Uber Technologies: Deep Dive Analysis

From cash-burn to cash-gush: Is the current pullback a long-term entry?

Overview & Positioning

Uber Technologies is a global leader in ride-hailing and delivery, operating Mobility (rides), Delivery (Uber Eats), and Freight segments. Transforming from a cash-burning disruptor to a mature enterprise, Uber focuses on profitable growth. As of 2025, it serves 189 million monthly consumers with 3.5 billion quarterly trips. Revenues approach a $50 billion annual run-rate, with Q3 2025 at $13.5 billion (+20% YoY). Now consistently GAAP profitable, Uber posted $1.8 billion net income in Q1 and $6.6 billion in Q3 (boosted by a $4.9 billion tax release), generating substantial free cash flow.

Its global scale across 70+ countries and 15,000 cities creates a unique dual-platform ecosystem connecting riders, drivers and, well, eaters :). Strategy emphasises subscription loyalty. Uber One reached 36 million members (+60% YoY) by mid-2025. Members account for 1/3 of bookings, showing 3x higher spend and 35% better retention. CEO Dara Khosrowshahi has pivoted Uber toward “sustained growth,” exiting non-core markets to focus where Uber can lead. This yields improving fundamentals and a clear value proposition as a “go-to” urban platform. Uber’s addition to the S&P 500 (2023) and now S&P 100 (Sept 2025), with a ~$165 billion market cap, underscores its status as a resilient large-cap company.

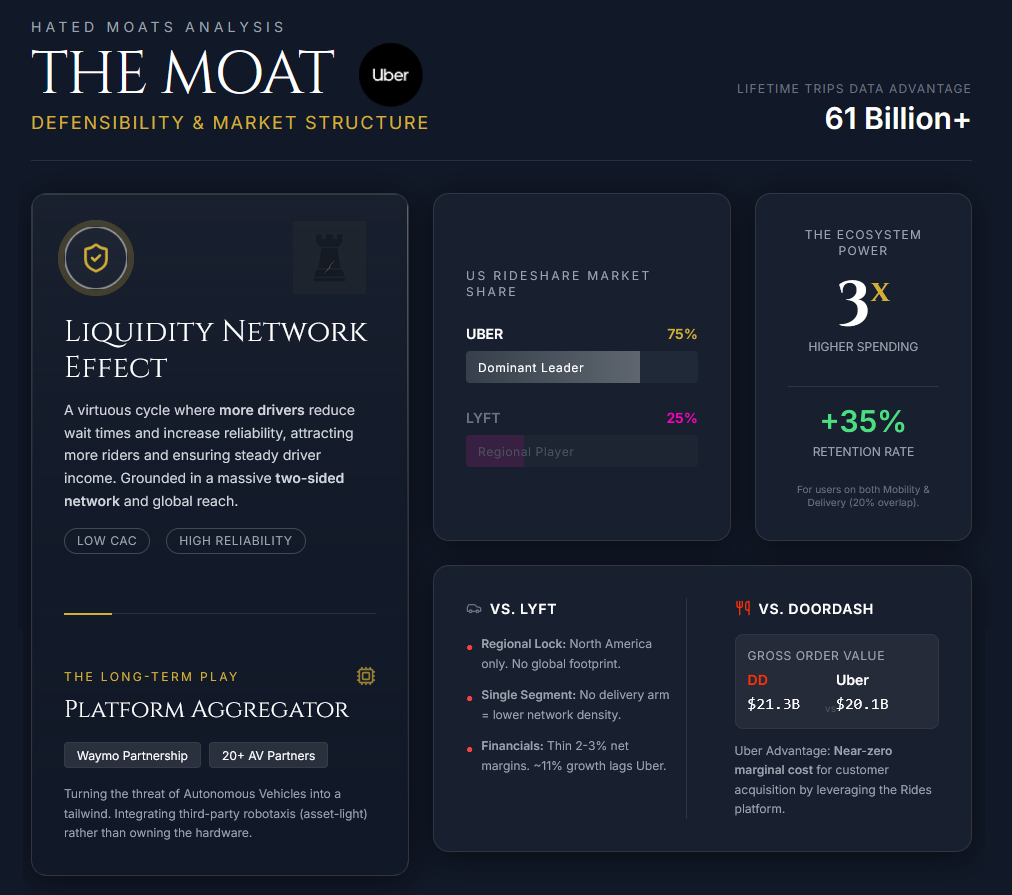

Competitive Moat & Competition

Uber’s competitive moat is grounded in its vast two-sided network and global reach. A liquidity network effect creates a virtuous cycle where more drivers reduce wait times and increase reliability, attracting more riders and ensuring steady driver income. This dynamic has made Uber the dominant platform in most regions. In the US, Uber holds 70–75% rideshare market share compared to Lyft’s 25–30%. Globally, it secures influence through #1 positions or strategic stakes in players like Didi and Grab, while its brand has become synonymous with ride-hailing.

Economies of scale bolster this moat. Massive Gross Bookings (~$50B per quarter) allow Uber to spread fixed costs like R&D and mapping over a huge transaction base. An unmatched data advantage (over 61 billion lifetime trips) feeds algorithms for pricing, routing, and matching, creating efficiency smaller players cannot easily replicate. Unlike rivals, Uber operates both Mobility and Delivery at scale. This ecosystem encourages cross-usage. While only ~20% of users currently use both services, those who do exhibit 35% higher retention and 3x spending. This synergy allows Uber to leverage its rides base to grow delivery, a competitive edge unavailable to Lyft or DoorDash.

