Quick Summary & Investment Thesis

Adobe is a high-quality, wide-moat business currently trading at a reasonable valuation due to broader macroeconomic pressures and market sentiment, not a deterioration of its fundamentals. Its transition to a subscription-based model has created a fortress-like business with predictable, high-margin revenue and strong cash flow. The core thesis is that the market is mispricing Adobe's enduring competitive advantages and long-term growth potential, particularly from its generative AI initiatives. We believe the current stock price offers a favorable risk/reward profile for investors willing to look past short-term volatility.

Key Investment Drivers

Durable Economic Moat. Adobe’s dominant market position in creative and document software is protected by extremely high switching costs, brand power, and network effects, making its products the entrenched industry standard.

Resilient Financials. The company boasts consistent double-digit revenue growth, exceptional profitability (89% gross margin), and impressive cash flow generation, driven by its predictable subscription-based model.

AI Catalysts & Future Growth. The integration of its Firefly generative AI into core products and a clear roadmap for monetization is expected to drive a new wave of growth, increase ARPU, and justify a higher valuation over time.

Valuation Compression. The stock's P/E ratio has compressed significantly to ~21x, which is below its historical average and its software peers, suggesting it is currently undervalued relative to its quality and growth.

Primary Risks

Technological Disruption. The rapid evolution of generative AI and the emergence of nimble competitors (like Figma and Canva) could threaten Adobe's long-held dominance if the company fails to innovate quickly enough to maintain its lead.

Regulatory Scrutiny. As a dominant market leader, Adobe faces increasing antitrust pressure, as seen with the blocked Figma acquisition. Regulators may also challenge its subscription practices, potentially forcing changes to its business model.

Macroeconomic Headwinds. A severe economic downturn could lead corporate clients to reduce software spending, particularly in the Digital Experience segment, and prompt individual creators to cancel subscriptions.

AI Monetization Risk. Adobe is investing heavily in AI R&D, and failure to effectively monetize these features could lead to margin compression and disappoint investors.

Hated Moats Verdict

MODERATE BUY. At its current price, Adobe offers a compelling opportunity to own a best-in-class company with a wide moat, consistent growth, and a strong balance sheet. For investors with a long-term horizon, we believe the current lukewarm market sentiment provides a chance to accumulate a stock that has a high probability of outperforming the broader market as its fundamentals continue to compound value.

The Deep Dive

Overview, Positioning and Competitive Moat

Adobe Inc. (NASDAQ: ADBE) is a global leader in creative software and digital experience solutions, known for flagship products like Photoshop, Illustrator, Acrobat PDF, Lightroom,… and the Experience Cloud. Founded in the 1980s, Adobe has reinvented itself multiple times (from packaged software to subscription-based cloud offerings) and today enjoys a wide economic moat in the creative industry. In recent times, however, Adobe’s stock has plummeted ~40% from its 2024 highs amid broader tech market volatility and investor profit-taking. As of August 21, 2025, Adobe’s share price hovers around $353, down from a 52-week high of ~$588 in September 2024. This report provides a deep fundamental analysis of Adobe from a value and growth perspective focusing on business quality, financial fundamentals, valuation, and future outlook.

Adobe operates through two primary segments: Digital Media and Digital Experience, plus a smaller Publishing segment. The Digital Media segment (about 74% of revenue) includes Creative Cloud (software for creative professionals such as Photoshop, Illustrator, Premiere Pro, etc.) and Document Cloud (PDF and electronic document solutions like Acrobat and Adobe Sign). The Digital Experience segment (~25% of revenue) offers enterprise solutions for marketing, analytics, and e-commerce (the Adobe Experience Cloud suite). Adobe’s business model has become overwhelmingly subscription-based (around 95% of revenue is recurring subscription fees), providing predictable cash flows and customer lock-in. This transition to cloud subscriptions (initiated in 2013) has been highly successful, yielding a large base of Annualized Recurring Revenue (ARR) which stood at $18.1 billion for Digital Media as of Q2 FY2025.

