Quick Summary

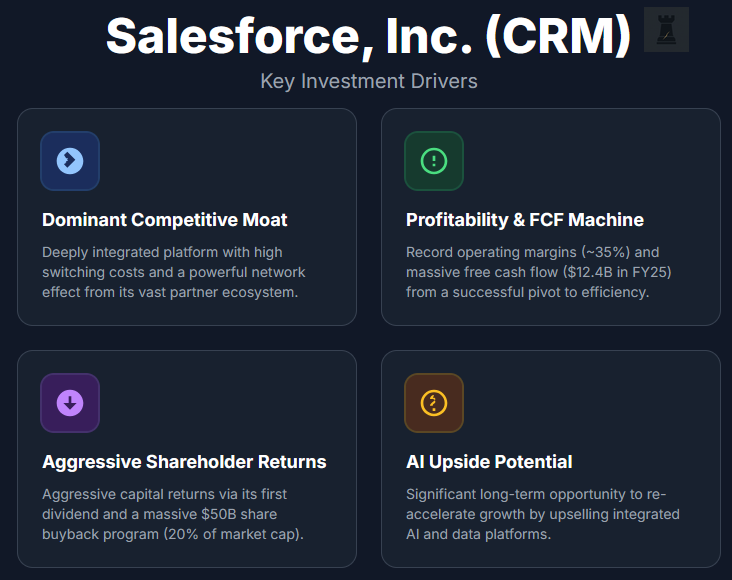

Key Investment Drivers

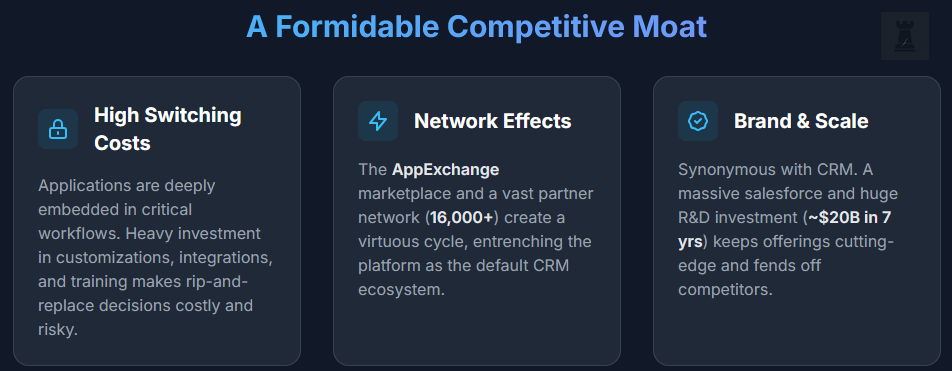

Dominant Competitive Moat. The platform's deep integration into customer workflows creates high switching costs. Its vast AppExchange and partner network produce a powerful network effect, solidifying its market leadership.

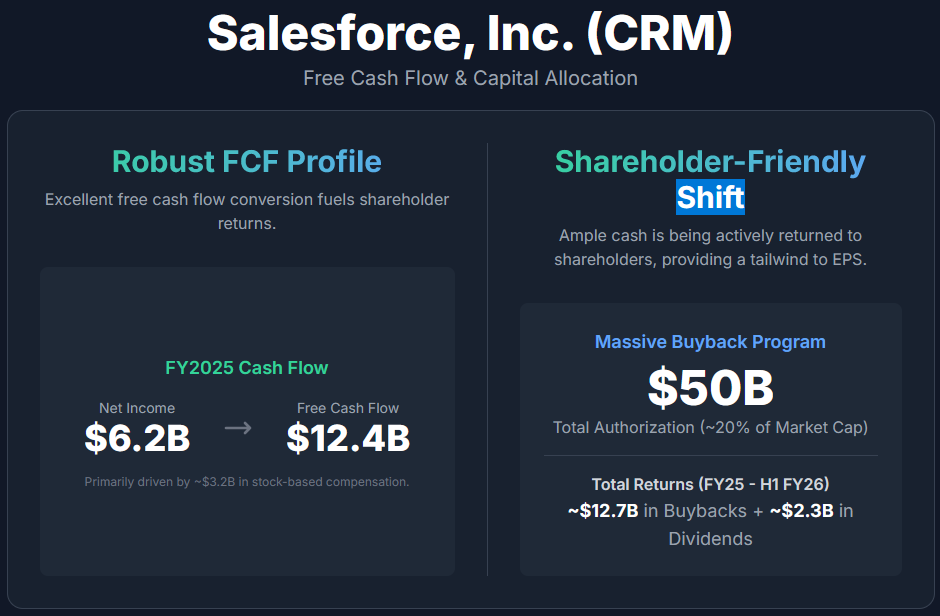

Profitability & Free Cash Flow Machine. A strategic pivot to efficiency has resulted in record operating margins (approaching 35%) and enormous free cash flow ($12.4 billion in FY2025), supporting an attractive FCF yield of nearly 5%.

Aggressive Shareholder Returns. Management has shifted focus from M&A to capital returns, initiating its first dividend and authorizing a massive $50 billion share buyback program (over 20% of the current market cap).

AI Upside Potential. The integration of AI and data platforms (Data Cloud, Agentforce, Informatica) creates a significant long-term opportunity to drive a new upgrade cycle and potentially re-accelerate top-line growth.

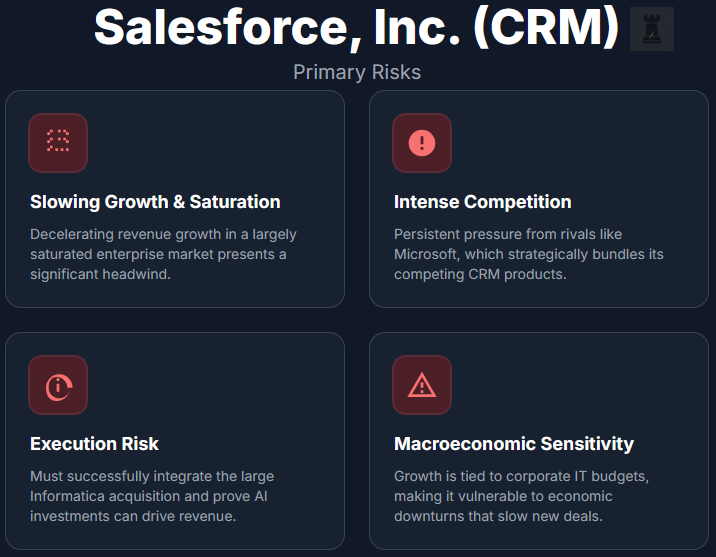

Primary Risks

Slowing Growth & Market Saturation. With revenue growth decelerating into the high-single-digits, the company faces the challenge of expanding within a largely saturated enterprise market.

Intense Competition. Salesforce faces persistent pressure from well-funded rivals, particularly Microsoft, which strategically bundles its Dynamics 365 product with its ubiquitous Office and Teams platforms.

Execution Risk: The company must successfully integrate its large $8B Informatica acquisition and prove that its heavy investment in AI can translate into meaningful revenue growth, not just cost savings.