Benchmarking against peers, Uber is significantly stronger than Lyft. Lyft operates only in North American rideshare, effectively a regional, single-segment player with under 1/3 market share. Lacking a delivery arm, Lyft has lower network density, leading to longer wait times and higher per-ride costs. Its 2025 revenue growth (~11%) lags Uber’s, and despite reaching thin 2–3% net margins, its smaller scale constrains strategic options. Without a new value proposition, Lyft’s narrow moat leaves it vulnerable to share erosion or even potential disruption by smaller players.

In US food delivery, DoorDash is the clear leader and Uber Eats is the clear no. 2. DoorDash’s execution is strong, yet Uber Eats is catching up globally. By late 2024, Uber Eats’ Gross Order Value (~$20.1B) nearly matched DoorDash’s (~$21.3B), and Uber’s Delivery segment has become a meaningful profit contributor (positive segment Adjusted EBITDA), reinforcing the shift to durable cash generation. Uber’s advantage lies in using its rides platform for customer acquisition at near-zero marginal cost. Additionally, its global footprint covers 11,500+ cities, allowing it to tap international markets where DoorDash is absent or nascent.

Uber’s moat is surely durable but not unassailable. Vulnerabilities include low switching costs, as drivers multi-home and riders price-shop. Uber must continually invest in incentives to maintain liquidity, though high capital barriers make it difficult for new entrants to disrupt its consolidated market position. Over time, Uber strengthens its defense by adding advertising and new verticals like public transit (we enjoyed Uber boat in London more than once :) to become a one-stop shop.

The most significant long-term threat is technological disruption from autonomous vehicles (AVs). If companies like Waymo operate standalone apps, they could bypass Uber. However, Uber’s strategy is to become a “platform aggregator.” With 20+ partnerships, including Waymo in Phoenix, Uber integrates third-party robotaxis into its app. This approach turns a potential threat into a tailwind, allowing Uber to offer AV rides without owning the hardware, effectively preserving its network moat. Overall, Uber’s moat is among the strongest in the industry, though regulatory changes or deep-pocketed tech competitors remain potential risks.