Moat

Adobe’s moat is exceptionally strong in its core creative markets. Its products are considered industry-standard. Photoshop for image editing, Illustrator for vector graphics, InDesign for publishing, Premiere for video editing, etc., and these tend to have high switching costs for professionals. The dominance of this moat was highlighted by regulators calling out Adobe’s “near-monopoly in the design software market” during their scrutiny of Adobe’s attempted Figma acquisition. Regulators and customers themselves recognized Adobe’s moat, fearing that if Adobe acquired the fast-growing upstart Figma, it could stifle competition and innovation. Ultimately, facing opposition from the EU and UK regulators, Adobe abandoned the $20B Figma deal in Dec 2023, paying an unpleasant $1B breakup fee. While the failed merger cost Adobe financially and left Figma as an independent competitor, it also highlighted the breadth of Adobe’s moat. Regulators blocked this deal precisely because Adobe + Figma would have been too powerful a combination in design software.

Beyond creative software, Adobe’s Document Cloud also enjoys a strong moat due to the prevalence of PDF (Adobe literally co-invented the PDF format). Acrobat remains the go-to solution for PDF editing and forms, particularly in enterprise settings. In Digital Experience (marketing/analytics), Adobe faces stiffer competition (Salesforce, Oracle, SAP, etc.), but its offering is comprehensive and benefits from integration with Creative Cloud. This cross-cloud integration gives Adobe a unique end-to-end value proposition in digital marketing - from content creation to campaign execution and analytics, all under one Adobe umbrella.

Recent Stock Performance & Market Sentiment

Adobe's stock has experienced significant volatility over the past two years, largely driven by macroeconomic forces and shifting market sentiment. After reaching an all-time high of ~$688 in November 2021 during the tech boom, the stock corrected sharply to around ~$300 by late 2022 due to rising interest rates and a negative investor reaction to the announced $20 billion acquisition of Figma. A strong rally followed into mid-2024, pushing the stock back to ~$580 as the launch of Adobe's Firefly generative AI (and AI boom as a whole) positioned the company as a key beneficiary. However, this momentum reversed by late 2024. After the Figma deal was terminated due to regulatory hurdles (and the company went from aquisition to competition), investor focus returned to core performance, and a lackluster Q1 2025 earnings forecast raised doubts about the speed of AI monetization. Despite a strong Q2 report, the stock was ultimately pulled down by a broader tech sector pullback.

As of August 2025, Adobe is trading around $350-360. This current weakness is primarily attributed to a isconnect between the company's strong (and even improving) fundamentals and its stock valuation. The stock's forward P/E ratio has compressed from nearly 50x at its 2024 peak to a more moderate ~21x, a shift driven by macro factors rather than business performance. These include persistently high interest rates, widespread investor profit-taking after the AI rally, and sector-wide ETF outflows that created selling pressure. While factors like economic growth can affect Adobe's corporate revenue, the company has managed inflation well and currency fluctuations have been a minor headwind. The largest macro impact has been from interest rates, which have compressed the stock's valuation multiple rather than harming its actual operations.

Despite the stock price fluctuations, institutional sentiment remain largely positive. This confidence is shared by institutional investors, who maintain high ownership (~82-85%). Analyst consensus is overwhelmingly positive, with an average price target around $500 (more on this below), and very low short interest indicates a lack of significant bearish bets. In summary, Adobe's recent stock decline appears driven by market sentiment and valuation compression, not a deterioration of its fundamentally strong and growing business.

Fundamental Analysis

Growth & Profitability

Adobe demonstrates consistent double-digit revenue growth, reaching $21.5 billion in fiscal year 2024 (+11% from 2023 while 2023 was +10% from 2022). Latest results continue this trend: in Q2 FY2025, Adobe posted a record $5.87B in quarterly revenue (up 11% YoY), beating estimates, and management raised the full FY2025 revenue forecast to $23.5–$23.6B (implying ~10% YoY growth).

This expansion is driven by its resilient subscription model, with Annualized Recurring Revenue (ARR) from its core Digital Media segment climbing to $18.09 billion by mid-2025. Profitability is a key strength, with gross margins around 89% (typical for software) and a target non-GAAP operating margin of approximately 46%. In fiscal year 2024, Adobe's expenses included $3.94B for R&D (18% of revenue), $5.76B for Sales & Marketing (27%), and $1.53B for G&A (~7%). While a one-time $1 billion thrown-out-of-window fee for terminating the Figma acquisition impacted GAAP earnings in 2024, Adobe's underlying net profit margin is around 30%, a figure superior to most industry peers. This financial performance is reflected in impressive return metrics, including a Return on Equity of about 39%.

