Mo-Bruk: Deep Dive Analysis

Let's have a look at Buffett's classic "wonderful company at fair price" that's turning trash into cash. Literally.

The Deep Dive

Overview & Positioning

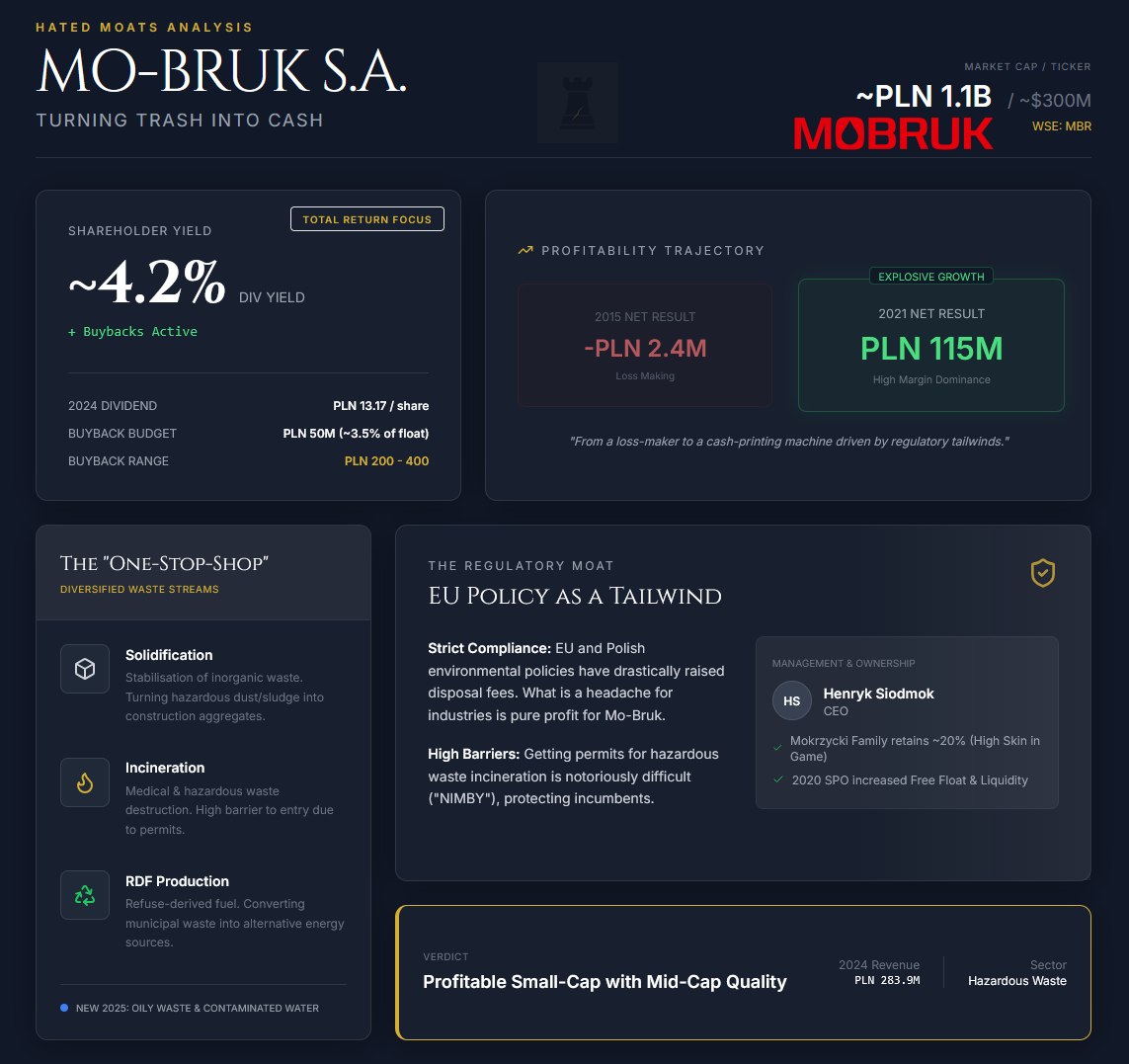

Mo-Bruk S.A. is a leading Polish waste management company specialising in hazardous and industrial waste processing. The company has also a growing footprint in recycling and alternative fuels. The company was founded in 1985 and publicly listed on the Warsaw Stock Exchange since 2012. Today, it operates in 3 main segments: stabilisation/solidification of inorganic waste, production of RDF (refuse-derived fuel) from municipal/industrial waste, and incineration of hazardous and medical waste. The company has several processing plants across Poland (e.g. in Niecew, Karsy, Skarbimierz, Wałbrzych) and subsidiaries focused on niche waste streams (including a newly launched unit for oily waste and contaminated water from Q4 2025). This broad capability allows Mo-Bruk to offer “one-stop-shop” waste utilisation services, turning trash into valuable outputs like alternative fuels and construction aggregates.

With a market capitalisation around PLN 1.1 billion (~$300m), Mo-Bruk is on the edge of being a small-cap/mid-cap company that punches above its weight in profitability, so to speak. It generated PLN 283.9 million in revenue in 2024 and historically enjoys exceptionally high margins (more on that below). The firm’s net profit soared from a PLN 2.4 million loss in 2015 to PLN 115 million profit by 2021, a proof of its savvy positioning in an increasingly regulation-driven industry. You know how EU has all this strict (and some would say weird, bizarre even) policies? Well, Mo-Bruk directly benefits from these stringent EU and Polish environmental policies that has raised disposal fees for hazardous waste throughout the years. That is a favourable tailwind that dramatically expanded its revenue and pricing power in the last decade. In effect, Mo-Bruk has become a “picks and shovels” play on environmental compliance, profiting as industries pay to safely offload their waste.

The company’s strategic focus, to our liking, is on value and growth concurrently. It paid a dividend of PLN 13.17 per share in 2024 and again approved PLN 13.17 per share from the 2024 profit (payable in 2025), implying a ~4.2% yield around the time of the announcement, even while reinvesting in new capacity and technologies. Management (led by CEO Henryk Siodmok) emphasises balancing shareholder returns with expansion. For example, the 2025 AGM approved a PLN 46.3 million payout (13.17 PLN/share) for 2024 profits and authorised a share buyback of up to 3.56% of stock (124k shares) with a budget of PLN 50 million. This signals confidence in Mo-Bruk’s financial strength and undervaluation, as the buyback will be executed at prices between PLN 200–400 over 2025–2026. Insider ownership is high (the founding Mokrzycki family retains a substantial stake via family foundations, which also might be a risk factor - more on that below), aligning management with shareholders. In 2020, selling shareholders Ginger Capital and Value FIZ sold 1,405,154 shares in an offering priced at PLN 200 (40% of share capital / 33.3% of votes), which increased free float and broadened institutional ownership. This move improved liquidity and also broadened the shareholder base. The Mokrzycki family foundations are reported at roughly ~20% of shares (with higher voting power), with the remainder largely in free float held by a mix of pension funds/institutions and other investors.