Macroeconomic Sensitivity: As an enterprise software provider, Salesforce's growth is tied to corporate IT budgets, making it vulnerable to economic downturns that could slow new deals and expansions.

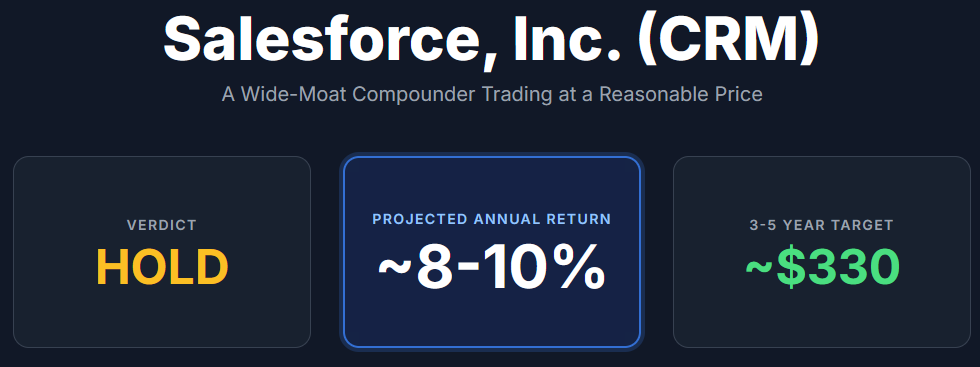

Hated Moats Verdict

We assign a 55% probability that Salesforce will outperform the S&P 500 over the next five years (Hated Moats Score™). This reflects our view that the company is a steady compounder likely to yield returns very similar to the broad market, with only a slight edge for outperformance. Our Investment Verdict is thus: HOLD. At its current price of ~$250, Salesforce appears fairly valued. In our view, the risk/reward profile does not justify initiating a new position. We would re-rate the stock to BUY in the $215–$230 range and STRONG BUY below $215, where the margin of safety would be more compelling.

The Deep Dive

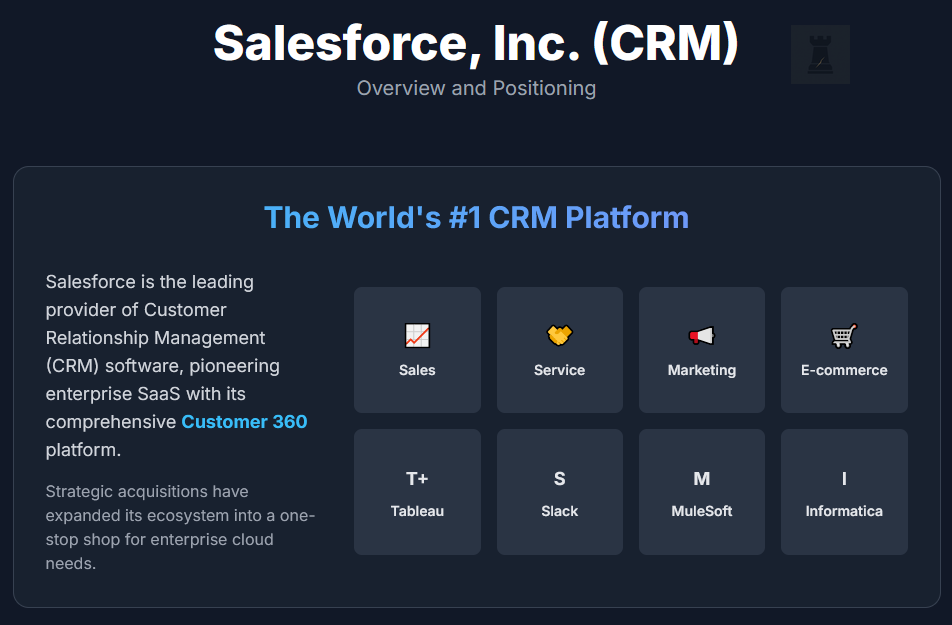

Overview, Positioning and Competitive Moat

Salesforce, Inc. (NYSE: CRM) is the world’s leading provider of customer relationship management (CRM) software, offering a broad cloud-based platform (Customer 360) that spans sales, service, marketing, e-commerce, analytics (Tableau), collaboration (Slack), and more. The company pioneered enterprise Software-as-a-Service (SaaS) and has grown into a market-defining platform with a presence across industries and company sizes. Salesforce’s strategic acquisitions (MuleSoft for integration, Tableau for analytics, Slack for collaboration, and now a planned $8 billion acquisition of Informatica for data management) have expanded its ecosystem into a one-stop shop for enterprise cloud needs.

Competitive Moat

The above gives Salesforce a formidable competitive moat.

Salesforce’s applications often become deeply embedded in customers’ critical workflows and data = high switching costs. Enterprises invest heavily in customisations, integrations, and user training on the Salesforce platform, making rip-and-replace decisions costly and risky. Customers tend to stick with Salesforce and expand usage over time (reflected in healthy renewal and upsell rates).

Salesforce’s AppExchange marketplace and large partner network (over 16,000 partners, including ~9,000 consulting) create a network effect – third-party developers build extensions and integrations for Salesforce, further entrenching the platform in customers’ operations. The wide array of plugins and industry-specific solutions available reinforces Salesforce’s position as the default CRM ecosystem for enterprises.

Salesforce is synonymous with CRM. The brand carries weight in enterprise IT decisions (the old adage “no one gets fired for buying Salesforce” applies). This strong reputation, combined with a massive global salesforce (over 75,000 employees), helps fend off competitors. Salesforce’s scale also gives it resources to invest in R&D (~$20B invested in the last 7 years in new features like AI), keeping its offerings cutting-edge.

According to our research, the company’s moat appears robust. It would be highly challenging for a new entrant to replicate Salesforce’s integrated data+AI+CRM platform and its partner network. Key rivals like Microsoft (Dynamics 365 CRM) and Oracle/SAP have their own CRM offerings, but none match the depth and unification of Salesforce’s Customer 360 platform across so many functions. Microsoft does pose a threat by bundling its CRM with popular productivity tools, yet Salesforce’s independence and focus have so far preserved its edge in large enterprises. Even as generative AI and autonomous “Agent” software emerge, Salesforce has quickly incorporated these trends (e.g. its new “Agentforce” AI platform for autonomous agents) to ensure its moat evolves with technology. In short, Salesforce’s castle in the cloud is well-fortified by a deep, data-rich moat. One that is perhaps underappreciated by a market currently infatuated with flashier AI pure-plays. The bear case leans heavily on Salesforce being outdated and not utilising AI (enough) but our research shows otherwise.