The company converts over a third of its revenue into free cash flow (FCF), which totaled roughly $7.9 billion in 2024. This provides a solid trailing FCF yield of over 5%, a strong figure in the current market. Adobe's balance sheet is fortress-strong, with a net cash position of about $3.5 billion and an A+ credit rating, ensuring resilience in any economic environment. The stability of its earnings is remarkable, thanks to its recurring revenue model that has allowed it to weather economic downturns while consistently growing.

Regarding capital allocation, Adobe prefers returning capital to shareholders through substantial share buybacks rather than issuing dividends, underscored by a $25 billion repurchase program authorized in 2024. These buybacks are a critical part of its strategy, as they more than offset the shareholder dilution from its significant stock-based compensation program, which amounted to $1.83 billion in 2024. A key area to monitor is the potential for margin pressure from rising R&D and data center costs associated with its generative AI investments. However, Adobe is actively working to monetize these features, with a rapidly growing revenue stream from AI add-ons that is expected to recoup these costs and drive future growth.

Valuation & Key Financial Metrics

Intrinsic Value & DCF

Adobe's valuation appears attractive when assessed through relative comparisons. As of August 2025, its GAAP forward P/E ratio is ~16–17×, significantly below other large-cap software peers such as Microsoft (~32–33×), Autodesk (~29–30×), and Salesforce (~21–22×). This relative discount is striking given Adobe’s superior profitability, stronger free cash flow conversion, and higher operating margins compared to most peers. Other valuation measures also look modest: its EV/EBITDA multiple stands at ~18.5× and EV/Sales at ~6.8×, far below the ~15× sales multiple Adobe commanded during the 2021 tech peak. Historically, Adobe has traded in a pre-2020 forward P/E range of ~25–30×, suggesting today’s valuation reflects unusually depressed sentiment rather than business fundamentals.

A detailed Discounted Cash Flow (DCF) analysis further supports this view. Starting from Adobe’s trailing free cash flow (FCF) of ~$8 billion, and projecting 10% annual growth over the next five years (reaching ~$12.9B in year 5) before tapering to a long-term terminal growth rate of 3%, the intrinsic value comes out in the $518–$588 per share range. This uses an 8% discount rate (WACC) consistent with Adobe’s stable, low-debt profile. The model is highly sensitive to rates: raising the discount rate to 10% lowers fair value to roughly ~$350 (near the current market price), while a 7% rate lifts fair value above $600. This sensitivity underscores why Adobe’s valuation has been so tightly linked to macro rate expectations over the last two years. Even under more conservative assumptions (8% growth, 9% WACC), intrinsic value remains north of $400 per share.

Combining relative and intrinsic valuation methodologies, a reasonable fair value range for Adobe today is $500 ± $50 per share. This aligns with consensus analyst targets of ~$505 and is reinforced by alternative metrics such as its EV/ARR multiple of ~6.5× on ~$22.5B revenue. With the stock trading in the mid-$350s, the market appears to be pricing in either a sharp growth slowdown or persistently high interest rates — scenarios that seem more pessimistic than the company’s actual fundamentals justify. This disconnect provides a potential margin of safety for investors who believe in the durability of Adobe’s moat and its ability to compound value over time.

Key Metrics

P/E Ratio: The trailing P/E is approximately 28.6 (based on FY2024 GAAP EPS of $12.36). The forward P/E for FY2025 is lower at ~21.5 (GAAP) or ~17.1 (non-GAAP), well below its historical 5-year average of 30–50.

PEG Ratio: The forward PEG ratio is reasonable, ranging from ~1.1 (using non-GAAP P/E) to 1.4–1.8 (using GAAP P/E). This suggests the stock is no longer in the "overvalued" territory it occupied in 2021 when its PEG was > 2.

Price/Sales (P/S) Ratio: Approximately 7.0 (based on a ~$150B market cap and $21.5B in revenue).

Price/Book (P/B) Ratio: Roughly 10.6. This ratio is high but not very meaningful, as Adobe's book value ($14.1B) is suppressed by significant stock buybacks ($37.6B in treasury stock).

Leverage Ratios: Debt is very manageable with a Debt/Equity ratio of 0.29 and a Debt/EBITDA ratio of only ~0.5x.