Overall, Mo-Bruk is well-positioned as Poland’s preeminent waste processor, operating in a niche that is small enough to deter global giants but crucial enough to enjoy robust demand and pricing. Its “moat” in this space is key to understanding the company’s value proposition. Let’s dive into it…

Competitive Moat & Peer Comparison

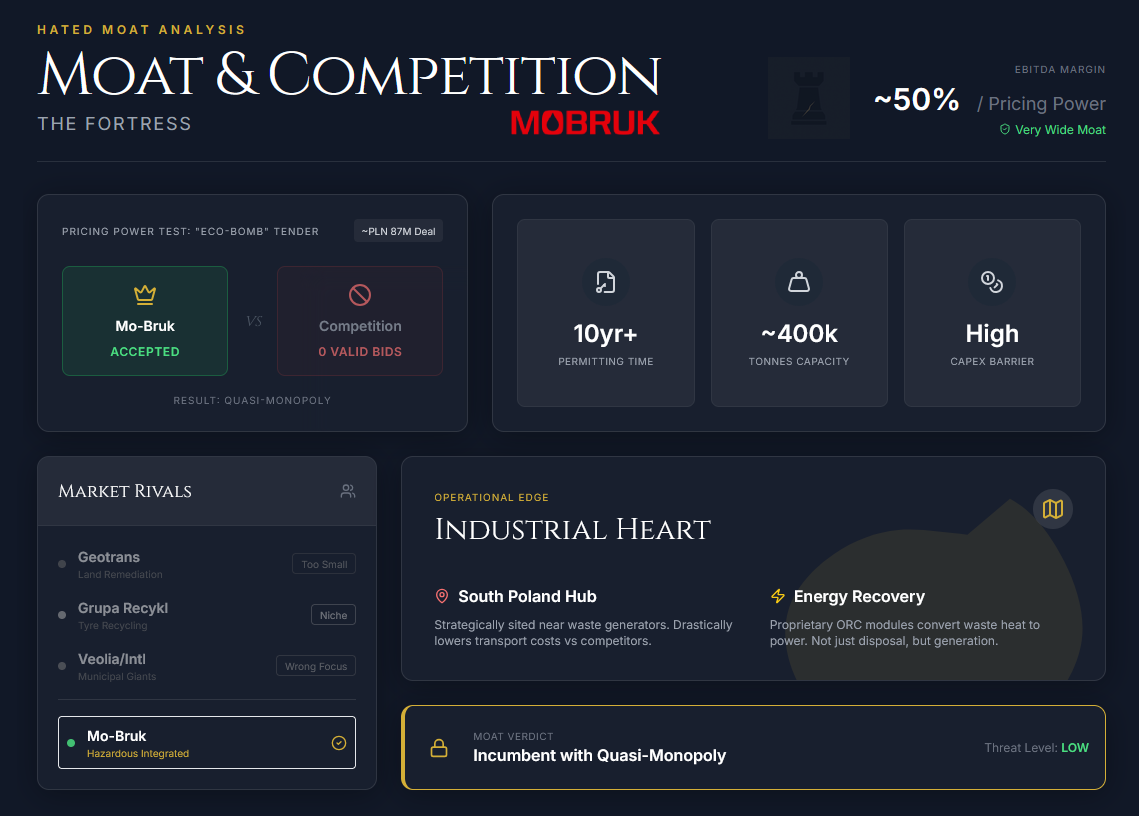

Mo-Bruk has built a formidable economic moat in the hazardous waste disposal industry, underpinned by regulatory barriers, technical know-how, and first-mover advantage. Crucially for the thesis, the right to process waste in Poland requires government licenses (integrated permits) that are time-consuming to obtain. This licensing regime effectively limits new entrants and “concretes over” the niche, raising the bar for any would-be competitor. Across key operations, Mo-Bruk’s permitted/technical capacity is in the high hundreds of thousands of tonnes per year (for example, group capacity in the stabilisation area was reported around ~390k tonnes per year), giving it meaningful headroom versus current volumes. Utilisation varies by line and tender timing, so growth increasingly depends on winning projects and filling capacity rather than simply having permits in place. Any competitor trying to start from scratch faces years of permitting and substantial capex to replicate Mo-Bruk’s network of incinerators, stabilisation lines, and RDF production.

What’s more in the aspect of moat, hazardous and industrial waste processing requires specialised expertise and compliance. Mo-Bruk has developed proprietary methods to neutralise toxins and convert wastes into usable products. For instance, it solidifies ash/slag into construction filler and produces alternative fuel from refuse. These are processes that demand engineering skill and a track record with regulators. The company’s long operating history and reputation serve as intangible assets. Clients (industries, municipalities) trust Mo-Bruk to dispose of dangerous waste safely, which isn’t an easily won status by a new entrant. Additionally, location is a competitive advantage in this case. Mo-Bruk’s plants are strategically sited in southern Poland (the country’s industrial heart) which lowers transport costs for waste generators. Its nationwide coverage (with recent expansion into northern regions via acquisitions/subsidiaries) gives it a logistical edge over any single-location rival.

As far as competition goes, few direct peers exist on the Polish market at Mo-Bruk’s scale. Smaller listed companies target sub-segments of environmental services and waste management. For example, Geotrans focuses on waste management and land remediation services and is far smaller than Mo-Bruk, but it is not a like-for-like peer in hazardous waste neutralisation and incineration. Grupa Recykl recycles used tyres and is a niche player versus Mo-Bruk’s integrated hazardous waste platform (and it has reported revenue at or above the ~PLN 100m level). Krynicki Recykling, a glass recycler, is no longer a relevant listed peer as it was taken over and delisted from the WSE. Mo-Bruk’s nearest competitors in hazardous waste are mostly private or municipal entities (or captive facilities run by large industrials). No other listed company on the WSE (Warsaw Stock Exchange) offers the same integrated waste neutralisation services. Internationally, one could compare Mo-Bruk to mid-sized European waste firms (e.g. Germany’s Remondis or France’s Veolia Environmental’s hazardous division), but those conglomerates focus more on municipal waste and are not as entrenched in Poland’s regulatory landscape.

In this sense, Mo-Bruk enjoys a quasi-monopoly in certain high-margin segments like “eco-bomb” clean-ups (remediation of illegal toxic dumps), and we like those (monopolies, not eco-bombs). When such projects are tendered, Mo-Bruk can face limited effective competition. In the Nowe Miszewo tender (~PLN 87m), Mo-Bruk’s bid was reported as the only one within the budget, while another bid was higher and did not meet the competency requirements. That screams monopoly to us. Even in routine operations, the company’s ~50% EBITDA margins signal pricing power and lack of commoditised competition. Its moat is not entirely unassailable, though. A deep-pocketed (foreign) entrant or consortium could attempt to buy permits (perhaps via acquiring smaller operators) or governments could liberalise licensing under pressure. However, the current system strongly favours incumbents. As Mo-Bruk itself has noted, the faster way to growth is acquiring existing permitted firms, and Mo-Bruk would likely be the consolidator rather than the target, given its war chest and share buyback authority.

One emerging competitive consideration that needs to be mentioned here is the value chain extension. Mo-Bruk is now leveraging its waste streams to produce energy and materials, somewhat analogous to how large waste companies generate power from landfill gas or incineration. It implemented energy-recovery solutions (for example, an ORC/heat-recovery type module) to reduce purchased electricity and improve energy efficiency. These initiatives further differentiate it from any pure disposal competitor.

Overall, Mo-Bruk’s moat is robust, grounded in regulation, expertise, and scale. By comparison, peers on the WSE lack these advantages, and global waste giants have not seriously encroached on Polish hazardous waste (often partnering with or contracting Mo-Bruk instead). This positions Mo-Bruk as a classic “moat” business in a niche market. The company is basically turning a dirty, difficult job into a lucrative enterprise that few others can easily enter, and by all means it does so quite succesfully.

Recent Stock Performance & Market Sentiment

Mo-Bruk’s stock has experienced a rollercoaster ride over the past decade. From 2015 to mid-2021, the share price skyrocketed roughly 50-fold as earnings exploded. This was a phenomenal run that outpaced even tech darlings. The stock hit an all-time high in February 2021 after 2 years of triple-digit percentage gains (2019: +144%, 2020: +137%). However, since that peak, the stock has been “hammering out a bottom” for over 3 years, roughly 40% below the highs. In 2022, the price corrected sharply (–23% for the year), then partially rebounded in 2023 (+34%). For most of 2024–2025, Mo-Bruk traded range-bound roughly between PLN 260 and PLN 370. As of late December 2025, the stock sat near PLN 315, essentially flat to down slightly (~–1.5%) year-on-year, underperforming the broad market. The spark came in by late December and start of January 2026, where the stock climbed near PLN 340.