Recent Stock Performance & Market Sentiment

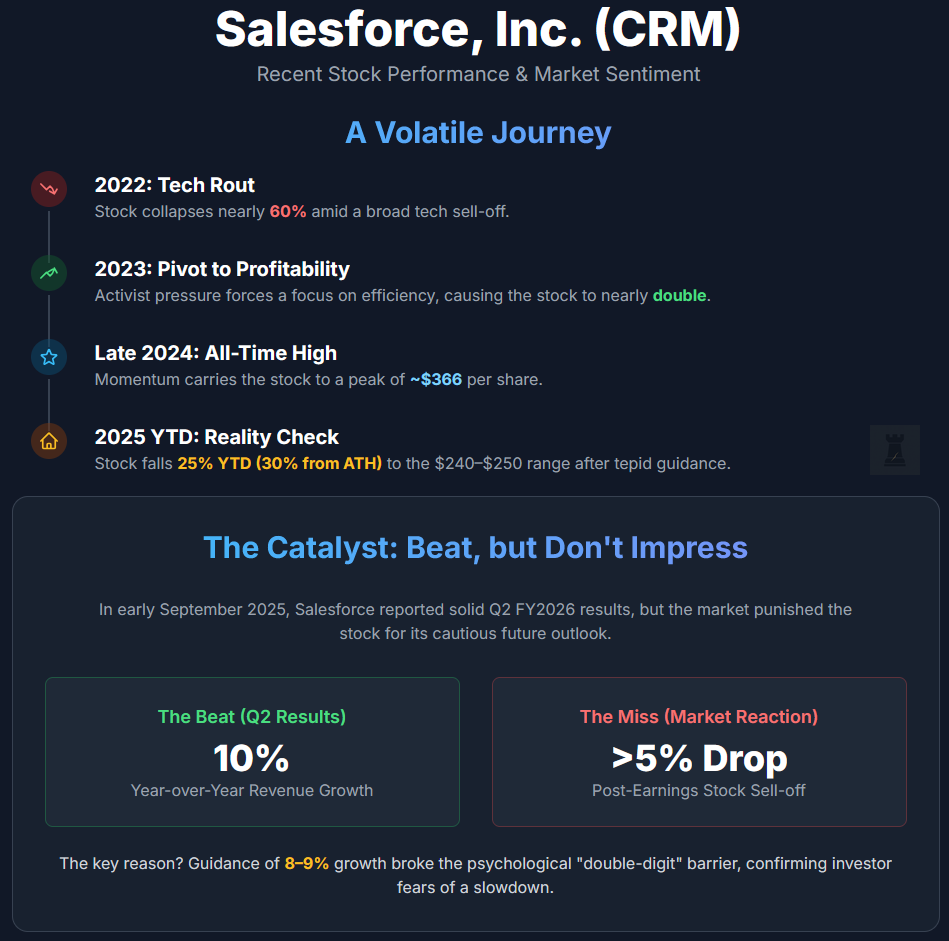

Salesforce's stock performance tells a tale of two narratives. An activist-spurred pivot to profitability clashing with decelerating growth. After collapsing nearly 60% in 2022 amid a tech rout, CRM nearly doubled in 2023 as management was forced to focus on efficiency. The stock hit an all-time high of ~$366 in late 2024 before a reality check in 2025, which has seen it fall 25% year-to-date (and 30% from ATH) to the current $240–$250 range.

The latest trigger for the sell-off was a classic case of beating estimates but failing to impress. In early September 2025, Salesforce reported solid Q2 FY2026 results with 10% year-over-year revenue growth. However, the stock dropped over 5% on what the market deemed tepid guidance. A revenue outlook of 8–9% for the upcoming quarter and full year confirmed investor fears (breaking under the psychological double-digit revenue). The company's much-hyped AI products are not yet accelerating the top line.

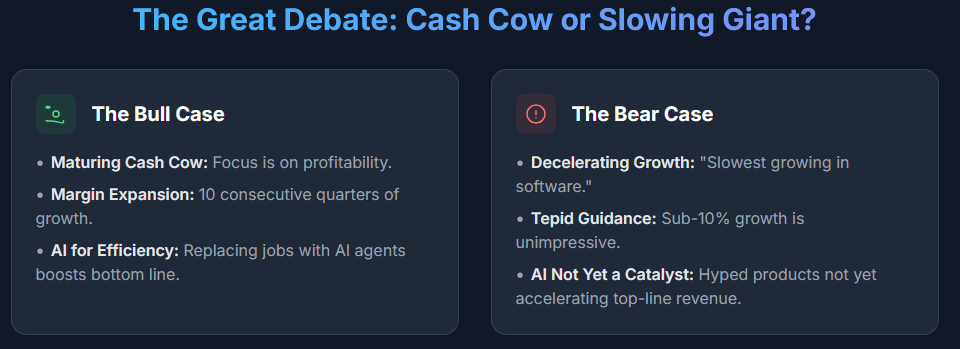

Market sentiment has soured to cautious. The debate is whether Salesforce is a maturing cash cow or if it can reignite double-digit growth. Bulls point to 10 consecutive quarters of margin expansion, while bears lament that it’s “the slowest growing in software.” Retail investors are largely unimpressed, rotating to hotter AI names while Salesforce consolidates.

This focus on profitability is tangible. Following a 10% workforce reduction in 2023, the company recently cut another 4,000 support jobs, replacing them with AI agents. While these moves are margin-accretive, they underscore a company banking on AI for efficiency rather than immediate top-line explosion. The annual Dreamforce conference remains a potential catalyst, but only if new announcements can genuinely move the needle on growth.

In summary, Salesforce's stock is caught between its wide-moat, cash-generating reality and the market's disappointment with its growth trajectory. The recent pullback suggests expectations have been reset from "AI hyper-growth" to "profitable but slower software giant." Any significant upside from here likely depends on a surprise re-acceleration in revenue or a more favorable macro environment.

Fundamental Analysis

Growth & Profitability

Salesforce's era of 20%+ growth is over, with revenue now settling into a high-single-digit pace. For fiscal 2025, revenue hit $37.9 billion, up ~9%, a rate maintained through the first half of fiscal 2026. This deceleration reflects both macro headwinds and the law of large numbers. With new customer acquisition slowing, the company is shifting its strategy from a "land grab" to harvesting its massive installed base. The primary lever for this is pricing power. In August 2023, Salesforce enacted its first price increase in seven years, hiking list prices by an average of 9% to monetize a claimed $20 billion in R&D investments. While core subscription revenue remains healthy (+11% YoY last quarter), the new growth narrative hinges on upselling AI. The Data Cloud & AI products boast 120% YoY recurring revenue growth, albeit from a small base, and are now included in nearly 60% of top deals, signaling potential for future re-acceleration.

After years of prioritizing growth over profits, Salesforce delivered a record 33.0% non-GAAP operating margin in FY2025, a figure that climbed to 34.3% in the most recent quarter. This marks ten consecutive quarters of margin expansion, driven not by newfound genius but by blunt cost-cutting, including a 10% staff reduction and rationalised real estate. This discipline has transformed the company's financial profile. Operating cash flow jumped 28% to $13.1 billion in FY2025, translating into a massive $12.4 billion in free cash flow, i.e. a free cash flow margin of ~33%. With a trailing P/E of ~36x and a forward P/E around ~20x, the valuation is reasonable for a business that now gushes cash, offering an attractive FCF yield of nearly 5%.