Recent Stock Performance & Market Sentiment

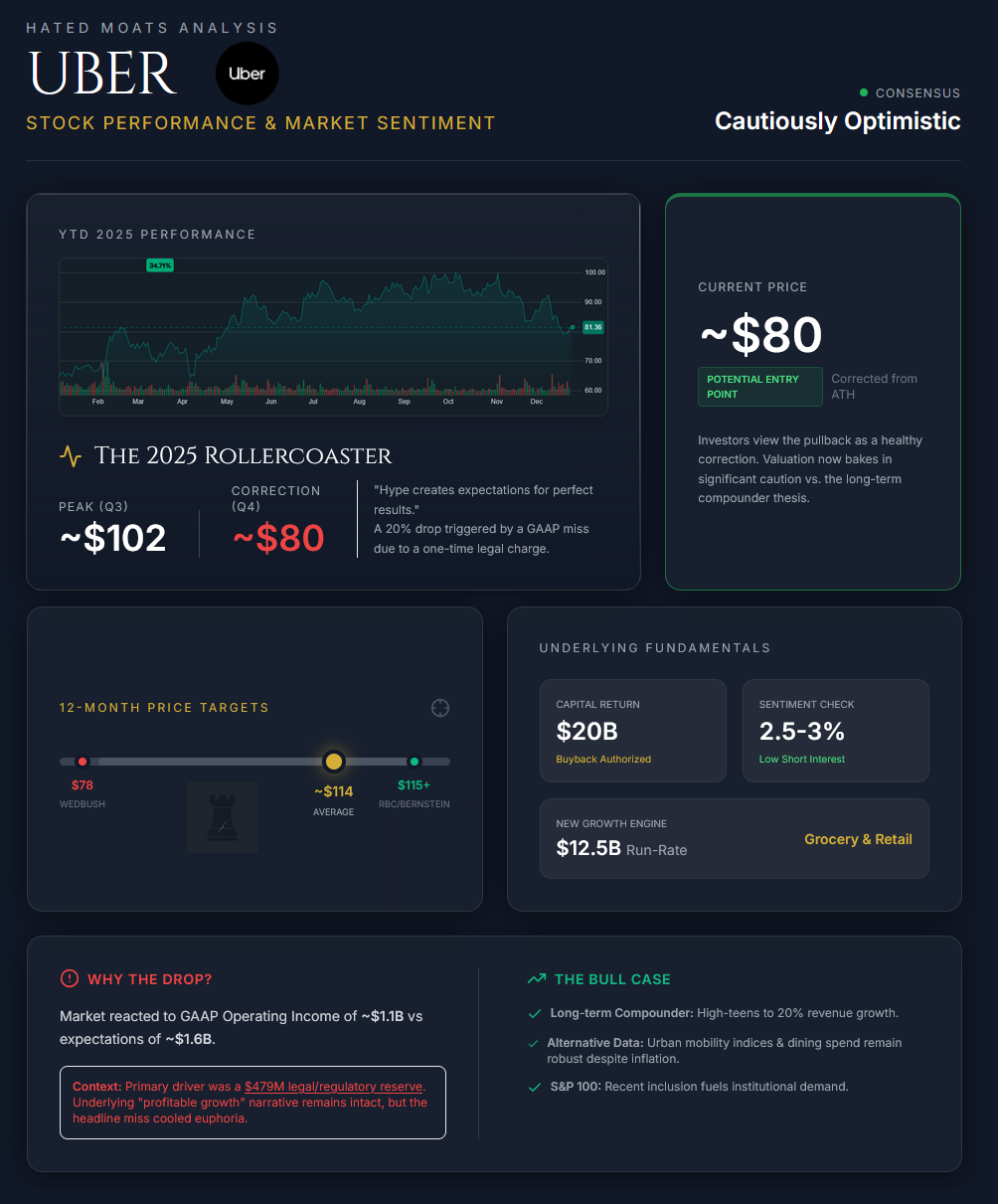

Uber’s stock experienced a rollercoaster in 2025, to say the least. Through Q3, shares surged over 60% to an all-time high of ~$102, driven by improving fundamentals and consistent earnings beats. Q3 revenue of $13.47B and a strong EPS beat confirmed the “profitable growth” narrative. Technical factors like a $20B buyback authorisation and S&P 100 inclusion further fueled demand. However, the euphoria cooled in Q4. Following earnings, the stock fell ~20% to ~$80 by mid-December. This drop was attributed to GAAP operating income of ~$1.1B versus ~ $1.6B expected, primarily due to a legal/regulatory reserve (reported as a ~$479m legal charge), with Q4 outlook viewed as solid but not a ‘blowout’. You know the story - hype creates expectations for perfect results and great results create dissapointment in such an environment.

Current sentiment is cautiously optimistic. Sell-side analysts remain bullish with an average one-year price target around ~$113–114 (with bulls at $115+ and the low end around $78). After Q3, firms like RBC and Bernstein raised targets, citing accelerating volume growth, a $12.5B grocery run-rate, and solid margins. Bulls view Uber as a long-term compounder with a reasonable valuation given high-teens to ~20% recent revenue growth, with faster multi-year growth if you include the post-pandemic rebound period. Conversely, some caution persists regarding rising insurance costs and regulatory headwinds. Wedbush, for instance, set a target of $78. We’ll see further why we disagree with such a number. Short interest remains low at 2.5–3%, suggesting sceptics are not betting on a collapse.

Alternative data supports the bullish case. Consumer spending on ride-hailing and dining remains robust despite inflation, and urban mobility indices show strong activity. Strategic moves in the autonomous vehicle space are viewed favourably. While macro factors like high Treasury yields compressed multiples late in the year, many investors view the recent pullback as a healthy correction. The ~$80 share price likely bakes in significant caution, offering a potential entry point for long-term investors if Uber continues to execute.

Fundamental Analysis

Growth & Profitability

Uber’s top-line growth has reaccelerated impressively, returning to strong double-digit expansion. In Q3 2025, revenue grew 20% year-over-year to $13.47 billion, capping a robust first half where Q2 revenue rose 18%. The company now boasts a 5-year revenue CAGR of ~28%. Growth is broad-based across key segments. Mobility revenue increased 20% in Q3, fueled by a 22% jump in trip volume, while Delivery revenue surged 29% as Uber Eats gains share and expands into grocery (now a $12.5B run-rate). Freight remains flat amid industry softness but accounts for under 5% of bookings. Importantly, the user base is clearly not saturating. Monthly Active Platform Consumers hit 189 million (+17% YoY), and average trips per user rose 4%. Management credits sticky features like Uber One and “Price Lock” for driving this habitual usage. Guidance predicts sustained high-teens growth, supported by secular urbanisation trends.

As far as profitability goes, it has fundamentally shifted, with Uber achieving consistent GAAP profit. Headline Q3 net income was $6.6 billion, though this included a massive $4.9 billion one-time tax benefit taht inflated net income. GAAP income from operations was $1.113bn (i.e., operating profitability before tax). Adjusted EBITDA reached a record $2.3 billion, or 4.5% of Gross Bookings. Mobility remains the cash cow, acting like a platform toll with a ~26% EBITDA margin. Delivery has also turned a corner, generating a ~21% margin on revenue thanks to better logistics and advertising income.

Free Cash Flow & Capital Allocation

Uber’s cash flow generation is a real highlight, as the company now turns a large portion of revenue into free cash. In Q3 2025, operations provided $2.3B in cash and Free Cash Flow (FCF) was $2.2B, meaning nearly every dollar of operating cash became free cash given modest capex (Uber doesn’t own vehicle fleets). Year-to-date 2025 FCF is ~$6.7B, and trailing 12-month FCF is around $8.5B, equating to a strong ~17% FCF margin on revenue. Notably, FCF has exceeded net income in many quarters thanks to favourable working capital and deferred tax assets. The CFO highlighted a 114% FCF conversion of Adjusted EBITDA in Q2, which is a sign of high-quality earnings.