This stagnation of recent performance reflects a major shift in market sentiment. After the exuberance of 2019–2021, when Mo-Bruk was a market darling and the narrative/expectations ran hot, valuation ultimately compressed back into the low-to-mid teens on earnings. By late 2024, valuation multiples had compressed to the low-teens. Sentiment was further tested in 2025 by disappointing earnings. The Q3 report delivered rather a shock (in perception). A PLN 38.8 million net loss versus a profit the prior year. Although caused by a one-time write-off, the headline loss spooked investors (as it usually does), driving the price below ~PLN 300. The stock was effectively priced for a “40% collapse,” with sentiment bordering on pessimistic.

However, perception began improving in December 2025. Management clarified that the loss stemmed from a non-recurring PLN 65.2 million provision, while underlying EBITDA and revenue actually beat expectations. With a strong outlook for 2026, the stock somewhat stabilised above 300. Value-oriented investors might be seeing Mo-Bruk now as an “overlooked dividend cash cow”. The 4%+ yield and ESG dominance appeal to long-term holders.

In summary, Mo-Bruk’s recent performance has been lackluster, marked by consolidation. The market’s love affair has cooled, yet current pessimism appears rooted more in optics (specifically one-off losses) than long-term fundamentals. Trading at reasonable multiples with excellent profitability, the company is attracting contrarian interest - that’s why you’re currently raeding this article :). As it moves past these setbacks, Mo-Bruk may be positioned for a sentiment re-rating from “yesterday’s high-flyer” to a steady value compounder.

Fundamental Analysis

Growth & Profitability

Mo-Bruk’s growth over the past decade has been exceptional. Revenues rose from PLN 45 million in 2015 to about PLN 267 million in 2021 (a CAGR of roughly 35%) driven by increased waste volumes and higher fees per ton due to regulatory changes. Net profit surged from a small loss to PLN 115 million by 2021, reflecting strong operating leverage as fixed costs remained stable while revenues expanded. By 2021, Mo-Bruk’s net margins exceeded 40%, a rare feat in the waste industry. Growth slowed afterwards, though. Revenue in 2024 was PLN 283.9m, only 6% higher than 2021, while net profit fell from PLN 78.9m in 2023 to PLN 70.3m in 2024. Analysts noted that the fee hikes which drove past growth had plateaued, and capacity utilisation reached limits, meaning future gains depend on new projects or market share expansion.

The year 2025 can be tagged as transitional. In H1, profits fell YoY due to higher depreciation and interest expenses from recent investments and a lack of one-off contracts. During the first 3 quarters, revenue reached PLN 210.2m (+5% YoY) but a net loss of PLN 12.4m was reported. This was driven by a one-time PLN 65.2m provision for historical fees. Excluding this, adjusted net profit was around PLN 55m, just 3.6% below the prior year’s PLN 57m. Thus, the core business remained solid despite cost pressures. Management expects a strong Q4, guiding for full-year revenue above PLN 300m (a new record) and an adjusted EBITDA margin near 50% versus 45% in 2024. This rebound should come from lucrative “eco-bomb” projects in Q4, generating over PLN 30m in high-margin revenue from cleaning hazardous waste dumps. So, while reported 2025 results will show a loss, underlying profitability remains intact and growth is expected to resume in 2026.

Wehn we look at Mo-Bruk’s profitability, we see it clearly remains far above industry norms. In 2024, EBITDA margin stood at about 45%, EBIT margin around 35–37%, and net margin roughly 25% (PLN 70m net on PLN 283.9m sales). These figures reflect strong pricing power (clients pay premiums for compliant waste disposal) and high operational efficiency. Most global waste firms achieve only single-digit net margins, highlighting Mo-Bruk’s moat-like economics. Return on Equity was around 28% in 2024 (PLN 70m profit on PLN 247m equity), historically exceeding 30–40%. The 2025 provision temporarily reduces book value and ROE, but adjusted figures remain near 30%. Return on invested capital is also high thanks to relatively asset-light operations and modest leverage.

Margins have compressed slightly due to inflation and higher D&A. Depreciation rose by roughly PLN 10.7m in 2025 as new installations came online, and interest costs increased with higher Polish rates and expanded borrowing. These factors lowered net margins to 20–25% in 2023–24 from over 30% previously. However, with major capex completed and rates expected to ease, margins could recover. Management projects core EBITDA margin to reach about 50% in 2025 and remain high thereafter. In Q3 2025, adjusted EBITDA margin was 49%, underscoring Mo-Bruk’s ability to sustain strong profitability once one-offs are excluded.

Overall, Mo-Bruk’s earnings quality is robust. There are stable contract revenues, thick margins, and low volatility aside from accounting charges. Its business model resembles an annuity, i.e. waste disposal is a perpetual need, ensuring recurring income even during economic downturns. Mo-Bruk’s combination of regulatory tailwinds, pricing strength, and disciplined operations positions it (in our opinion) as one of the most profitable and defensible players in Europe’s environmental services sector.

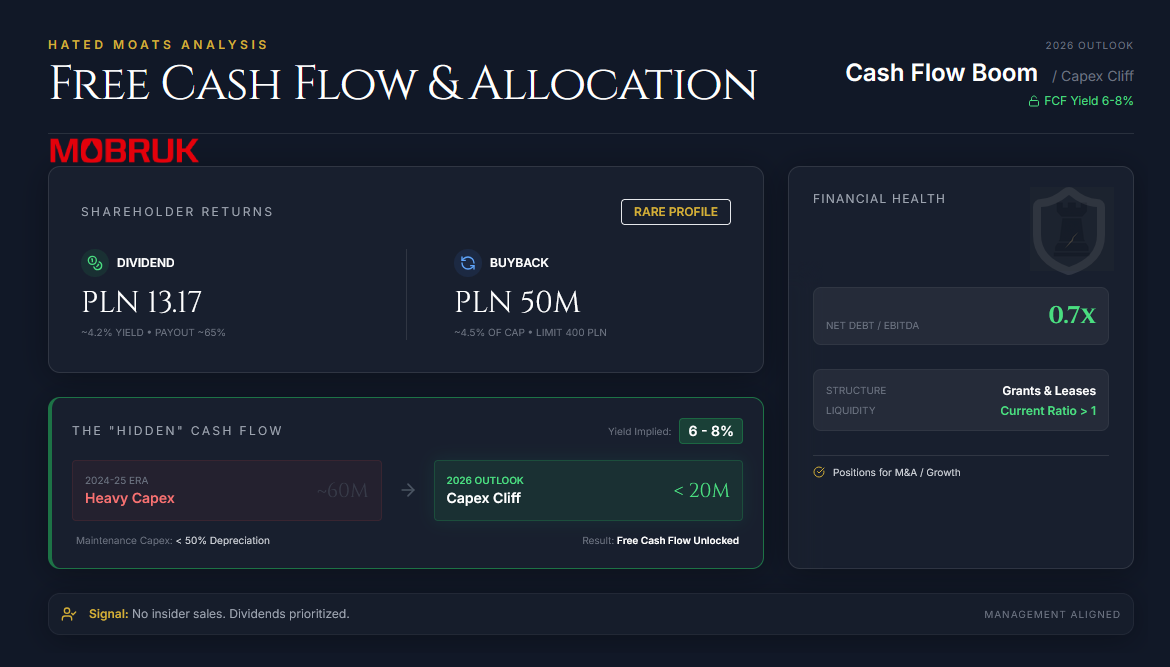

Free Cash Flow & Capital Allocation

Mo-Bruk continues to generate strong cash flows, though heavy investment during 2023–2025 has temporarily masked its full free cash flow potential. Operating cash flow has historically tracked EBITDA closely, supported by upfront customer payments for waste disposal. In 2024, operating cash flow reached PLN 59m for the first nine months, exceeding net profit and reflecting solid cash conversion. However, FCF was muted as Mo-Bruk spent around PLN 53m on capex in 9M of 2024 and another PLN 30m in 9M of 2025 to fund new facilities such as an RDF production line and waste storage halls. With major projects concluding in 2025, management expects a sharp fall in capital expenditure. Planned 2026 capex is projected to drop to only a few tens of millions of PLN, with maintenance capex below 50% of annual depreciation (under PLN 10m). This shift means annual investment will fall from roughly PLN 50–60m to below PLN 20m in 2026, unlocking significant free cash flow. Absent new expansions, FCF should closely track EBITDA minus taxes, implying a 2026 FCF yield of 6–8% at current valuations.