Free Cash Flow (FCF) Yield: An attractive ~5.2% (based on ~$7.9B FCF and a ~$151B market cap), which compares favorably to the S&P 500 average (~3-4%).

Return on Equity (ROE): 39% for FY2024. This figure is elevated by buybacks;. The ROE would still be a strong ~26% if treasury stock were added back to equity.

Return on Invested Capital (ROIC): Estimated to be well above 50%, highlighting the immense profitability generated from its intangible assets (the company holds $12.8B in goodwill on its books).

In summary, Adobe’s fundamentals show a high-quality business with consistent growth, wide margins, and excellent cash flows. Its valuation multiples have come down significantly from peak levels, now appearing reasonable relative to its growth and profitability. However, the stock is not a “deep bargain” on an absolute basis – one is still paying ~21x forward earnings, so the investment case hinges on sustained growth and moat durability.

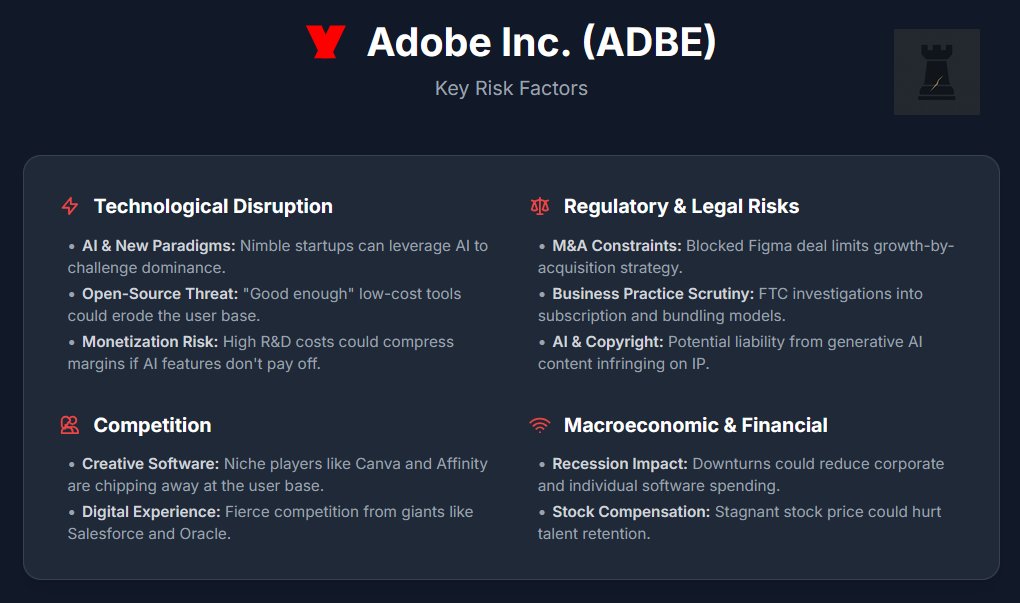

Risk Factors

Despite its market leadership, Adobe faces several important risks that could impact its future performance. The primary challenges are technological and regulatory in nature.

Technological Disruption and Failure to Innovate

This is arguably the most significant long-term risk for Adobe. The rapid emergence of generative AI is a double-edged sword. While Adobe has integrated it into its products with features like Firefly, it also lowers the barrier to entry for competitors.

One threat here is new creative paradigms. Nimble startups or established competitors could leverage AI to create entirely new workflows that challenge Adobe's established dominance. The success of Figma, a cloud-native collaborative tool that surpassed Adobe's own XD product, serves as a stark reminder that innovation can come from outside Adobe's ecosystem.

Another threat is competition from open-source. The availability of powerful open-source AI models could allow smaller developers to build "good enough" creative tools at a fraction of the cost, eroding Adobe's user base, particularly at the lower end of the market.

Last but not least, there’s monetization risk. Adobe is investing heavily in AI R&D, which increases operating costs. If the company cannot effectively monetize these new AI features through higher-tier subscriptions or a credit-based system, it risks compressing its high profit margins. The market showed initial skepticism on this front after the Q1 2025 earnings report, highlighting investor concern about the timeline for AI-driven revenue growth.