Uber is displaying clear operating leverage. Despite 20% revenue growth, core expenses like R&D and marketing are growing much slower. Gross margins improved to ~40% as incentives were cut and algorithms improved efficiency. While G&A expenses spiked temporarily due to legal charges, overall workforce levels have stabilised. Management is actively addressing dilution from stock-based compensation (~$1.38bn year-to-date through 30 Sep 2025) through a massive $20 billion buyback authorisation. Adjusting for one-off gains, true trailing 12-month net income stands at ~$3.5–4 billion (~8% margin). With interest costs declining and tax assets shielding cash flows, Uber is positioned for continued margin expansion.

This cash gush thus generally funds a shareholder-friendly capital allocation. After a $7B program in 2024, Uber stunned the market in August 2025 by authorising, as we mentioned above, an additional $20B in repurchases. That’s one of the largest buyback programme relative to market cap (~12%) in the tech sector. “Through 30 Sep 2025, Uber repurchased $1.5bn in Q3 and $4.6bn in 9 months of 2025, with the rest to be deployed over the next couple of years. This signals management views the stock as undervalued and wants to return capital. Uber has no dividend, but aggressive buybacks effectively increase each share’s claim on earnings.

When we look at the balance sheet, Uber’s financial position is solid. As of Q3 2025, Uber had $9.1B in unrestricted cash and short-term investments against total debt of ~$11.8B. This debt includes senior notes and a $1.2B convertible note due Dec 2025, which the company indicates it will redeem with cash to avoid dilution. Effectively, Uber is in a net debt position of ~$2.7B. That net debt is only ~0.8× 2025E Adjusted EBITDA, which we’d define as a very comfortable leverage.

Uber’s debt-to-equity ratio stands at ~0.4. While RBC noted this is higher than the industry average of 0.06, in absolute terms it is not worrisome in our opinion. Interest expense of ~$450M is easily covered by operating profits (8–10x coverage). The company’s corporate credit rating is in the mid-to-upper BBs (just below investment grade) and could improve. Liquidity is strong with a current ratio >1. Additionally, large equity stakes in Didi, Grab, and Aurora (~$10.3B) provide extra cushion and can be monetised if needed.

Valuation & Key Financial Metrics

Intrinsic Value & DCF

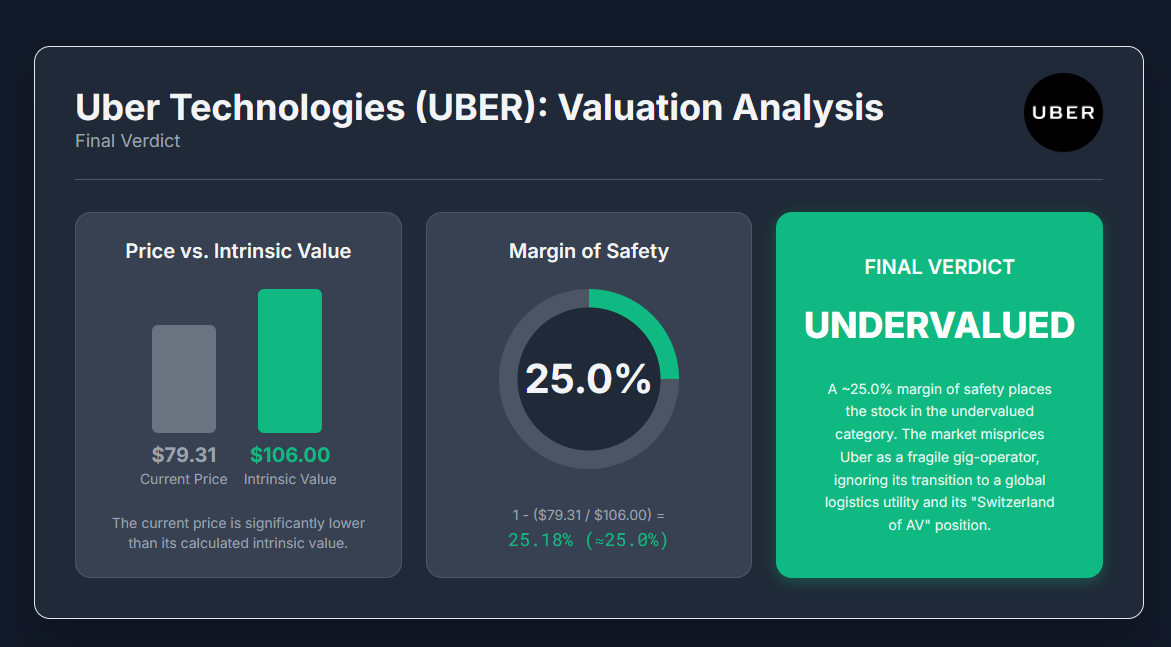

We have conducted a detailed Discounted Cash Flow (DCF) valuation for Uber to estimate its intrinsic value based on fundamentals.

Our DCF base case of $106 is deliberately conservative on inputs (growth tapering, margins not exceeding 18%, g lower than GDP). We’d like to note that slightly tweaking a few inputs could justify a modest premium. For instance, if we assume a bit lower WACC (say 7.8% due to deleveraging or beta coming down) and terminal growth of 3.0%, the fair value inches up to ~$114–115/share. This range aligns with bullish analyst targets. But staying disciplined, we keep $106 as the baseline intrinsic value. At the time of writing with price of ~$79, Uber stock trades at about 75% of our intrinsic value, i.e. with a 25% margin of safety.