Mo-Bruk’s capital allocation record can be considered disciplined and shareholder-friendly. Since 2018, the company has paid regular dividends, which it increased through 2021 and then maintained at PLN 13.17 per share for the last 2 years while funding growth internally. The current yield of about 4.2% remains above market average, with a 2024 payout ratio near 65%. Despite the 2025 accounting loss, management plans to preserve the dividend by using retained earnings. This signals commitment to shareholder returns in our eyes. Furthermore, a newly authorised PLN 50m share buyback (around 4.5% of market capitalisation) provides flexibility to repurchase undervalued shares. Usually, you get either dividend, or buybacks. With Mo-Bruk, you get both, which is noteable. The price limit of PLN 400 suggests management’s confidence in long-term intrinsic value. No insider sales have been reported in 2025. This reinforces alignment between management and investors.

When we look at the balance shee, it remains strong. As of Q3 2025, equity totalled PLN 188.5m (down from PLN 246.9m in 2024 after the PLN 65m provision), with total assets around PLN 464m. Net debt stands near PLN 84m, implying leverage of only about 0.7x normalised EBITDA (~PLN 120m expected for 2025) and 1.2x net earnings. The debt-to-equity ratio rose temporarily after recognising the provision, but this will normalise as the obligation is settled. Much of the debt consists of low-cost environmental grants and leases rather than expensive bank loans. Interest coverage remains comfortably in double digits, with limited exposure to rate volatility. Liquidity of the company is objectively healthy. Excluding the short-term impact of the provision, the company’s cash and operating cash flow adequately cover obligations, maintaining a current ratio above 1.

The balance sheet also includes standard environmental provisions and deferred income from EU grants, typical for the sector. These items are non-threatening and reflect compliance rather than risk. With low leverage and strong internal cash generation, Mo-Bruk is well positioned for opportunistic acquisitions or further deleveraging. Management has indicated potential interest in acquiring additional waste permits or complementary businesses, which could reignite growth while preserving financial safety.

Overall, Mo-Bruk stands out as a highly profitable, cash-generative company with prudent management and conservative leverage. Despite recent flat revenue trends, core operations remain resilient and poised to rebound with new projects. Given its 45–50% operating margins, robust returns on capital, and clear free cash flow recovery ahead, the current multiples of the company appear undemanding. In our opinion, Mo-Bruk’s disciplined capital allocation, strong balance sheet, and predictable cash generation provide a solid foundation for long-term shareholder value creation.

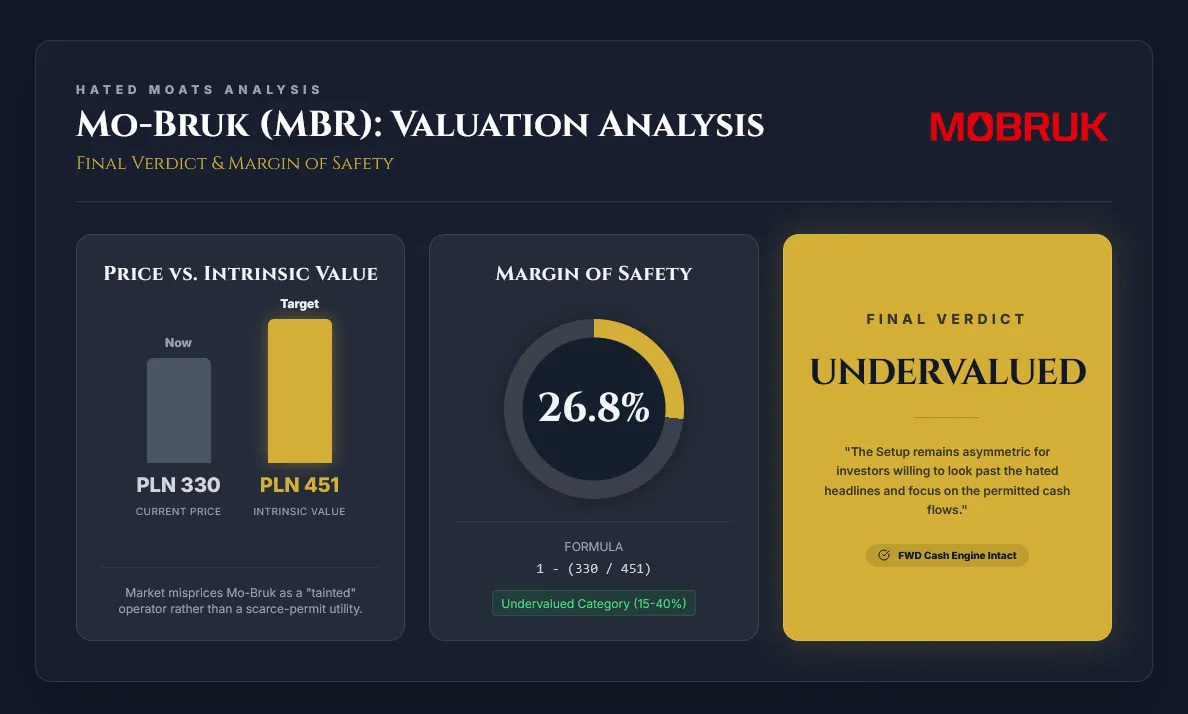

Valuation

Intrinsic Value & DCF

Our detailed DCF with calculated intrinsic value was part of our DCFriday and can be found in a standalone article HERE.

Management Quality and Insider Activity

Mo-Bruk combines founder-led control with a more “professional CEO” model. In 2022, it appointed Henryk Siodmok as CEO, with experience in large operating businesses and consulting (including a CEO stint at Atlas Group). This matters because the next phase of the company is less about easy price lifts and more about execution, i.e. new installations, eco-bomb contract selection, disciplined capital allocation, and potentially acquisitions.

Governance is defined by concentrated insider influence via the Mokrzycki family’s foundations. Disclosures around the 2024 AGM show Modus Fundacja Rodzinna and Patronum Fundacja Rodzinna each holding 425,574 shares (11.11% of capital) but 466,545 votes (13.61% of votes). Ownership tables suggest the insider cluster is ~20% of shares but ~33% of AGM voting participation. The upside here is long-term alignment but we cannot omit that the trade-off is limited minority influence.

Insider activity looks more supportive than extractive. A key signal was Patronum Fundacja Rodzinna’s off-market purchase on 5 June 2024 of 234,214 shares at PLN 218.4. Other transactions (e.g., via Ginger Capital linked to the vice presidents Tobiasz and Wiktor Mokrzycki) look more like internal restructuring than open-market selling. Capital allocation including buybacks, mentioned above, furhter reinforces this stance.