Salesforce’s balance sheet is healthy. As of mid-2025, the company had $14.1B in cash and marketable securities against roughly $12.5B in debt. Debt/Equity stands at a modest 0.19×, and interest coverage is very high given EBITDA in the ~$10B+ range. In short, leverage is low and not a concern. Salesforce could, if needed, borrow significantly for strategic purposes (its credit ratings are strong investment-grade). The company did authorize a large debt-funded share buyback in 2022, but with cash flows so strong, funding returns to shareholders hasn’t strained the balance sheet. Goodwill and intangibles are sizable on the balance sheet after years of acquisitions (Slack, Tableau, etc.), but impairment risk seems low as those businesses are integrated and performing reasonably. One thing to monitor is that with the planned $8B Informatica acquisition (an all-cash deal at $25/share), Salesforce will use some cash and potentially issue debt. However, even that should be manageable given ~$6B+ in annual free cash flow after dividends. The bottom line is that financial stability is solid, and Salesforce has flexibility to invest or weather downturns.

Free Cash Flow & Capital Allocation

Salesforce’s cash flow profile is robust, and its capital allocation has shifted to a much more shareholder-friendly stance recently. Free cash flow (FCF) conversion is excellent – net income of $6.2B in FY25 translated to $12.4B in FCF, thanks to non-cash expenses (notably $3.2B stock comp) and upfront billing. This ample cash is being actively returned to shareholders. In FY2025, Salesforce repurchased $7.8B worth of stock and paid $1.5B in dividends. In the first half of FY2026 alone, it bought back another ~$4.9B and paid ~$800M in dividends. The company also just boosted its share repurchase authorization by $20B to a total of $50B – a massive program amounting to over 20% of the current market cap. This reflects confidence from the board/management that the stock is undervalued, and it provides a tailwind to EPS growth going forward. Share count has already dropped modestly (shares outstanding ~955M now vs ~974M a year ago), reversing the dilution trend of prior years.

It’s worth highlighting how dramatic this shift is. Salesforce went from an aggressive acquirer (spending ~$50B on deals from 2018–2021) to now a net capital returner. They even disbanded the internal M&A committee in 2023 after criticism that Salesforce overpaid for Slack and others. That doesn’t mean acquisitions are off the table – the Informatica deal shows M&A is still a tool, but likely pursued more judiciously. The planned Informatica acquisition for $8B is notable, as far as capital allocation goes. It’s Salesforce’s largest purchase since Slack’s $28B in 2021. Informatica brings master data management (MDM) and data integration capabilities, which should bolster Salesforce’s Data Cloud and AI initiatives. While some investors are wary of big acquisitions (given mixed records on past deals), management insists this one is about strengthening the core platform for the “AI + Data” era. They have signaled no impact on FY26 guidance from this deal (closing expected in FY27, i.e. next calendar year), implying perhaps that Informatica’s ~$1.5B revenue will just offset any financing costs. We will monitor execution here, but given Salesforce’s better cost discipline, there’s reason to hope they won’t let acquisition spending balloon uncontrollably again.

Valuation & Key Financial Metrics

Intrinsic Value & DCF

To estimate Salesforce’s intrinsic value, we perform a discounted cash flow (DCF) analysis incorporating its current fundamentals and outlook. We use free cash flow as the basis, given the reliability of Salesforce’s cash generation. Here are the key assumptions in our base-case DCF:

Revenue Growth: ~8% CAGR for the next 5 years, starting from the FY26 revenue guidance ~$41.2B. This assumes Salesforce sustains high-single-digit growth through a mix of modest new customer additions, continued upselling of AI & Data Cloud, and periodic price increases, but doesn’t re-accelerate to double digits (a conservative stance given current guidance ~9%).

Profitability: We assume FCF margins gradually improve from ~30% currently to ~33–34% over 5 years. This reflects continued operating leverage (from cost discipline and AI-driven efficiency) and potentially slightly lower stock-comp expense as a % of revenue. Salesforce’s own non-GAAP op margin target for the full year FY26 is ~34%, which corresponds to ~30%+ FCF margin after CapEx. We expect margin gains to mostly plateau by year 5 as the company likely reinvests any excess in growth or acquisitions.

Terminal Growth: ~3% long-term growth (in line with nominal GDP/inflation), reflecting a steady-state mature software company & Discount Rate: ~8.5% weighted average cost of capital. Salesforce is a large-cap with a beta around 1.1 and modest debt. An 8–9% discount rate seems appropriate in today’s interest rate environment.

Using these inputs, our DCF indicates an intrinsic equity value in the range of $290–$300 billion, which on ~0.95 billion shares equals roughly $300–$315 per share. This suggests the stock’s fair value is about 20–25% above the recent trading price. In other words, Salesforce appears moderately undervalued on a DCF basis, with our base-case yielding a value in the low $300s per share. The margin of safety isn’t huge, but it is meaningful for a company of Salesforce’s caliber.

To sanity-check, in this base scenario Salesforce’s FCF would grow from ~$12B today to about $18–20B in five years, and the terminal value (beyond year 5) would be around 15× FCF, which is reasonable for a durable software firm. This outcome hinges on Salesforce hitting its margin targets and sustaining mid to high-single-digit growth – essentially executing its current game plan. It does not assume any step-change like a major re-acceleration from AI or a big recession. It’s a middle-of-the-road outlook.

We can also consider alternative scenarios: In a bull case where growth re-accelerates to ~10–12% (perhaps AI and new products drive extra demand) and margins push to 35%+, our DCF would produce a value well over $350/share. Conversely, in a bear case with growth slipping to ~5% and margins stuck around 30%, fair value might dip to ~$220–$250/share. These align with our scenario analysis in the next section. Overall, the DCF supports the view that Salesforce is slightly undervalued to fairly valued, with upside potential if it can execute well on growth initiatives. The market, by pricing CRM at ~20× forward earnings, appears to be discounting a no-growth or low-growth future. Yet the company’s own outlook and the secular tailwinds in digital transformation suggest higher growth than that pessimistic scenario. Thus, for the patient long-term investor, buying Salesforce at ~$250 offers a chance to own a high-quality franchise at a reasonable price (perhaps even a bargain if one believes growth will surprise to the upside).

(Note: Our DCF uses a relatively low discount rate reflecting Salesforce’s stability – if one used a higher 10% rate, the fair value would come out a bit lower, around the current market price. We acknowledge the valuation is sensitive to assumptions, but the main takeaway is that Salesforce’s strong cash flows provide fundamental downside protection, while any improvement in growth could provide upside not currently baked into the price.)