Competition (Traditional and Emerging)

Adobe faces intense competition across both of its major business segments. In creative software, while no single competitor matches the breadth and depth of the Creative Cloud, numerous players are chipping away at specific segments. Canva, for example, has captured a massive audience of non-professionals and small businesses with its user-friendly interface for simple design tasks. For professionals, tools from companies like Affinity and Corel offer one-time purchase options that appeal to users experiencing subscription fatigue. The ever-present risk is that a major tech giant like Microsoft or Apple could decide to compete more seriously in the creative space.

Another one is digital experience. This is a fiercely competitive enterprise market. Adobe's Experience Cloud competes directly with offerings from Salesforce, Oracle, and dozens of other specialized SaaS firms. Growth in this segment depends on winning large, complex enterprise deals, which have long and unpredictable sales cycles. An economic downturn or a more compelling offering from a competitor could lead to slower deal closures and revenue shortfalls.

Regulatory, Antitrust, and Legal Risks

As a dominant market leader, Adobe is under increasing scrutiny from regulators worldwide, which creates several challenges. The decision by regulators in the UK and EU to block the $20 billion acquisition of Figma sent a clear signal. Adobe will not be allowed to grow by acquiring major direct competitors. This significantly constrains its M&A strategy and forces it to rely more heavily on organic innovation.

Another thing is that the current regulatory environment in the U.S. and Europe is more aggressive toward Big Tech. Adobe could face investigations into its business practices, such as product bundling or how it locks customers into its ecosystem. The company's subscription model has drawn legal challenges. The U.S. Federal Trade Commission (FTC) is reportedly investigating "dark patterns" in subscription cancellations across industries, and Adobe has faced criticism and lawsuits (including one from several states in August 2023) over its allegedly deceptive and difficult cancellation process, which includes early termination fees. These actions could result in fines or force changes to its business model.

Not to forget that generative AI creates novel legal questions around copyright. While Adobe has proactively tried to mitigate this by training Firefly on its "ethically sourced" Adobe Stock library, there is still a risk that its AI could produce content that infringes on third-party IP, potentially exposing the company to liability.

Macroeconomic and Financial Risks

While Adobe's subscription model provides resilience, the company is not immune to broader economic forces. A recession could slow growth significantly. Corporate customers might cut marketing spend and delay large software purchases, impacting the Experience Cloud. Individuals and freelancers (a core part of the Creative Cloud user base) may pause their subscriptions if they lose work. A mild version of this occurred in early 2024 when a slowdown in enterprise deals caused Adobe's growth to temporarily dip.

This might be the right place to mention that Adobe relies heavily on stock-based compensation (~$1.8 billion/year) to attract and retain talent. If the stock price stagnates, this compensation becomes less attractive, posing a risk to talent retention. Conversely, the company spends billions on stock buybacks to offset this dilution. If it repurchases shares at an inflated price, it could destroy shareholder value.

In summary, while Adobe has a formidable market position, its path forward is not without challenges. The intersecting risks of rapid technological change from AI and increased regulatory pressure represent the most critical factors for investors to monitor.

Our Scenarios (3–5 Year Horizon): Bull, Base, Bear Case

Given Adobe’s current situation, we outline three possible scenarios for the company’s performance and stock price over a 3-5 year horizon, with estimated probabilities and the conditions required for each scenario:

Bull Case (~30% Probability)

Key Assumptions

In this optimistic scenario, Adobe successfully capitalizes on generative AI, leading to a reacceleration of revenue growth into the 12–15% annual range. AI features become a significant new revenue stream through higher-priced subscription tiers or usage-based billing, boosting average revenue per user (ARPU). A robust global economy (by 2026) fuels marketing budgets, accelerating the Digital Experience segment's growth. Adobe also successfully executes small, strategic "tuck-in" acquisitions in areas like AI or 3D content without regulatory issues.

Financial Outcome

High revenue growth and operating leverage push non-GAAP operating margins towards 50%. Driven by strong performance and continued share buybacks, GAAP EPS could double from ~$12 in 2024 to approximately $24 by 2028.

Valuation & Stock Price: Investors reward the renewed growth and AI leadership by assigning a premium P/E multiple of 25x to 30x. This would imply a stock price in the $600 to $720 range, resulting in new all-time highs and delivering over 20% in annualized returns.