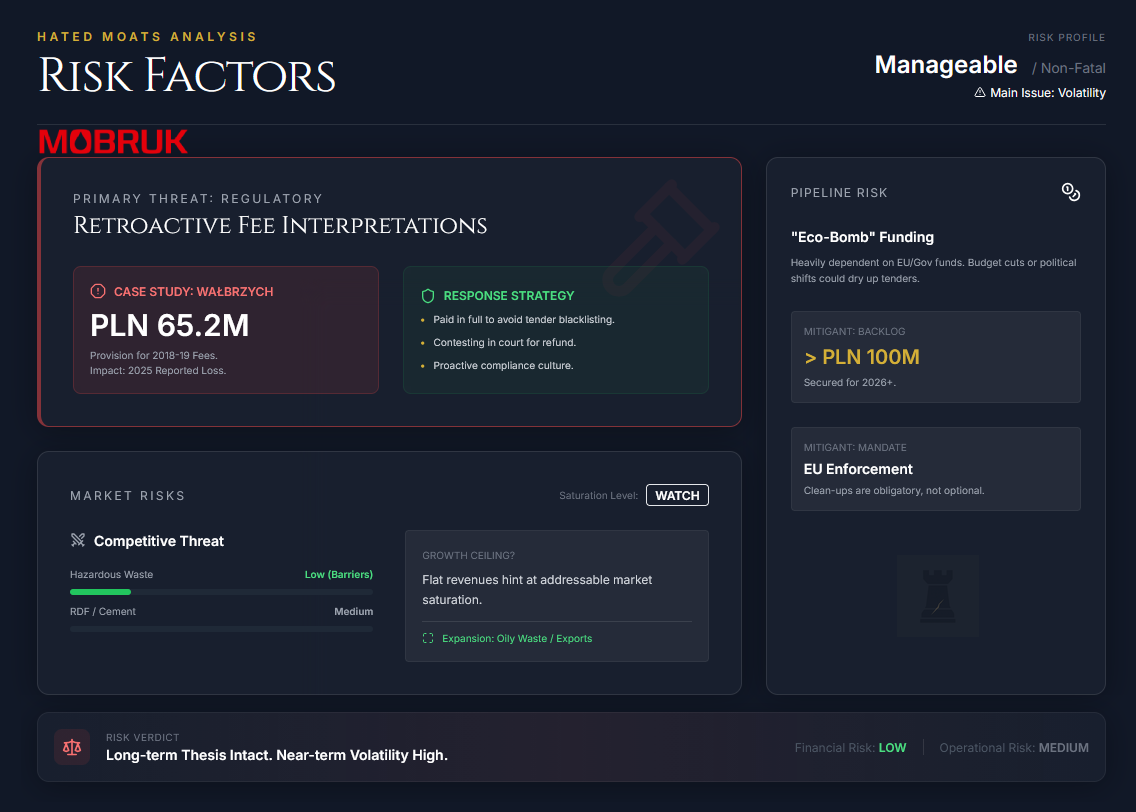

Risk Factors

Mo-Bruk has a few specific risk factors to keep in mind:

Regulatory and Legal Risk

Ironically, the same regulatory environment that enables Mo-Bruk’s high margins can also pose risks. Environmental laws can change, potentially affecting waste fee structures or licensing. A pertinent example is the legacy fee dispute that hit Mo-Bruk in 2025. Polish authorities demanded retroactive higher fees for waste stored at Mo-Bruk’s Wałbrzych landfill in 2018–2019, leading to a PLN 65.2m provision. Management decided to pay these “raised fees” in full to avoid accruing interest and to prevent the issue from undermining the company’s standing in public tenders. While Mo-Bruk is contesting the validity of these fees in court (seeking a favourable administrative ruling and refund with interest), there’s no guarantee of success. This incident highlights the mentioned regulatory risk. Sudden interpretations of rules can impact profitability. Looking forward, similar risks include the possibility of new waste taxes, stricter EU waste shipment regulations, or even environmental penalties in case of any compliance lapse. So how does the company mitigate this risk? Mo-Bruk generally maintains good relations with regulators and proactively complies (the quick payment was to “neutralise risk of unfavourable court outcomes or tender blacklisting”). Still, this area requires monitoring.

Policy and Funding Risk (Eco-Bombs)

A significant part of Mo-Bruk’s growth outlook is tied to remediation projects of illegal waste dumps (so-called “ecological bombs”). These projects are typically funded by government or EU funds. If there are cuts or delays in public funding for environmental clean-ups, Mo-Bruk’s pipeline could dry up. For instance, a change in government priorities or budget constraints could postpone the tendering of new projects. Mo-Bruk noted that pricing on bomb projects has come down from prior years (as more firms try to bid or budgets are tighter). While they still have the edge, lower unit prices mean slightly lower margins in this segment than a few years ago. Any shift in political will to address these toxic dumps (for example, a less environmentally focused administration) could reduce this lucrative work. Mitigation for this risk is that Poland has EU mandates to clean these sites (EU is known for being a fan of healthy environment), and Mo-Bruk has already secured a strong backlog (over PLN 100m potential for 2026), suggesting at least a couple years of work ahead. Also, broad public support exists for removing hazardous dumps, making it likely that funding continues albeit at varying levels.

Competition and Market Saturation

Although Mo-Bruk currently enjoys a dominant position, one risk is (always) potential competition entering the field. For example, a large international waste management company or a domestic conglomerate might decide that hazardous waste is a growth area and invest heavily (or acquire a competitor). If a new incinerator facility is built by a competitor or if existing ones (e.g. cement plants that can co-incinerate waste) ramp up capacity, Mo-Bruk could face price competition or lose some volume. The current licensing environment protects against sudden influx of competitors, but not indefinitely. Permits can be obtained with time, and rivals could poach Mo-Bruk’s talent or customers by offering discounts. The risk is somewhat low in hazardous waste (few want to enter due to high barriers), but in the RDF segment competition exists (other firms produce alternative fuel for cement plants, etc., which could pressure Mo-Bruk’s market share in that sub-segment). Moreover, market saturation is a concern as well. Mo-Bruk’s recent flat revenues hint that it may be close to saturating its current addressable market. If Poland’s industrial output doesn’t grow or if companies find ways to reduce waste generation, Mo-Bruk might struggle to grow core revenues. The mitigant here is that the company is expanding into adjacent niches (oily waste processing, exports to neighboring countries) to enlarge its market. And as noted, any competitor faces a long road to catch up due to licensing and Mo-Bruk’s integrated services.

Economic Cyclicality

Waste generation tends to correlate with economic activity. A downturn in Poland’s industrial or construction sectors could reduce hazardous waste volumes (for instance, if factories produce less or construction slows, there’s less waste to treat). Additionally, if clients face economic stress, they might push back on prices or delay waste removal projects. However, Mo-Bruk’s exposure is somewhat defensive (much of its revenue is from ongoing waste disposal needs that cannot be postponed long and some is from public sector contracts that proceed regardless of the economy). During the COVID-19 slowdown, Mo-Bruk actually continued to grow earnings, showing resilience. Still, a severe recession could dent volumes or create receivables risks if clients struggle (Mo-Bruk had to write down some receivables in the past, though not significant aside from the fee issue). Mitigantion for this risk is the essential-service nature of waste management and Mo-Bruk’s diversification across many clients/industries that help buffer economic swings.

Operational and Environmental Risks

As a waste processor, Mo-Bruk faces operational risks like accidents, pollution, or community opposition. A serious incident (e.g. a fire at a waste storage site, a pollution leak, an injury accident) could lead to costly shutdowns or fines, and damage the company’s reputation. So far, Mo-Bruk’s track record on safety and environmental compliance has been good, but the risk is inherent. Environmental regulations could also tighten. For example, the EU could impose even stricter emission standards on incinerators or require expensive upgrades (raising capex needs). There’s also the matter of climate-related policy. If carbon credit costs rise or if waste incineration faces carbon taxes, Mo-Bruk might see higher operating costs. Mitigant here could be that Mo-Bruk invests in modernising its facilities (e.g. new filters, energy recovery systems) and monitors compliance closely. It has insurance for certain liabilities. Additionally, it is turning some processes into resource recovery (reducing environmental footprint), which aligns with regulatory trends favouring recycling over disposal.