Key Financial Metrics

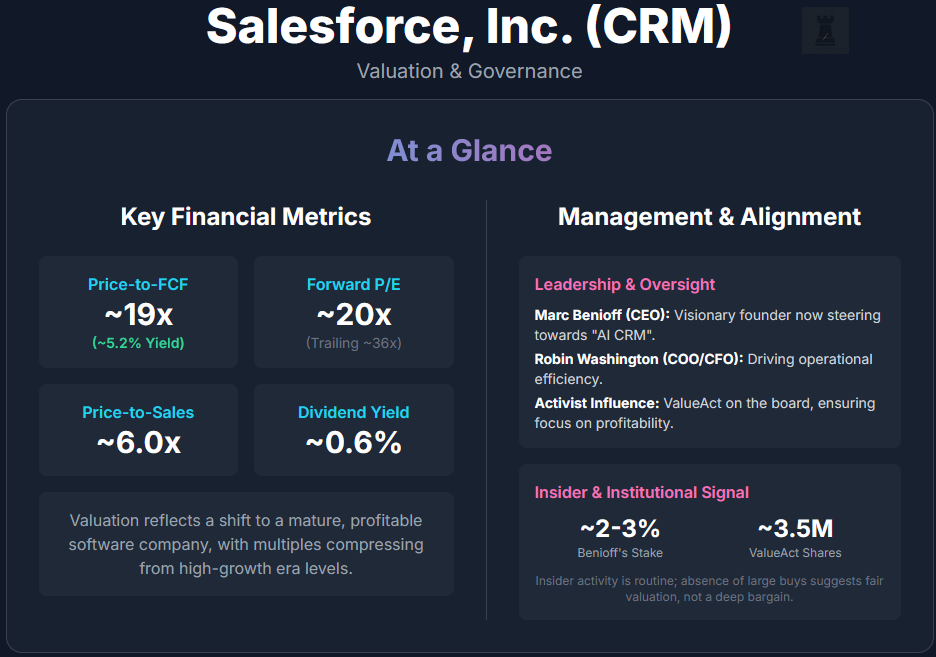

Salesforce’s valuation multiples have compressed to reflect its new identity as a mature, profitable software company. The most compelling metric is its Price-to-Free Cash Flow of ~19x, which translates to an attractive ~5.2% FCF yield, a rarity for a business with such a strong competitive moat. On an earnings basis, the stock trades at ~36x trailing GAAP EPS and a more reasonable ~20x forward earnings, putting it in line with the S&P 500 but significantly cheaper than higher-growth peers like ServiceNow (~60x) and Workday (~28x). The Price-to-Sales ratio has fallen to ~6.0x, a far cry from the 10x+ multiples it commanded during its high-growth phase. Other metrics are less telling: a Price-to-Book of ~3.9x on a ~$64/share book value is not particularly relevant for an asset-light business, and its ~11% ROE is decent but still reflects the drag from past M&A, a key part of the bear case on its historical return on invested capital. Finally, signaling its maturity, the company initiated its first dividend in FY2025. While the ~0.6% yield is modest (stemming from a ~$1.44 annualized dividend that represents a conservative ~25% payout ratio) it underscores management's confidence in steady cash generation and contributes to a solid total shareholder yield when combined with aggressive buybacks.

Management Quality and Insider Activity

Management quality and alignment have improved. Marc Benioff remains the charismatic founder CEO. He’s a visionary salesman (now dubbing Salesforce as an “AI CRM” company) who previously prioritised growth over profit. With activists on board (ValueAct’s Mason Morfit joined the board in 2023) and a new Chief Operating & Financial Officer, Robin Washington (since 2025), there is stronger oversight on efficiency. The decision to combine the COO and CFO roles under Washington (a highly respected former CFO of Gilead Sciences) underscores that Salesforce wants a tight ship operationally. The prior CFO, Amy Weaver, helped start the margin expansion, and Washington is continuing that focus. Most insider ownership is by Benioff himself at around ~2-3%, which is significant in absolute value and generally aligns his interests with shareholders (though not enough to control the vote). Insider activity has mostly been routine sales under trading plans – we have not seen notable insider buying, which is common for a mature tech firm where insiders receive much stock via compensation. The absence of buying isn’t a red flag per se (insiders already have plenty of exposure), but it suggests insiders feel the stock is fairly valued rather than a screaming bargain. On the positive side, activists and institutional holders still own chunks of Salesforce. For example, ValueAct owns ~3.5M shares, indicating that sophisticated investors see further value to be unlocked.

Risk Factors

Salesforce faces several risk factors that investors should monitor. The company itself provides a comprehensive risk discussion in its 10-K. Here, we highlight the most pertinent risks:

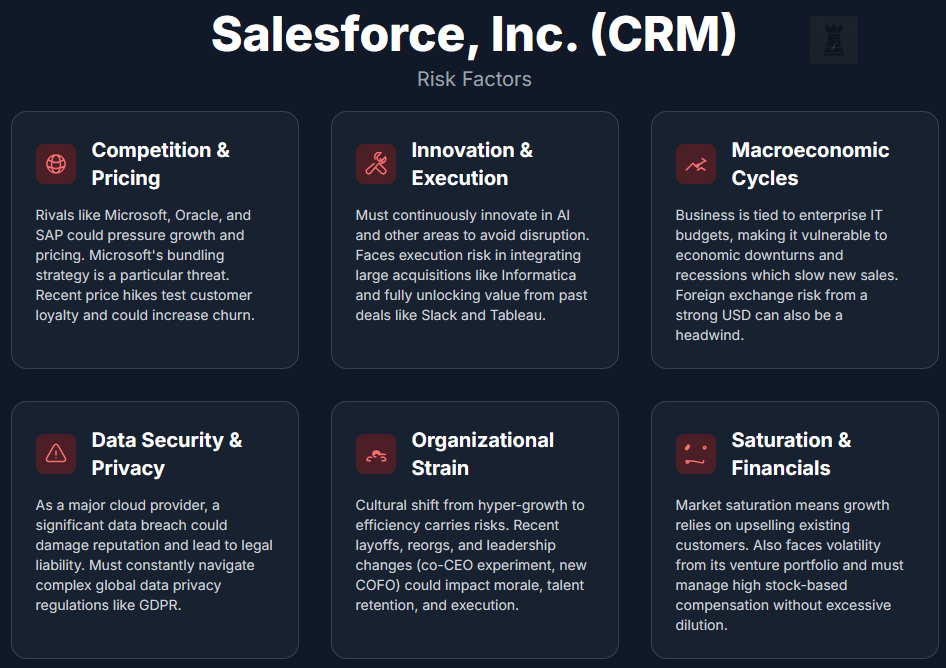

Competition and Pricing Pressure

Salesforce operates in highly competitive markets. Major tech players (Microsoft, Oracle, SAP, Adobe, HubSpot, etc.) are vying for pieces of the CRM and enterprise cloud pie. Microsoft in particular bundles its Dynamics CRM with Office and Teams at attractive pricing, posing a threat especially for smaller customers. Intense competition could pressure Salesforce’s pricing or growth, especially if a rival introduces a disruptive product. And the mentioned rivals are more than capable of doing so. So far, Salesforce has competed effectively, but the landscape evolves quickly. The risk is that Salesforce fails to “keep pace with technological developments” or new offerings from rivals. For example, if a competitor’s AI capabilities leapfrog Salesforce’s, clients might reconsider their commitments. Salesforce’s recent price hike also tests how much pricing power it truly has. Any customer pushback or increased churn would be a warning sign.

Innovation and Technological Change

The tech industry’s rapid change is a double-edged sword. Salesforce must continuously innovate (AI, automation, analytics) to stay relevant. There’s a risk of disruption if Salesforce misses a major tech trend or if the value of its platform is diminished by new paradigms. For instance, could lighter-weight AI-driven CRM tools or open-source alternatives erode Salesforce’s moat at the low end? The company is investing heavily in AI to ensure it remains on the cutting edge, but execution matters. Lean, quick-in-execution startups with narrow niche could definitely erode the giant’s moat. There is also execution risk in large projects like the Informatica integration. Absorbing a big acquisition and realising its promised benefits (creating the “most complete AI data platform”) is no small feat. Saying “incredible” many times and dreaming of being Palantir from the CEO won’t cut it. Also, past acquisitions like Slack and Tableau still require ongoing integration finesse to unlock full value.