Base Case (~55% Probability)

Key Assumptions

This scenario assumes Adobe continues on its current path of steady, solid growth. Revenue grows at a compound annual rate of approximately 10%. AI features are successfully integrated as a value-add that increases customer retention and justifies modest price increases, but they do not dramatically alter the revenue growth curve in the near term. Adobe holds its market share against competitors in both Creative and Digital Experience segments.

Financial Outcome

Margins remain stable as efficiency gains offset increased costs from AI infrastructure. Due to operating leverage and consistent share buybacks, GAAP EPS grows slightly faster than revenue, at a 12-15% CAGR. Price target: $580-$600.

Bear Case (~15% Probability)

Key Assumptions

This negative scenario involves several headwinds occurring simultaneously. A global recession causes businesses to slash marketing budgets and software spending. At the same time, competitive pressure intensifies, with open-source AI tools or rivals like Canva and Figma successfully siphoning off a significant portion of Adobe's user base. Regulatory action could also impose costly changes to Adobe's subscription model or AI development.

Financial Outcome

Revenue growth slows dramatically to the 3-5% range, or even turns flat for a year. To fight competition, Adobe is forced to increase spending or cut prices, causing profit margins to compress. As a result, GAAP EPS stagnates or stalls around ~$15.

Valuation & Stock Price: Investor confidence erodes, causing the P/E multiple to contract into the teens (15x to 18x). This would result in a stock price between $225 and $270, implying a potential downside of -20% to -35% from current levels.

Summary of Our Scenarios

Our analysis indicates a favorable risk/reward profile for Adobe over the next 3-5 years. The most probable outcome, our Base Case (with a ~55% probability), envisions Adobe continuing its trajectory as a steady compounder, delivering solid returns that should roughly track the broader market.

However, a significant and real potential for upside exists, as outlined in our Bull Case (~30% probability). In this scenario, the successful monetization of Adobe's AI initiatives could reaccelerate growth and drive significant multiple expansion, pushing the stock toward new all-time highs.

The downside risk, captured in our Bear Case, is a low-probability event (~15%). This scenario would require a confluence of negative factors (such as a deep global recession combined with intense competitive pressure) to materialize. While this would negatively impact the stock, we view it as the least likely of the three outcomes.

