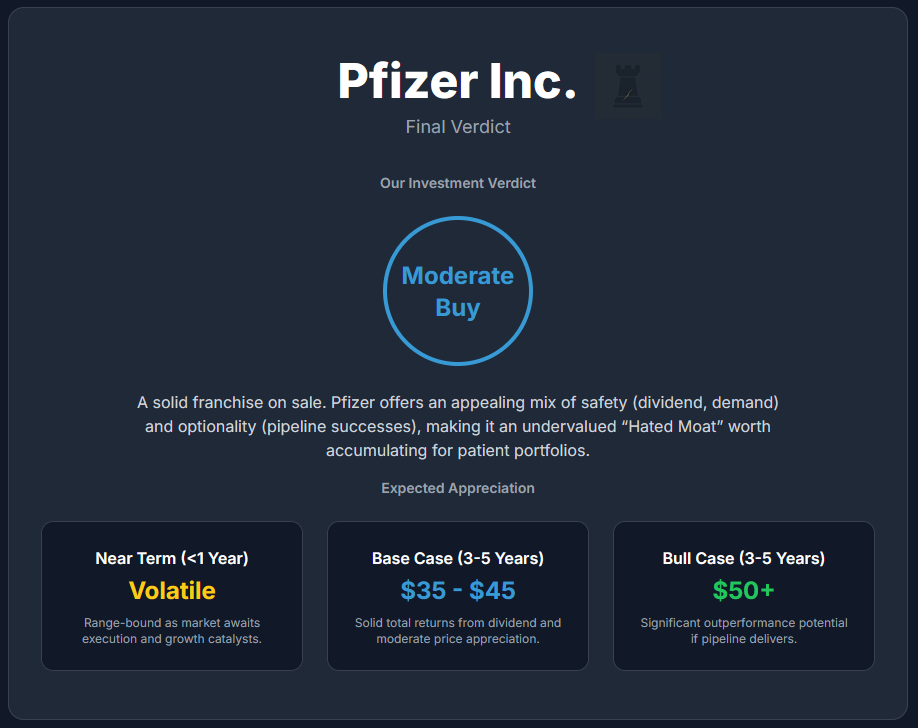

Final Verdict

Our Investment Verdict: MODERATE BUY

Taking all factors into account (Pfizer’s fundamental strength vs. its market discount, the scenarios we outlined, and the Moat analysis) our investment verdict is leaning positive. We would categorise Pfizer as a “Moderate Buy” at current levels. It’s not a clear Buy (there is a risk of ‘perfect storm’ via the patent cliff and the company remains deeply in the ‘show-me’ territory) or even an unequivocal Strong Buy (we reserve that for cases with clearer immediate catalysts, less dependence on uncertain R&D outcomes and clearer superficial ‘headlines’ hate), but it does appear too cheap to ignore. Essentially, Pfizer is a solid franchise on sale. You get a world-class pharma business at a price that assumes very little growth, and you get paid generously in dividends while you wait to see if the company can execute its rebound.

For investors with a contrarian bent, Pfizer offers an appealing mix of safety and optionality. The safety in its dividend and entrenched healthcare demand, optionality in its pipeline successes (which could surprise to the upside). We conclude that at ~$25, the balance of evidence tilts toward Pfizer being an undervalued “Hated Moat” worth accumulating for patient portfolios. In five years, we wouldn’t be surprised if the company has outperformed the S&P 500. Thus, our final verdict of Moderate Buy for long-term value investors or dividend-oriented investors. Treat it as a cornerstone dividend stock with recovery potential, rather than a quick trade or super growth stock. With a bit of patience and Pfizer’s enduring moat, this could very well be a case where the market’s hate today becomes an investor’s gain tomorrow.

Disclaimer & Our Investment

The author of the analysis does not own Pfizer as I concentrate my pharma exposure to Novo Nordisk and currently Pfizer do not represent a compelling enough case (Buy or Strong Buy) to initiate a position. No part of this entire analysis should be used as a financial advice and should be used solely for educational and research purposes.

What are your thoughts on Pfizer? Is it a value trap or is it an opportunity?

Let us know in the comments! We read and answer every one of them and we really appreciate anyone liking, commmenting and subscribing to our channel as it means big support and immense signal to dedicate our time to these. Thank you!

Great comparison with Merck. The 45-50% revenue concentration from Keytruda is indeed Merck's biggest vulnerabilty heading into 2028. While their oncology pipeline is strong, replacing half your revenue stream is an enormous challenge. That said, their higher operating margin (40% vs Pfizer's 30%) gives them more cushion to invest in late-stage assets and partnerships to bridge that gap. The next few years will be critical for both companies.

I prefer NVO, but yeah I’ve kept and eye on Pfizer