Data Security and Privacy

As a cloud software provider managing critical customer data, Salesforce is inherently exposed to cybersecurity risks. A significant breach or outage could damage Salesforce’s reputation and lead to customer loss or legal liabilities. Salesforce must also navigate data privacy regulations (GDPR in Europe, etc.). Any missteps or compliance failures could result in fines or loss of client trust. So far, Salesforce has a solid track record on security, but the constant threat of cyber attacks is a background risk for all SaaS firms.

Macroeconomic and IT Spending Cycles

The company remains a cyclical business tied directly to enterprise IT budgets, making it vulnerable to economic downturns. While its subscription model offers some cushion, new sales and expansion inevitably slow when corporate confidence wanes, as seen during the 2020 and 2022–2023 budget tightening. In a recession, large deals face longer sales cycles, and Salesforce could struggle to meet even its high-single-digit growth targets. The current environment of elevated interest rates and slowing growth presents a persistent headwind. Furthermore, with over 30% of revenue generated overseas, a strong U.S. dollar creates foreign exchange risk. This was a headwind in FY2024 before becoming a slight tailwind in FY2025, highlighting the ongoing volatility.

Customer Attrition or Saturation

Salesforce's market saturation is a tangible risk. With most of the Fortune 500 already on its platform, future growth depends on expanding usage within existing accounts rather than acquiring new logos. This model is threatened by clients looking to trim costs by cutting unused subscriptions, which would pressure net retention rates. Furthermore, customer churn could rise if service quality slips. Investors should monitor metrics like renewal rates and cRPO growth for any signs of this weakness.

Integration and Organizational Strain

Supporting many cloud services and a huge customer base is complex. Salesforce risks straining its personnel and infrastructure as it grows. In recent years, there were some reports of sales force reorgs causing disruption. Frequent reorganization or high sales turnover could hurt sales execution. Culturally, Salesforce has also gone through changes – rapid hiring, then layoffs, a co-CEO experiment (Bret Taylor as co-CEO) that ended abruptly and now a new COO/CFO at the helm of ops/finance. There’s a human capital risk. Key talent loss or morale issues could slow innovation. So far, the company seems to be managing this (employee count is still ~76k, and engagement remains decent), but the past year’s upheavals mean this bears watching.

Legal and Regulatory Risks

In this category, Salesforce faces two notable, but distinct risks: regulatory battles and the volatility of its venture portfolio. On the regulatory front, its main exposure is Slack's antitrust complaint against Microsoft's bundling of Teams. While Microsoft's move to unbundle Teams in the EU is a partial victory, the broader competitive landscape remains a key variable. A more direct financial risk stems from Salesforce Ventures, its corporate venture arm. Fluctuations in this portfolio create significant GAAP earnings volatility, as seen in FY2023 when investment losses reduced net income to a mere $208 million. While non-GAAP results exclude this noise, investors should recognize that swings in the value of its startup stakes can obscure the core operating performance.

Stock-Based Compensation and Dilution

While not a traditional operational risk, Salesforce’s heavy use of stock-based compensation is worth noting. It remains high (over $3B/year) and, though offset by buybacks, could dilute shareholders if not managed carefully. If the stock price stays subdued, more shares may be granted to stay competitive, potentially negating buyback benefits. For now, the company is still net reducing its share count, so dilution risk appears low.

Summary

Overall, Salesforce’s risk profile is moderate for a tech giant. Industry risks like competition, tech shifts, and macro pressures are partly mitigated by its product diversification and financial strength, which allow it to invest even in downturns. A unique risk is the cultural shift from hyper-growth to operational efficiency. If cost-cutting is overdone, morale or innovation could suffer. So far, management seems to balance this well, maintaining R&D spend near 15% of revenue while trimming costs elsewhere. There are multiple areas (dealing with competition, necessary aggressive innovation, data security, handling of acquisition(s), balancing SBC & dilution) where the company needs to execute near perfection, otherwise strong competition like Microsoft will be merciless. And that’s not a simple task at all.

Our Scenarios (3–5 Year Horizon)

Bull Case (20% Probability)

In this optimistic scenario, Salesforce successfully capitalizes on the AI revolution and reignites growth. Revenue growth re-accelerates into the low-teens (%) annually, surprising the Street.

Key Assumptions

In this scenario, Salesforce successfully capitalizes on the AI revolution and reignites growth. The company’s “Agentforce” AI agents and Einstein GPT spark a new upgrade cycle as clients expand spending to automate workflows, purchase more licenses, and adopt Data Cloud (by this time boosted by the Informatica acquisition) as a central platform for unifying data. This drives revenue growth back into the low-teens annually within a couple of years. Even as growth accelerates, Salesforce maintains cost discipline, keeping non-GAAP operating margins near 35% or even pushing toward 40%, while internal use of AI reduces support and development costs. Net income grows faster than revenue, delivering 15%+ EPS CAGR. Competitive positioning strengthens as churn remains low, Microsoft and other rivals face occasional missteps or regulatory challenges, and Salesforce secures high-profile customer wins that enhance its reputation. International adoption further supports growth. This case also assumes a favorable macro backdrop (no deep recession, steady global growth, and lower interest rates) which encourages continued enterprise investment in digital transformation. Salesforce must execute well on product innovation and strategic acquisitions for this scenario to play out. Essentially, Salesforce needs to prove it can be a growth company again in the AI era.

Financial Outcomes

The financial result would be a re-acceleration of annual revenue growth into the low-teens (~12%), coupled with sustained non-GAAP operating margins expanding toward 35-40%. This would allow EPS to achieve a CAGR of 15% or more, leading to a potential $60–$70 billion in revenue and over $20 billion in profit by 2028. Consequently, improved investor sentiment would award the company a higher valuation multiple (e.g., 30x P/E), potentially causing the stock price to double into the $400–$500 per share range, with per-share results amplified by buybacks.

Base Case (60% Probability)

In our base case, Salesforce essentially achieves the trajectory it is currently guiding towards. A stable, moderate growth company with high margins, making it a solid compounder but not an explosive stock.

Key Assumptions

The base case assumes a continuation of the current trajectory, requiring a stable macroeconomic environment with normal GDP and IT spending growth. Salesforce must execute its existing business plan, delivering on guidance, balancing profitability with investment, and avoiding any major operational failures. The company's competitive moat holds, with no significant market share shifts and high customer renewal rates. In this scenario, AI adoption serves to sustain rather than accelerate growth, and the acquisition strategy is limited to smaller, tuck-in deals. Under these conditions, Salesforce becomes a bit like the next Microsoft or Oracle – a mature software giant that the market views as a stable earnings compounder.

Financial Outcomes

The result is sustainable annual revenue growth in the 7–9% range. Non-GAAP operating margins are maintained around 35%, leading to a low double-digit EPS CAGR, aided by share buybacks that reduce the share count by roughly 2% per year. Capital returns are consistent, with the execution of the existing buyback authorization and modest dividend growth. With the stock's valuation multiple holding steady at 20–25x earnings, this performance would translate to a share price of around $330 by 2028, delivering a solid but unspectacular annual total return of approximately 8–10%.