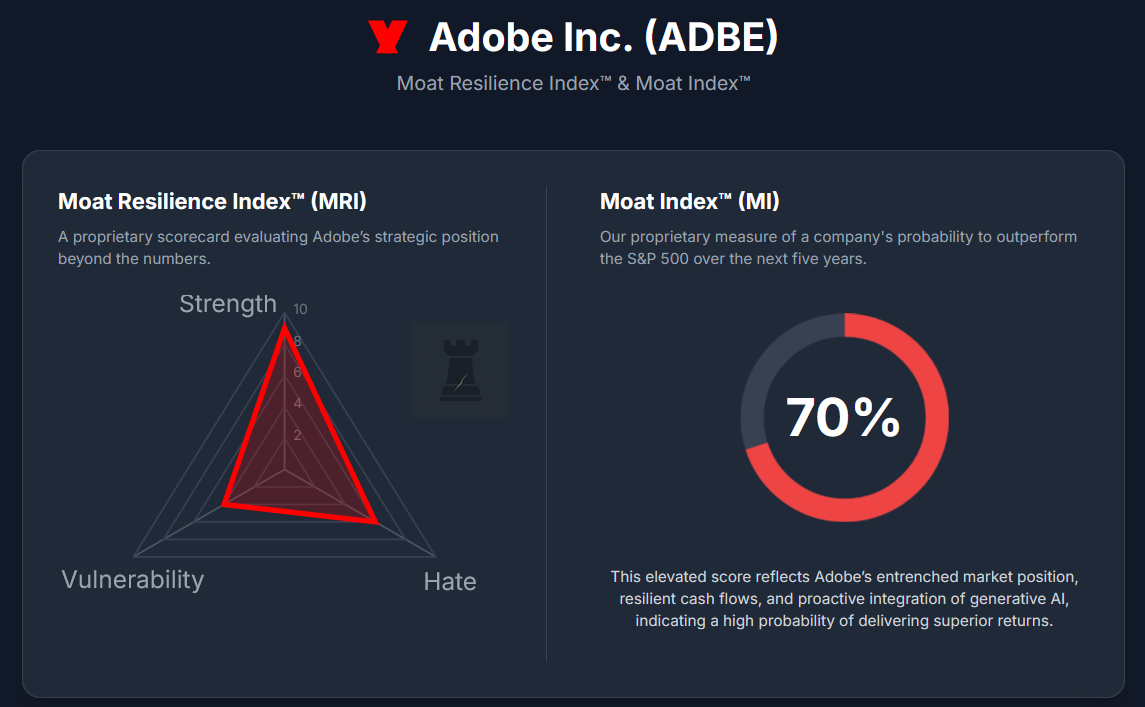

Moat Resilience Index™ (MRI) & Analysis & Moat Index™ (MI)

Our proprietary qualitative "MRI" scorecard evaluates Adobe’s strategic position beyond the financial numbers. The MRI framework refers to evaluating a company’s Moat (sustainable competitive advantage), the degree of Hate or pessimism the stock faces (contrarian opportunity), and its Vulnerability (exposure to factors that could erode the moat or performance).

Moat Strength: 9/10

Adobe possesses one of the widest and most durable moats in the software industry, with our analysis showing a score being 9 out of 10. This strength is built on several pillars, including powerful network effects that have made its software the entrenched industry standard for creative professionals. The moat is further reinforced by extremely high switching costs. Professionals invest hundreds of hours learning Adobe's complex tools, making migration to a new ecosystem prohibitively expensive and time-consuming. Finally, its brand and ecosystem are dominant, with "Photoshop" becoming a common verb and its Acrobat software giving it quasi-monopoly power over the ubiquitous PDF format. The only reason it does not receive a perfect score is that challengers like Figma and Canva have successfully made inroads in specific niches, proving the moat has limits and requires constant innovation to maintain.

Moat Hate: 6/10

Adobe's “hate” is complex and scores a 6 out of 10, as it varies significantly depending on the audience. Among enterprise customers and investors, its reputation is excellent. It is viewed as a reliable, innovative leader and a good corporate citizen, often praised for its workplace culture and ethical approach to AI. However, there is a persistent undercurrent of frustration among end-users, particularly individual creators. This "hate" stems primarily from its mandatory subscription model, the high price of its Creative Cloud All-Apps plan at $54.99/month, and unpopular policies like early cancellation fees, which have even drawn regulatory scrutiny. This sentiment was evident during the failed Figma acquisition, where many in the design community feared Adobe was simply trying to eliminate a beloved competitor. While this negativity is vocal, it amounts to more of a persistent grumbling than a serious threat of permanent brand damage.

Vulnerability: 4/10

With a lower score indicating less vulnerability, Adobe's position is quite secure with our algorithm and calculations showing a 4 out of 10. Thanks to its entrenched moat, the company is not highly vulnerable in the short-to-medium term, but several long-term threats exist. The greatest vulnerability is a major technological paradigm shift, such as an AI-native creative tool that is significantly easier to use and could bypass Adobe's complex software. Another key challenge is new user acquisition, as younger generations and emerging markets often gravitate towards cheaper, mobile-first tools like Canva. Other risks include its dependency on platforms like Windows and macOS, whose owners could become competitors, and intense competition in the enterprise marketing space from rivals like Salesforce. Despite these vulnerabilities, Adobe has a long history (decades) of successfully adapting to threats (for example, launching Adobe Fresco to compete with the popular iPad app Procreate), demonstrating a well-managed and relatively low overall vulnerability.

Moat Index™

The Moat Index™ is our proprietary measure of how likely a company is to outperform the market over the next five years based on the strength, durability, and adaptability of its moat. The MI reflects our conviction in the company’s ability to defend its competitive advantage against disruption, maintain pricing power, and continue compounding value relative to the broader market.

For Adobe, we assign a Moat Index of 70%, meaning we estimate a seven-in-ten probability that the company will deliver superior returns compared to the S&P 500 over a five-year horizon. This elevated score reflects Adobe’s entrenched position as the industry standard in creative software, the resilience of its subscription-driven cash flows, and its proactive integration of generative AI into core products.