Put another way, Uber is ~25% undervalued in our analysis, which is a significant gap for a company of Uber’s caliber. This margin of safety suggests that investors today are getting Uber’s long-term growth prospects at a discount, perhaps due to the overhang of past biases (“Uber never made money before”) or short-term worries that we believe are transitory.

The full DCF valuation is available as a standalone article, part of our DCFriday series, HERE.

Key Financial Metrics

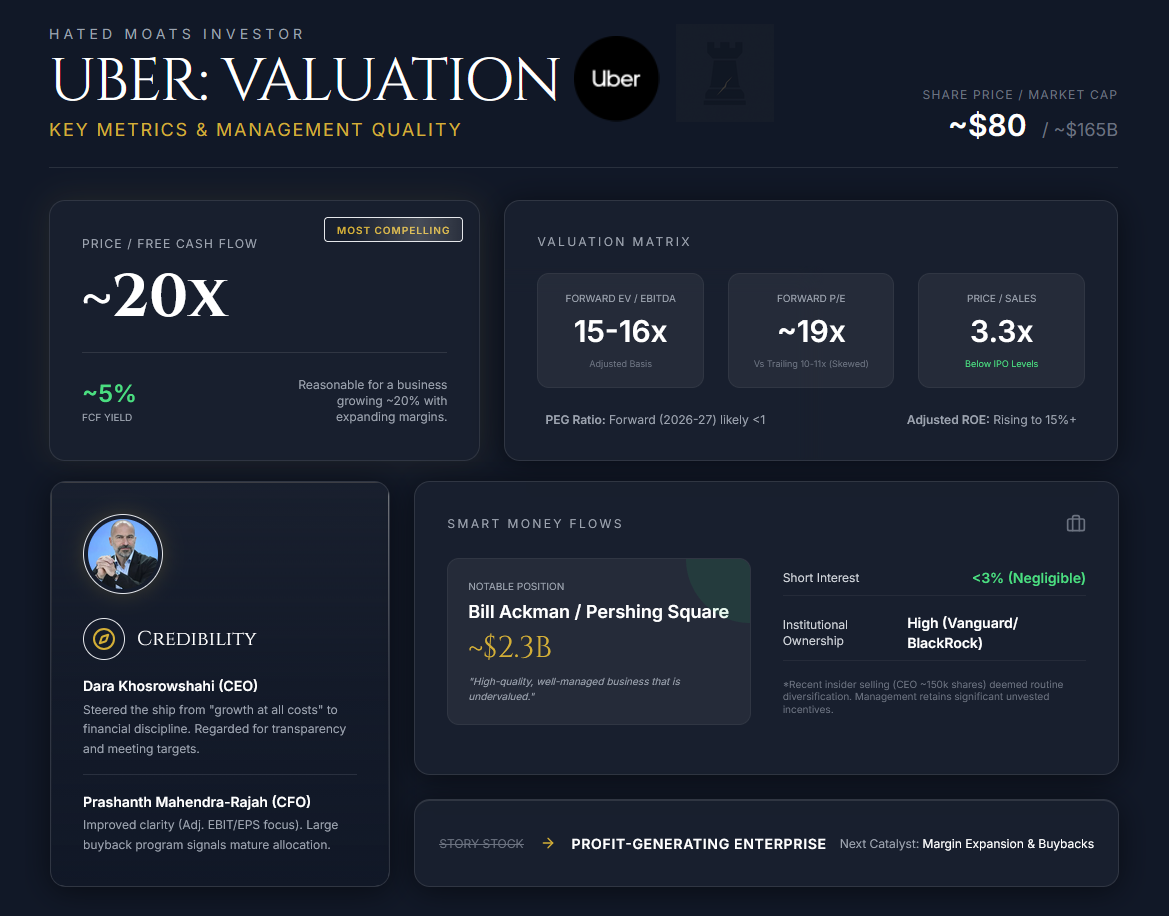

With recent profitability, we can finally assess Uber on traditional multiples, though GAAP earnings are skewed by one-offs. At ~$80 (market cap ~$165–170B), Trailing GAAP P/E looks low (~10–11x) and is skewed by one-offs (notably tax/investment revaluations). Forward P/E is roughly ~19–20x.

However, earnings are growing rapidly off a low base. Analysts often prefer EV/EBITDA, where On a forward basis, Uber trades around ~15–16x projected EV/ Adjusted EBITDA. More compelling is Price/Free Cash Flow at ~19–20x (using ~$8.5B FCF). A ~5% yield for a business growing ~20% with expanding margins is reasonable. Price/Sales is ~3.3-3.4x, in line with platform peers and well below IPO levels. Price/Book is ~5.5x, though book value is less meaningful n this case.

Profitability ratios are turning positive. GAAP ROE is ~30%+ (due to tax gains), while adjusted ROE is ~12–15% and rising as earnings scale and buybacks reduce equity. ROIC is also turning positive, with potential to become very attractive given Uber’s asset-light model. Uber’s valuation looks steep on PEG (Price/Earnings-to-Growth) using the current small earnings base, though forward-looking PEG (2026–27) might be <1 as margins expand.