Bear Case (20% Probability)

In the bear case, Salesforce hits a wall on growth or suffers an operational stumble, leading to underperformance.

Key Assumptions

Our bearish scenario assumes a combination of external headwinds and internal failures. It could be triggered by a global recession that slashes IT spending, or by Salesforce reaching market saturation. The company's competitive moat would erode as customers migrate to cheaper alternatives or new disruptive technologies. This is exacerbated by internal fumbles, such as a major strategic misstep like a failed acquisition, a deterioration of leadership and culture, or an inability to adapt to a post-cloud paradigm. Ultimately, Salesforce would be slowly but steadily lose its status as the default enterprise choice.

Financial Outcomes

The financial consequence would be a severe slowdown in revenue growth to low-single-digits (3-5%), or even stagnation. This would pressure margins, potentially causing them to contract as the company struggles with a high fixed-cost base or overspends to reignite growth, leading to negligible EPS growth. In response, investors would de-rate the stock, compressing its P/E multiple to ~15x or lower. This valuation, applied to stagnant earnings, could drive the share price down to the $120–$150 range, implying a significant loss of 30–50% from current levels.

Summary of Scenarios

Our base case is the highest probability, envisioning Salesforce as a steady grower with continued profitability focus. It’s a scenario yielding decent shareholder returns, even though we struggle to find an objective narrative where this most likely scenario would confidently outperform the broad market (see more below in Moat Score, Conclusion and Final Verdict sections).

The bull case, while rather optimistic and requiring internal and external factors in positive synergy, it highlights the potential if Salesforce’s AI push truly adds a new growth leg (this could make CRM a market-beating stock again). The bear case serves as a caution that even wide-moat businesses can stumble if innovation or execution falters. We assign moderate probability to each alternative scenario (bull ~20%, bear 20%) to account for uncertainty. Investors should regularly revisit these assumptions as new information (quarterly results, competitive moves, macro shifts) comes in, to see which path Salesforce is tracking.

Moat Resilience Index™ (MRI)

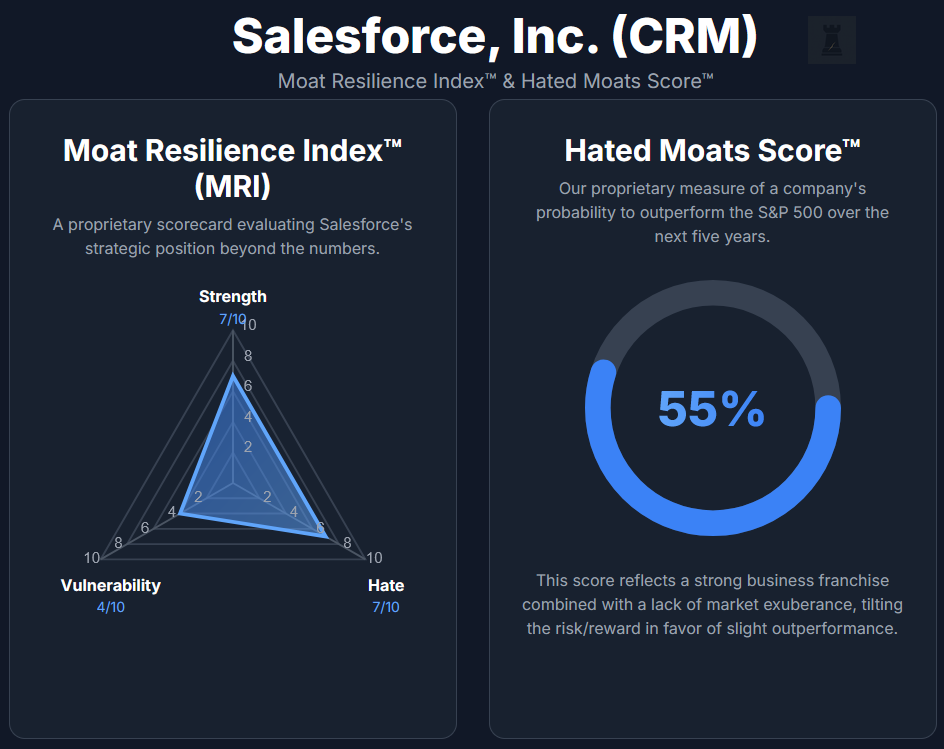

Moat Strength: 7/10

Salesforce boasts a wide and multifaceted moat. Its core competitive advantages such as high switching costs, a rich ecosystem of partners/add-ons, and a trusted brand, are very strong. Additionally, the sheer breadth of its product suite (covering sales, service, marketing, analytics, etc.) makes it a one-stop platform that is hard for point-solution competitors to dislodge. Salesforce’s scale ($40B revenue) allows it to out-invest most rivals in R&D and support. We stop short of a perfect 10 because the moat, while wide, is not completely unassailable. Big competitors (Microsoft, Oracle) have resources to nibble at its edges, and customers can and do mix-and-match solutions. Also, part of Salesforce’s moat in the past was continuous innovation via acquisitions. If this engine slows, the moat relies more on inertia than on product superiority. Still, by any measure, Salesforce has one of the stronger moats in enterprise software, evidenced by long-term client retention and its ability to sustain price increases. We give it 7/10 for being highly durable, albeit facing the perpetual pressure of tech evolution.

Moat Hate: 7/10

We use “moat hate” to gauge how underappreciated or disliked the company is in the marketplace relative to the strength of its moat. A higher score means the company is more “hated” (or at least not fully appreciated) despite a solid moat – which often is an opportunity for investors. We score Salesforce a 7/10 here. Why? In the current market, Salesforce doesn’t get much love or excitement. It’s seen as a boring, ex-growth story by some. After the stock’s underperformance in 2025, many investors have rotated to trendier AI names or simply written off Salesforce as a “stodgy old software stock.” This lack of enthusiasm is exactly what contrarians look for in a strong-moat business. Salesforce’s moat is strong (as we noted), yet it’s not reflected in a premium valuation. If anything, the stock’s multiple is roughly market-average. That suggests a degree of underappreciation. The market is essentially “hating on” Salesforce’s prospects, focusing on its slower growth rather than its formidable competitive position. All that said, it’s not a 9 or 10 on hate, because plenty of analysts do still rate it a Buy and the stock isn’t deeply undervalued (not single-digit P/E or anything extreme). So it’s moderately hated/ignored, but not outright despised. A 7/10 is fitting, as calculated by our proprietary formula. The company’s moat quality outweighs the market’s current opinion of it.

Moat Vulnerability: 4/10

We view Salesforce’s moat as rather low vulnerability to major disruption in the medium term. The low vulnerability score reflects that it would be difficult for customers to abandon Salesforce entirely as too much business process is built around it. The company also continuously fortifies its moat by integrating new tech (AI, data) and expanding use cases, which fends off potential obsolescence. Areas of vulnerability that keep this from a lower score include competition from adjacent tech giants (e.g., if Microsoft bundles a free CRM with Office, some SMBs might never become Salesforce customers), innovation risk (if a radically new approach to managing customer relationships emerges, Salesforce could be caught flat-footed), and customer budget fatigue (some clients complain about Salesforce’s cost, which opens a door for lower-cost rivals). Additionally, parts of Salesforce’s portfolio are vulnerable (Slack competes with Microsoft Teams and others in a harsh fight, and Marketing Cloud competes with Adobe, etc). If one of those components loses out, it could marginally weaken the whole and the Moat Vulnerability score would increase abruptly. Nevertheless, the integrated nature of Salesforce’s platform means weakness in one module often can be compensated by strength in another. Overall, a 4/10 in vulnerability indicates we believe Salesforce’s moat is quite resilient. Not immune to all challenges, but not easily toppled barring an unforeseen paradigm shift.