Financial and Currency Risks

Mo-Bruk’s financial risk is low given modest debt. But if interest rates rise further unexpectedly, interest expense could tick up (though Poland is currently in an easing cycle, which should help). Currency risk is minimal since revenues and most costs are in PLN (the risk is for non-Polish investors :). However, some equipment purchases were likely in EUR, and as Mo-Bruk starts exporting RDF or importing waste for processing, it could have FX exposure (the company mentioned exports to Sweden/Ukraine and imports for stabilisation). It’s a minor risk as of now and a weaker PLN would actually make its services cheaper to foreign clients.

Governance or Ownership Risk

The company’s ownership is concentrated, which typically is positive (strong insider alignment), but it could pose a risk if the family or key shareholders decide to sell a large stake (as they did in 2020). A significant sale might temporarily depress the stock or signal something to the market. That said, the 2020 sale was done at a high price and with a view to increase float. Generally, it wasn’t perceived negatively. Another angle is that the CEO Henryk Siodmok is an experienced professional, but he’s relatively new (appointed in 2022 after serving on the board). Any change in top management or strategy could introduce uncertainty. As of now, corporate governance appears sound, with audited reports, a majority-independent supervisory board, and adherence to stock exchange best practices.

In weighing these risks, none appear fatal to the long-term thesis, but they can cause volatility. The biggest near-term risk is probably regulatory/tender timing risk. If, for example, the huge Nowe Miszewo project contract gets delayed or cancelled, 2026 estimates would come down. Another material risk is earnings disappointment if growth does not resume. The market could further punish the stock if 2026–27 stay flat. We cannot forget to mention that the 2025 loss has an accounting knock-on effect. Because of it, Mo-Bruk’s ability to pay dividends from 2025 profit is limited (they’ll rely on retained earnings), so if by some chance shareholders vote against using reserves, 2026’s dividend could be reduced. We assume this is an unlikely scenario, but worth noting.

We conclude that while Mo-Bruk faces a variety of risks, many are mitigated (or has a clear way to be mitigated) or moderate in probability. The company’s strong moat and financial health give it tools to handle challenges (e.g. absorbing one-off costs, adapting to regulation). We will keep an eye on legal developments (fee refund case), tender outcomes, and any signs of competitive entries, as these will be early indicators if the risk landscape is changing.

Our Scenarios (3–5 Year Horizon): Bull, Base, Bear Case

Bull Case (20% Probability)

Key Assumptions

In the bull scenario, several positive factors align to unlock Mo-Bruk’s full potential. The company not only secures the Nowe Miszewo contract in 2026 but follows it with additional large-scale clean-up projects, keeping its backlog consistently full. With many historical waste dumps in Poland still awaiting remediation, public tenders remain abundant. Mo-Bruk also expands geographically, either by entering neighbouring markets or participating in Ukraine’s post-war hazardous waste clean-up, leveraging its specialised expertise.

At the same time, industrial activity rebounds and enforcement of waste regulations tightens, forcing more companies to rely on professional disposal services. EU funding for environmental projects flows strongly, supporting both domestic and cross-border initiatives. Crucially, Mo-Bruk executes flawlessly. It wins major contracts without sacrificing margins, potentially completes a value-accretive acquisition to expand capacity, and successfully defends its moat from new entrants.

Financial Outcomes

Under these conditions, Mo-Bruk could exceed PLN 500 million in annual revenue within 5 years, driven by high utilisation across core segments and recurring “eco-bomb” revenues of PLN 50 million or more per year. Improved fixed-cost absorption allows margins to edge higher, lifting annual net profit to PLN 130–150 million, i.e. roughly double the 2024 level.

As growth accelerates, the market may begin to view Mo-Bruk as both a growth and income stock with strong ESG credentials. At peak optimism, a valuation multiple in the high teens or even around 20x earnings becomes plausible, implying a long-term share price in the PLN 600–700 range. While this scenario is less probable than the base case, we believe it is firmly grounded in reality. Between 2018 and 2020, Mo-Bruk demonstrated its ability to scale revenues rapidly. With Poland and the EU prioritising environmental remediation, a return to a high-growth trajectory remains a credible upside outcome.

Base Case (60% Probability)

Key Assumptions

The base case reflects a continuation of Mo-Bruk’s current trajectory, with moderate improvements across its operations. In this scenario, the Polish economy grows at a steady pace, contributing to a gradual increase in industrial waste volumes. Mo-Bruk incrementally fills its expanded processing capacity and continues to secure a consistent share of “eco-bomb” remediation contracts each year. For example, the company lands the PLN 87 million Nowe Miszewo project in 2026 and follows up with one or two medium-sized contracts in subsequent years. In this setting, we assume that no major new competitors emerge in the hazardous waste segment, allowing Mo-Bruk to remain the preferred provider while maintaining pricing discipline.

This scenario also assumes that Mo-Bruk avoids any further regulatory disruptions and continues operating within a relatively stable legal and environmental framework. Capex remains low, in line with management’s recent guidance, and the company’s strong FCF allows it to balance reinvestment with generous shareholder returns. Additionally, even though it’s not scenario-breaking point, we assume a favourable outcome in the court case concerning the PLN 65 million provision, with some or all of the amount refunded. This would provide a one-time financial boost, though this is not factored into ongoing earnings.

Financial Outcomes

Under these conditions, Mo-Bruk achieves mid-single-digit revenue growth annually, with total sales potentially rising to the PLN 350–380 million range within the next 3-5 years. Margins in the core business remain high, and thanks to fixed depreciation and operating leverage, net profit could gradually grow to around PLN 90–100 million by 2028. This represents a healthy progression from current levels and signals a return to a more sustainable, albeit slower, growth path compared to the company’s earlier boom period.

The company maintains its dividend policy, targeting a payout ratio of 50–70%. As profits grow, this allows for gradual dividend increases, i.e. from the current PLN 13.17 per share to potentially PLN 15–18 per share over the next 5 years. With capex staying low and FCF robust, management has the flexibility to fund these rising dividends, consider opportunistic share buybacks, or pursue selective bolt-on acquisitions to support further growth.

If this scenario unfolds as expected, the market is likely to value Mo-Bruk at least in line with broader benchmarks. A 15x earnings multiple (reflecting the company’s stability, margins, and capital discipline), this would imply a share price of PLN 450+ over a 3–5 year horizon, aligning with our base case intrinsic valuation. Including dividends, this represents a solid total return. In short, this base case aligns closely with management’s current outlook. Revenue above PLN 300 million, core EBITDA margins near 50%, and continued improvement in utilisation and operational efficiency within a protected competitive niche.

Bear Case (20% Probability)

Key Assumptions

In the bear scenario, Mo-Bruk is unable to reignite growth and faces incremental headwinds across its core operations. Waste volumes stagnate or decline slightly, either due to a general slowdown in industrial output or improved waste minimisation efforts by clients. Competition begins to erode its dominant position at the margins. For example, a rival company could win several “eco-bomb” contracts at lower prices, or a competitor may build new capacity that forces Mo-Bruk to reduce its pricing to remain competitive. No major new remediation projects are secured beyond the current backlog, and the company’s addressable market begins to feel saturated.

Margins come under pressure from rising energy costs and a more aggressive pricing environment in this scenario. Additionally, the company could suffer a regulatory setback, such as losing the court case related to historical fees without receiving a refund, or facing new government-imposed levies. Without any fresh growth catalysts or strategic wins, Mo-Bruk begins to resemble a utility-like, ex-growth business. Macroeconomic weakness (such as a recession) combined with reduced public investment in environmental contracts would further solidify this low-growth trajectory.