Management Quality and Insider Activity

Uber’s management has gained significant credibility. Since 2017, CEO Dara Khosrowshahi has steered Uber with a steady hand, implementing safety programs, exiting cash-bleeding ventures, and instilling financial discipline that delivered profitability. He is well-regarded for transparency and consistently meeting targets. CFO Prashanth Mahendra-Rajah has further improved clarity, shifting focus to “Adjusted EBIT/EPS” for better financial transparency. Capital allocation has also matured, evidenced by the large buyback program rather than empire-building acquisitions.

Insider ownership is typical for a company of this size. Executives and directors hold ~0.2%, with Khosrowshahi’s disclosed ownership is in the low single-digit millions of shares (e.g., ~2.29m shares as of 31 March 2025, roughly ~0.1% of the company). Recent insider selling in 2025 (such as the CEO selling ~150,000 shares in September and the CFO selling ~5,500 in November) appears to be routine diversification or planned sales, not a warning sign. Management retains significant unvested stock incentives. Institutional ownership is high, with major stakes from Vanguard and BlackRock. Notably, Bill Ackman disclosed a ~$2.3bn stake (~30.3m shares) and publicly praised Uber as a high-quality, well-managed business that was undervalued. Hedge funds increased positions in Q3 2025, drawn by the improving free cash flow, while short interest remains negligible (<3%), indicating few are willing to bet against current execution.

In summary for fundamental analysis, Uber has transitioned from a “story stock” to a profit-generating enterprise. Growth is robust, profitability is scaling, and free cash flow is ample. The balance sheet is healthy, and buybacks mark a positive new chapter. The key question now is how high margins can ultimately go, which will determine Uber’s long-term earnings power and intrinsic value.

Risk Factors

No investment is without risks, and Uber, despite its strengths, faces several risk factors that could impair its business or stock performance. Let’s look at them.

Regulatory & Legal Risks

Despite the popular online narrative of “AV disrupting Uber”, we believe this is objectively the largest overhang for Uber. The company’s gig-economy business model (treating drivers and couriers as independent contractors) constantly faces scrutiny and legal challenges. Changes in labour laws could force Uber to reclassify drivers as employees or provide additional benefits, raising costs significantly. For example, in California, Proposition 22 (which allowed gig companies to keep drivers as contractors with some benefits) has been upheld, but any reversal or new legislation (e.g., a future California ballot or federal PRO Act) could undermine Uber’s labour model. Similarly, the EU has adopted new platform-work rules (the Platform Work Directive), which entered into force in 2024. Member States generally have until 2026 to transpose it. Depending on how countries implement it, this could raise costs in Europe or require structural changes. Uber often cites these risks prominently in its 10-K Risk Factors.

Aside from labour classification, regulatory risk includes price controls (some cities have tried to cap surge pricing or require minimum wages for drivers) and operational restrictions (airport pickup rules, city permit caps, etc…). Uber also faces legal risk from ongoing and future lawsuits, ranging from driver employment claims to passenger safety incidents and intellectual property disputes. The Q3 legal expense spike is a reminder that settlements or judgments (for example, a large class-action payout) can hit profitability. Additionally, privacy and data protection laws like GDPR in Europe impose compliance costs and potential fines if Uber mishandles data. All in all, regulatory changes remain an ever-present risk. A single adverse law in a major market could meaningfully dent Uber’s economics. A key mitigant is that Uber has been proactive in negotiating frameworks (e.g., Prop 22 style compromises) and diversifying across jurisdictions to avoid over-reliance on any one region’s rules.

Competition & Market Dynamics

While Uber currently enjoys duopoly or oligopoly status in many markets, competition can flare up. In rides, Lyft remains a substential competitor in North America. If Lyft engaged in aggressive price-cutting to gain share, it could pressure Uber’s margins. Internationally, local players (Grab in SE Asia, Ola in India, Bolt in Europe/Africa, Didi in China) can outcompete Uber if it missteps. In Delivery, DoorDash in the U.S. and Just Eat Takeaway/Delivery Hero in Europe provide stiff competition, evidenced by the need for constant consumer promos and driver incentives. Should any competitor secure a significant capital infusion and subsidise rides or deliveries heavily, Uber might have to respond in kind, hurting profitability.

New entrants could also emerge. For example, Amazon has dabbled in restaurant delivery and already offers grocery delivery via Whole Foods/Amazon Fresh, which competes with Uber’s Cornershop. A deep-pocketed entrant bundling delivery with other services could be disruptive. Autonomous vehicle (AV) technology is a wildcard competitive threat that perhaps gets the most attention recently. If companies like Tesla, Waymo, or Cruise manage to roll out large autonomous taxi fleets before Uber can integrate them, they might effectively replace the driver and go direct to consumers. In a scenario where a tech giant offers safer or cheaper rides via self-driving cars, Uber’s network moat could be partially circumvented. Competition for drivers/couriers is another angle. If gig workers find better earning opportunities elsewhere, Uber could face labour shortages or higher incentive costs to attract drivers, as seen in 2021.

Macroeconomic & Cyclical Risks

Uber’s business has some cyclicality. In an economic downturn or recession, discretionary consumer spending on ride-hailing and food delivery could drop. During severe recessions, people may cut back on rides (opting for public transit) and ordering food (cooking at home), hitting Uber’s volumes. Corporate travel, a driver of airport and premium rides, would also slow with a weak economy. Additionally, high fuel prices can reduce driver supply or increase Uber’s costs if it decides to subsidise fuel. Inflation raises costs generally (driver pay expectations, menu prices), which can dampen demand or squeeze margins.