Hated Moats Score™: 55%

Based on our analysis, we assign a 55% probability that Salesforce will outperform the S&P 500 over the next five years. We believe its strong business franchise, combined with a lack of market exuberance, creates a scenario for solid returns. This suggests Salesforce can keep pace with the broad market, but with a slight potential for outperformance. Our research indicates a base-case CAGR of approximately 8-10% over this period, assuming the company follows its current guidance.

Our "Hated Moats" score of 55% reflects this stance, signifying a slightly higher probability of the bull case occurring than the bear case. Ultimately, we believe owning Salesforce at its current valuation will likely yield returns very similar to an S&P 500 index fund.

Conclusion

Salesforce has undergone a notable transformation from hyper-growth disruptor to disciplined incumbent. The stock’s journey has mirrored that, from market darling to, more recently, an underperformer facing skepticism. After this deep-dive analysis, our stance is that Salesforce remains a fundamentally strong enterprise with a wide moat and improving financial fitness. However, in our analysis, at current price ( ~$250), the margin of safety is not big and the probability of outperforming the broad market is not significantly in favour of the stock.

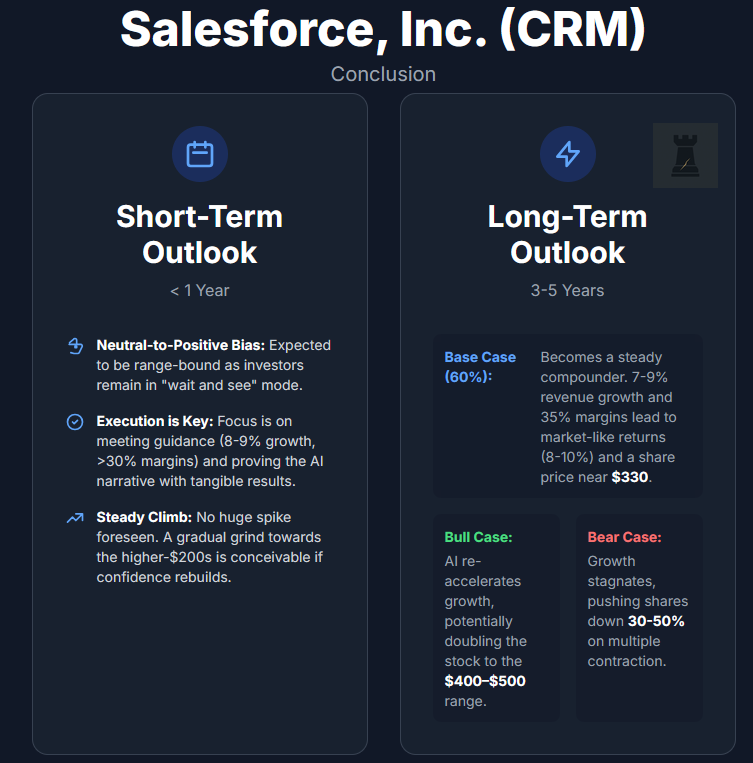

Short-Term Outlook (< 1 Year)

In the short term (next <12 months), we expect the stock to be somewhat range-bound with a neutral-to-positive bias. Macroeconomic cross-currents (inflation, interest rates, and any potential economic slowdown) could keep a lid on big multiple expansion in the very near term. Additionally, investors seem to be in “wait and see” mode regarding Salesforce. It may take a couple more quarters of execution (or a notable growth catalyst) to win back enthusiasm. The upcoming quarters will be about meeting the guidance (8–9% growth, >30% margins) and proving out the AI narrative with tangible numbers. If Salesforce can deliver consistent earnings beats and perhaps raise guidance modestly, the stock should grind higher. We don’t foresee a huge short-term spike. Rather, a steady climb back toward the higher-$200s is conceivable over the next year as (and if) confidence rebuilds.

Long-Term Outlook (3-5 Years)

Salesforce is likely to settle into its mature, cash-generating phase. Our base case (60% probability) envisions revenue growing 7–9% annually, with operating margins holding near 35% and EPS compounding at low double digits, supported by share buybacks. This could produce market-like annualized returns (8–10%) and a share price near $330 by 2028.

Upside, i.e. beating the market, exists if AI adoption drives a growth re-acceleration into the low-teens and investor sentiment rewards Salesforce with a higher multiple, potentially doubling the stock into the $400–500 range. The bear case would see growth stagnate, margins compress, and valuation multiples contract toward 15× earnings, which could push shares down 30–50% from today’s levels.

Overall, we view Salesforce as a steady compounder with slight potential to outperform the S&P 500 if execution remains strong and AI adoption delivers incremental growth rather than just cost efficiencies.

Final Verdict

Our Investment Verdict: HOLD

Our deep-dive analysis suggests that Salesforce’s most likely path over the next 3–5 years is the base case. This should yield market-like total returns (8–10% CAGR), which, while respectable, does not clearly outperform the S&P 500.

The probabilities of a bull case (AI-driven re-acceleration, multiple expansion, and stock doubling) and a bear case (growth stagnation, multiple compression, and a 30–50% drawdown) are roughly balanced, effectively a coin toss, while for now, the stock remains in the “show-me” category. With a thin margin of safety at the current $240–$250 price range, we don’t believe the risk/reward skews favorably enough to initiate or add to a position here. At the same time, the company’s good fundamentals, solid financials and strong competitive moat prevent us from rating the stock a Sell.

Our framework would become more constructive at lower levels. We would re-rate Salesforce to BUY in the $215–$230 range and to STRONG BUY below $210-$215 (considering circumstances why the stock dropped to these price levels), where the margin of safety would provide a more compelling setup relative to the downside risk.

Disclaimer & Our Investment

This analysis is for informational purposes only and reflects our independent research and opinions. While we have conducted an extensive fundamental review, this is not our area of full-time professional expertise, and we do not claim to have perfect foresight. Investors should conduct their own due diligence and consider their risk tolerance before making investment decisions. We do not own Salesforce’s stock.

Final words

Salesforce is a world-class business with a durable moat, strong cash generation, and shareholder-friendly capital allocation. However, at today’s price, according to our analysis the stock offers no obvious edge over simply owning a low-cost index fund. In our view, this is a time for patience. The base case is already priced in, and the probability of market outperformance is no better than a coin toss.

For investors seeking exposure to stocks with more upside skew, there are alternatives with clearer growth trajectories or deeper discounts. That said, for existing holders, Salesforce remains a solid compounder. It’s just not a table-pounding buy at this level. We will revisit our stance if the price approaches our target accumulation zones ($215–$230 for BUY, <$215 for STRONG BUY) or if execution and AI adoption meaningfully surprise to the upside.