Conclusion

Short-Term Outlook (< 1 Year)

The short-term outlook for Adobe is cautiously optimistic, though the stock will likely experience volatility. Over the next year, its performance will be heavily influenced by macroeconomic signals and the perceived pace of AI adoption rather than major shifts in its business fundamentals. Key drivers will include continued earnings momentum and tangible proof of AI monetization, such as progress toward the company's goal of doubling AI-related revenue. The stock's trajectory will also be closely tied to the broader market environment, particularly the direction of interest rates. Any signal of rate cuts from the Fed could boost its valuation, while a "higher for longer" scenario would likely cap its upside. Given technical support in the low-$300s, the near-term strategy is to "Buy on dips," with a potential for the stock to revisit the $400 - $450 range within a year.

Long-Term Outlook (3-5 Years)

Over a 3-5 year horizon, Adobe appears to be a very solid long-term investment. The company is powered by the durable secular trend of increasing global demand for digital content, which provides a strong tailwind for growth. The core thesis is that Adobe will continue to compound earnings at a healthy 10-15% annually, driven by its strong market position and new opportunities in areas like AI and even future creative frontiers like AR/VR content. Within five years, it's plausible for revenues to reach the $35-40 billion range with an earnings per share figure well over $20. As its growth continues and interest rates normalize, the stock has a plausible path to a valuation of around $580 - $600 per share.

Final Verdict

Considering all factors, the final recommendation is a MODERATE BUY if you only accept the base case and BUY if you assign non-trivial weight to the bull case and/or there are any significant dips from here (assuming fundamentals and macro don’t change/change to more favourable).

On base assumptions, Adobe will track the market. On bull assumptions, it will beat it decisively. The disconnect is that the market is currently pricing Adobe as if the bull case has near-zero chance. That asymmetry is why we bought. At its current price, Adobe offers a favorable risk/reward profile, providing an opportunity to acquire a high-quality, wide-moat franchise at a reasonable valuation. The key takeaway for us at HatedMoats is to accumulate this stock while market sentiment is lukewarm, hold it through inevitable volatility, and allow its strong fundamentals to compound value over the long term, with the expectation that it will outperform the broader market.

Disclaimer & Our Investment

Please note that this is not a financial advice and our disclaimer in holding position is as follows: Owning shares since October 24th 2022 at avg. price of $310.86 per share and added to the position on August 22nd 2025 at avg. price of $360.24 per share.

Final words

Adobe represents a classic case of the market punishing a high-quality company for reasons largely outside its control. While short-term sentiment has been swayed by macroeconomic headwinds and concerns over AI monetization, the underlying business remains a best-in-class cash-flow machine with a fortress-like moat. The recent stock price decline has created a disconnect between the company's elite financial performance and its public valuation.

This temporary dislocation presents a compelling opportunity. Investing in Adobe today isn't just a bet on the next earnings report; it's an investment in the enduring global shift towards digital content, marketing, and experiences. The path forward will undoubtedly have its share of volatility, but for investors with a multi-year horizon, the current valuation provides a significant margin of safety to own a dominant market leader. Our conviction is that Adobe is a compounder in temporary disguise. The thesis is simple: buy this franchise while it's out of favor, and let its powerful fundamentals drive long-term outperformance.

Thinking out loud. No support for it at current levels - $350. If it can’t hold here seems like next stop could be around $320. But if it can’t hold there Aug ‘21 at $275 is the next stop.

I watched UNH build a base around $300 and pulled the trigger only to see it go off a cliff and trade down to $240, thank GOD for Buffett, he came in a two weeks later with $1.5 billion long and saved me. I won’t be that lucky twice.

But now I’m a little more gun shy about going long on a position that’s suspended in mid-air.

Your other post about the markets being on a sugar high made sense to me, we have NVDA today, sounds like they’ll beat (but warn?) and probably get .25 from the Fed in September.

After that this bull run could be out of gas which is why I’ll keep my eye on ADBE, but not go long now. If your thesis from your other post is correct 2 months from now this market could be a kicked in the balls fire sale.

Like a shark, I’ll be circling.

Adobe is getting cheap, quite attractive to be honest!! Customer delight is certainly not the reason behind it reoccurring revenue, its more like customer captivity. Yet, I believe at prices below $300, it presents good entry point which kinda provides a cushion against this melting ice cube. https://open.substack.com/pub/latebloomr/p/adobe-adbe-adobe-a-cash-generating?utm_source=share&utm_medium=android&r=5bgci5