Interest rates matter as well. Higher rates increase Uber’s discount rate, contributing to multiple compression. If high rates persist, growth stock valuations like Uber’s could be restrained even if business execution is solid. On the flip side, mild inflation can help Uber grow gross bookings, and in a moderate downturn, Uber could benefit from increased driver supply. However, a sharp recession remains a risk that could slow growth to low single digits or cause a decline.

Execution & Strategic Risks

Uber is a large organisation that needs to execute well on multiple fronts. Maintaining platform safety and trust is paramount. Incidents of rider or driver safety lapses can harm Uber’s reputation and invite regulatory crackdowns. Technology failures or security breaches are another risk. A major hack or app outage could drive users to alternatives and create liability, especially if it was a recurring event. Strategically, expansion into new areas like freight or grocery delivery must be carefully managed. Past ventures like developing in-house self-driving tech led to heavy losses. If Uber misallocates capital or struggles with integration risks from acquisitions, it could squander resources.

Foreign operations entail risk from currency fluctuations and divergent regulatory regimes. Uber’s ability to localise strategy is tested in markets with different cultural and competitive landscapes, such as India and the Middle East.

“Moat Vulnerability” & Innovation Risk

Uber’s moat is strong but somewhat vulnerable to disruptors. One is commoditisation. If consumers see ride or delivery services as interchangeable, brand loyalty could erode, leaving price as the only factor. To combat this, Uber invests in brand and product differentiation. Another vulnerability is the “super-app” model. If a competitor locks users into an ecosystem with a competing mobility suite, Uber could face ecosystem-level competition. Technological innovation outside of AVs also poses risk. If urban transportation shifts to modes that bypass Uber (e.g., subsidised public transit or new micro-mobility), demand could stagnate.

Cost Structure & Input Risks

Uber’s cost structure includes volatile items. Insurance costs have been rising industry-wide. Mispricing risk or a spate of accidents could boost insurance reserves, impacting operating results. Legal compliance costs are significant ongoing expenses. Server infrastructure costs could rise with usage as well. Currency exchange is another risk we identified in our research, as a strong dollar can reduce reported revenue from international markets.

Geopolitical & Sociopolitical Risks

Uber operates globally, exposing it to geopolitical events. Political instability or social unrest in key cities can disrupt operations. Trade restrictions or worsening U.S.-China relations could indirectly affect global investor sentiment or Uber’s investment in Didi. The company also navigates public opinion. Calls for boycotts or driver strikes can occur. Environmental/ESG factors are increasingly important as Uber’s carbon footprint and impact on congestion are often criticised. Cities imposing congestion taxes or emissions fees could raise ride prices. Uber is countering this by pushing EV adoption, but execution is ongoing and generally, it’s a process.

Summary

The largest risk to the thesis is regulatory hits or margin erosion that invalidate the assumption of improving profitability. If Uber were forced to significantly increase driver compensation via law or face a price war, the margin expansion narrative would falter, likely leading to a lower intrinsic value. However, we believe successful navigation of these challenges would preserve the path to upside. Ideally, as it goes in investing, the reward adequately compensates for these known risks.

Our Scenarios (3–5 Year Horizon): Bull, Base, Bear Case

To account for the range of potential outcomes, we outline 3 scenarios for Uber over a 3-5 year horizon, assigning probabilities to each and describing the key assumptions required for each scenario to materialise.

Bull Case (15% Probability)

Key Assumptions

In the bull case, Uber executes (almost) flawlessly while external conditions remain favourable. The global economy remains healthy, avoiding major recessions, which supports steady growth in urban mobility demand. We assume Uber’s revenue grows at a robust pace (approximately 15% CAGR or higher) for the next 5 years. This growth is driven by continued expansion in core rides and delivery, alongside successful new initiatives. A critical driver (pun intended) in this scenario is the meaningful contribution of autonomous vehicles (AVs) by 2028. Through partnerships, Uber rolls out robotaxis in many cities, significantly reducing the need to incentivise human drivers and structurally improving margins. Since it’s unlikely to eliminate human drivers by then, a hybrid network (robotaxis + human drivers) is the more realistic base in an ‘AV goes right’ world.

Simultaneously, the Uber One membership becomes ubiquitous, potentially doubling to ~70 million members. This boosts customer loyalty and usage frequency, allowing Uber to capture greater wallet share as users rely on the platform for all local transport and commerce needs, including grocery/retail via Uber Eats’ grocery efforts. High-margin adjacencies also add incremental value. The advertising business is a billion-dollar stream with high incremental margins, and Uber Freight turns profitable. Competitively, the moat widens. Lyft may falter or be acquired, leaving Uber potentially pushing US rideshare share higher (e.g., high-70s/low-80s), while Uber outpaces DoorDash internationally. Regulatory headwinds abate, perhaps through new laws that codify gig work as unique, removing the existential threat of reclassification.