Financial Outcomes

Under this scenario, Mo-Bruk’s revenue remains flat in the PLN 280–300 million range, failing to grow meaningfully beyond current levels. EBITDA margins contract to approximately 40%, and net profit margins fall into the 15–20% range, reflecting both pricing pressure and rising operating costs. This translates into annual net profits of around PLN 50–60 million. In the absence of growth, the market may assign the company a more conservative valuation multiple (perhaps around 10x earnings) which would imply a share price drifting down into the low-200s PLN, despite our intrinsic value in bear case being around PLN 360s, the market sentiment could be ruthless in this case, pushing the price way lower. The company may continue paying its current dividend, but doing so would require a high payout ratio of 80% or more, leaving little room for reinvestment or strategic flexibility. In this view, Mo-Bruk remains a solidly profitable business, but one that is increasingly viewed through the lens of a low-growth, low-multiple stock. The risk in this scenario is not one of business failure, but of market re-rating and negative sentiment, where investors no longer price in premium expectations for growth or strategic upside.

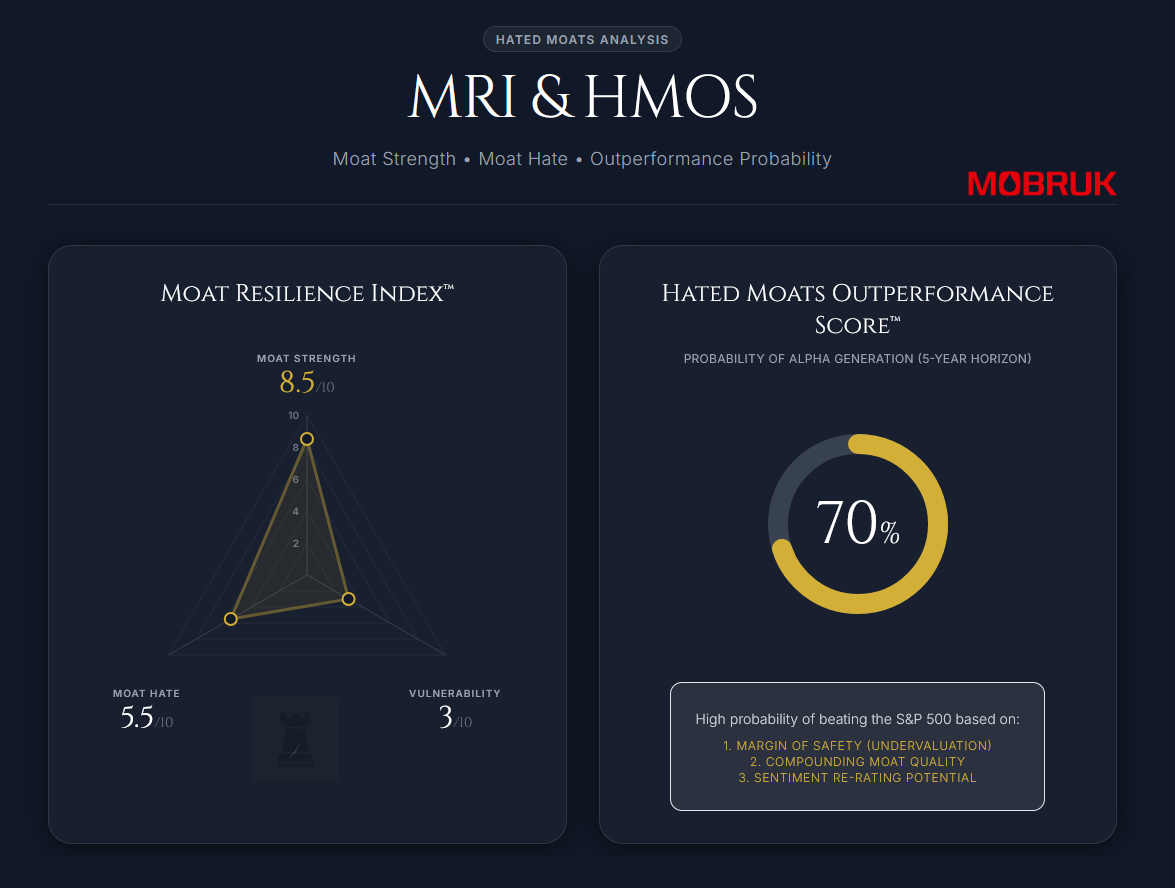

Moat Resilience Index™ (MRI)

We assess Mo-Bruk on our proprietary Moat Resilience Index™ (MRI), focusing on three dimensions – Moat Strength, Moat “Hate”, and Moat Vulnerability.

Moat Strength: 8.5/10

Mo-Bruk enjoys a strong and durable moat, built on high entry barriers, specialised licensing, and years of operational expertise. Its entrenched leadership in Poland’s hazardous waste segment, combined with vertical integration and scale, gives it a clear edge. The company’s consistently high margins and returns on capital show that competitors have struggled to take share. While not completely unbreachable (new technologies or a well-funded entrant could eventually pose a threat), there are currently no serious challengers. Mo-Bruk’s diversified revenue streams (stabilisation, RDF, incineration, and clean-up) further strengthen its competitive position. It resembles a toll-bridge on an essential industrial service with few substitutes.

Moat Hate: 5.5/10

Despite its strong fundamentals, Mo-Bruk remains underappreciated by the market. Its small-cap status, sector stigma (waste isn’t glamorous), and recent profit volatility have kept sentiment muted. The stock has pulled back ~40% from its highs and traded sideways for three years, reflecting investor indifference. While not actively shorted or widely despised, it fits the “Hated Moat” profile, i.e. a high-quality company with low valuation multiples (<15x normalised earnings) and a high dividend yield that suggest the market isn’t fully pricing in its competitive strength. We assign a 6 rather than higher because the sentiment is more apathy than hostility but that indifference presents an opportunity, in our opinion. Mo-Bruk looks like a boring but beautiful business hiding in plain sight.

Moat Vulnerability: 3/10

Mo-Bruk’s moat appears resilient, with little short-term vulnerability. Regulations work in its favour, customer relationships are sticky, and no near-term technological disruption threatens its business model. Long-term risks include a major shift toward zero-incineration policies or a subsidised competitor entering the market, though both seem unlikely. The one real area of concern is regulatory risk. As the landfill fee case showed, policy shifts can impose large costs. Geographic concentration is another factor. Mo-Bruk is entirely Poland-based, so it is vulnerable to country-specific economic or political shifts Though as we mentioned above, Poland is doing well on these fronts recently and shows no signs of slowing down. We believe these risks are manageable. We score it 3/10 to reflect that while not invincible, its moat should hold strong under most plausible scenarios.

Hated Moats Outperformance Score™ (HMOS): 70%

Our “Hated Moats” score, an aggregate indicator which we interpret here as the probability that Mo-Bruk will outperform the market (S&P 500) over a 5-year period. Considering the strong moat, the current low market expectations, and the company’s capacity for continued high returns, we assign a HMOS of ~70%. In plain terms, we’d say there is roughly a 70% chance Mo-Bruk’s stock beats the S&P 500 over the next 5 years in total returns. This high probability is justified by its combination of:

1) undervaluation – giving a margin of safety and higher dividend yield starting point,

2) quality moat business – likely to keep compounding value, and

3) the “hate” factor – low expectations that could be positively surprised.

Mo-Bruk has, in fact, massively outperformed the market historically (it turned tens of thousands into millions for early investors during 2015–2021), albeit with volatility. Looking ahead, even if it doesn’t repeat such explosive growth, the risk-reward skews towards outperformance. The market could very well rerate Mo-Bruk once growth visibility improves or simply as the high dividend and buybacks do their work – delivering returns that in our opinion should outstrip a broad index.

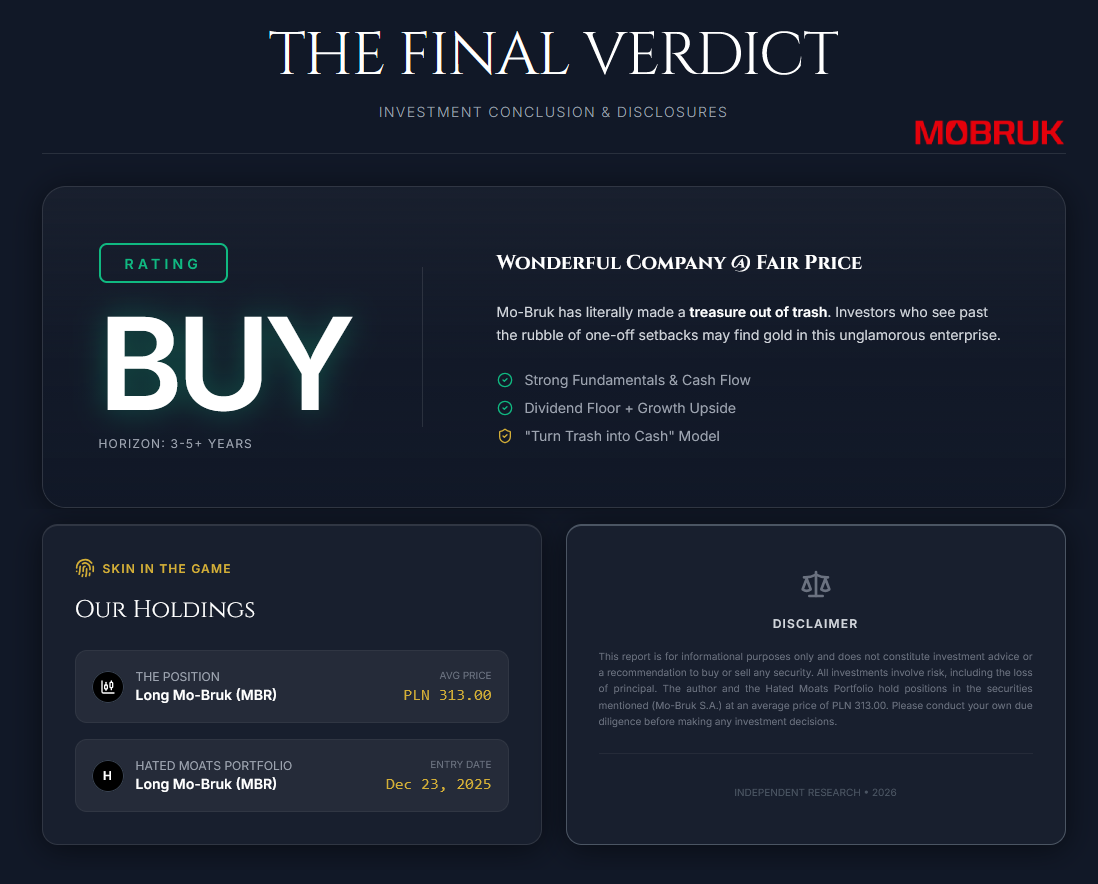

Conclusion

Mo-Bruk S.A. represents a compelling blend of value and quality. On one hand, it’s a market leader with a wide moat in a niche industry where demand is recurring and growing (environmental waste management). The company has proven it can translate that position into superb financial results, i.e. high margins, strong free cash flow, and generous shareholder returns. On the other hand, the stock is trading at an undemanding valuation because of short-term headwinds (earnings plateau and one-off charges) and low investor enthusiasm. We believe the market is undervaluing the stability and resilience of Mo-Bruk’s earnings, as well as its future growth potential from new projects and fuller capacity utilisation. Management’s alignment (significant insider ownership), prudent capital allocation (steady dividend, opportunistic buyback), and transparent communication (guiding >PLN 300m revenue and ~50% EBITDA margin for 2025) all inspire confidence that shareholder interests are front and center.

Short-Term Outlook (< 1 Year)

In the short term, we anticipate a rebound in reported earnings as Mo-Bruk laps the provision and benefits from a big Q4 2025. It’s quite possible the company will report a robust Q4 profit (the PLN 35m+ revenue in that quarter from eco-bombs likely carries very high margins), which could remind investors of Mo-Bruk’s earnings power. This, along with an expected decision on dividend (we suspect they will maintain ~PLN 13, using reserves if needed), could act as catalysts in the next 6-12 months. The stock has already begun creeping up from its autumn lows & we wouldn’t be surprised to see it move back toward the PLN 350-370 range if the 2025 full-year results and 2026 guidance confirm the turnaround (especially if management quantifies the 2026 contract pipeline more). Broader market factors (like a potential decline in interest rates in Poland in 2026) also favour Mo-Bruk, since a lower discount rate increases the present value of its cash flows and reduces interest expense. Market sentiment, currently lukewarm, may start tilting positive as the “bad news” of 2025 is fully digested and forward estimates tick up.

Long-Term Outlook (3-5 Years)

Over a multi-year horizon, we expect Mo-Bruk to resume modest growth and continue compounding value for shareholders. Even under rather conservative assumptions (our base case), the combination of mid-single-digit growth, 20-25% net margins, and a 4-5% dividend yield implies double-digit annual total returns. If the company can capitalise on additional opportunities (be it larger government clean-ups, expansion into new waste streams, or maybe inorganic growth via acquisitions), there is upside to those returns. Mo-Bruk’s fundamental profile (high ROE, low debt, essential service) is one that typically outperforms across cycles. Considering all this, we view Mo-Bruk as not just a short-term rebound play but a solid long-term holding that can deliver both income and growth. By 2030, Mo-Bruk could realistically be earning ~PLN 100m+ and possibly be a takeover target for a larger waste management company or infrastructure fund (given its cash flows and ESG angle). Such an event could unlock additional value (premiums in infrastructure M&A are often 20-30%). While we aren’t banking on an acquisition, it’s a non-zero possibility that adds an extra layer to the long-term story.

Final Verdict

Taking all factors into account (the company’s strong fundamentals, reasonable valuation, and expected improvement in operations) our investment verdict on Mo-Bruk S.A. is a “Buy”.

We consider it a moderate to strong buy for investors with a 3-5+ year horizon, though we officially categorise it as simply Buy (one notch below a hypothetical “Strong Buy” which we’d reserve for cases of extreme undervaluation or imminent catalysts). The fact is that Mo-Bruk offers an attractive risk-reward profile. The downside seems limited by its stable core business and dividend floor, while the upside includes not only a valuation re-rating but also growth-driven appreciation. In the lexicon of famed value investor, this stock looks like a classic “wonderful company at a fair price.” Without directly invoking names, we believe the analysis here – focusing on

In short, Mo-Bruk’s ability to turn trash into cash is the kind of investment that we believe in. :)

In conclusion, the stock’s recent dip and uninspiring spell appear to be an opportunity to accumulate a high-quality business that the market currently discounts. “One man’s trash is another man’s treasure,” the saying goes, and in this case, Mo-Bruk has literally made a treasure out of trash, and investors who can see past the rubble of one-off setbacks may find gold in this seemingly unglamorous enterprise. We expect Mo-Bruk to outperform the broader market in the years ahead, rewarding patient shareholders with growing dividends and capital appreciation.

Our Investment Verdict: BUY

Disclaimer & Our Investment

The author of this report does hold a position in the security of Mo-Bruk S.A. via our Hated Moats Portfolio with avg price of PLN 313.00 per share since December 23, 2025. This report is for informational purposes only and does not constitute investment advice or a recommendation to buy or sell any security.