Financial Outcome

Financially, the bull case yields significant margin expansion. Take rates increase as competition rationalises and scale allows for pricing power. By 2030, EBIT margins reach up to ~20%, reflecting highly efficient operations aided by AVs and high-margin ad revenue. Free Cash Flow (FCF) explodes due to operating leverage, potentially reaching $15–20 billion annually within 5 years. Uber could use this cash to fund massive buybacks, initiate a dividend, or deleverage completely to lower its WACC.

In this scenario, investor perception shifts to viewing Uber as an indispensable, utility-like platform deserving of a premium multiple. The stock would not only realise our current intrinsic value estimate of $106 but exceed it as the next leg of growth is priced in. Valuation could reasonably reach the $140–$160+ range, delivering a ~15%+ CAGR to shareholders over 4-5 years, significantly outperforming market benchmarks.

Base Case (65% Probability)

Key Assumptions

The base case represents our core thesis. Uber continues its current trajectory of solid, sustainable growth and gradually improving profitability. Revenue growth moderates but remains healthy, estimated at ~12–15% CAGR for the next few years before settling into high-single digits by year 5. Mobility rides grow in line with GDP and modest market share gains, while Delivery grows slightly faster than rides initially before normalising.

Crucially, no major disruptions hit the business model. Regulators may impose some costs, such as mandated benefits or minor wage floors, but not enough to derail profitability. Competition remains rational. Lyft stays in the game without sparking ruinous price wars, and DoorDash and Uber Eats maintain equilibrium without destructive subsidy battles. Uber’s membership and cross-selling efforts pay off, with 25–30% of users adopting both services (up from ~20% today), improving retention. However, this scenario does not assume a dramatic “new S-curve” from autonomous vehicles. AVs likely remain in pilot modes, contributing only marginally by year 5.

Financial Outcome

Under these conditions, margins expand gradually. We assume EBIT margin reaches the mid-to-high teens (~15–18%) in 5 years, aligning with our long-run base DCF. This is achieved through continued cost discipline, a favourable mix shift toward higher-margin advertising, and economies of scale where G&A and R&D grow slower than revenue. By 2028–2030, Uber could generate ~$10 billion in net income as taxes normalise.

Free cash flow generally lands in the $10–12 billion range annually. The company continues to use this cash for buybacks, primarily to offset stock-based compensation and moderately reduce share count. Valuation implies that market recognition improves, closing the gap between the current price and intrinsic value. The share price would likely appreciate at a rate tracking earnings growth. From current levels, if earnings grow ~30% annually for a few years and then ~15%, the stock could trade in the $110–130 range in 3-5 years. This delivers a satisfactory return of roughly 8–12% annual stock price CAGR, validating Uber as a solid large-cap compounder rather than a hyper-growth story.

Bear Case (20% Probability)

Key Assumptions

In the bear case, several negative factors materialise to hinder growth and compress margins. The primary driver (pun intended yet again) is unfavourable regulation. For instance, the EU has adopted platform-work rules that can increase reclassification risk and compliance burden, but it doesn’t automatically ‘force’ employee status everywhere. The impact will depend on Member State transposition and enforcement. Apart of that, California might revisit gig-worker laws. This would dramatically increase fixed costs (minimum wages, benefits), forcing Uber to either raise prices (hurting demand) or absorb costs (hurting margins).

Competition also intensifies in this scenario. Lyft might claw back share with aggressive pricing, or a tech giant like Google/Waymo could launch a proprietary ride-hailing app tied to its AVs, bypassing Uber’s network. On the delivery side, Amazon could fully enter restaurant delivery, pressuring Uber Eats. These moves of a perfect storm would force Uber to spend heavily on incentives to defend its turf. Macroeconomic troubles, such as a recession or stagflation (high inflation and high fuel prices), could further squeeze the business by dampening ride volume and increasing input costs. In such a climate, revenue growth could slow to low single digits or even stagnate.

Financial Outcome

Financially, the bear case sees compressing or stagnant margins. We assume Uber cannot push EBIT margin beyond ~12% in the long run, and it may slip lower due to cost pressures. Free cash flow would persist (Uber is unlikely to burn cash unless competition is devastating) but it might stagnate around $5–6 billion annually. Management might pare back buybacks to preserve cash.

The stock’s valuation would fall to a lower multiple, reflecting heightened uncertainty and lack of growth. Uber would likely be treated as a “market weight” stock, trading at perhaps 15x forward earnings. In our DCF, the bear case yields a fair value of ~$65 per share. If the market views Uber as ex-growth or margin-capped, the stock could drift into the $50–$60 range, representing a return to pre-2025 levels and underperforming the broader market.

Summary of Scenarios

To recap, our Base Case (55% probability) sees Uber delivering on expectations with strong growth and margin expansion to the mid-teens, resulting in a stock price of ~$120 and market-beating returns. The Bull Case (25%) envisions Uber exceeding expectations through flawless execution or an autonomous revolution, offering a great opportunity with a stock price of $140–$160+. The Bear Case (20%) accounts for regulatory or competitive setbacks that stagnate progress, potentially leaving the stock in the $50–65 range.

We find the risk/reward attractive because the combined probability of the Base and Bull scenarios (80%) significantly outweighs the Bear scenario. Uber’s future will depend on how reality tracks against these assumptions, and we will monitor key indicators (market share, regulatory decisions, and margin trends) to adjust these scenarios as time progresses.

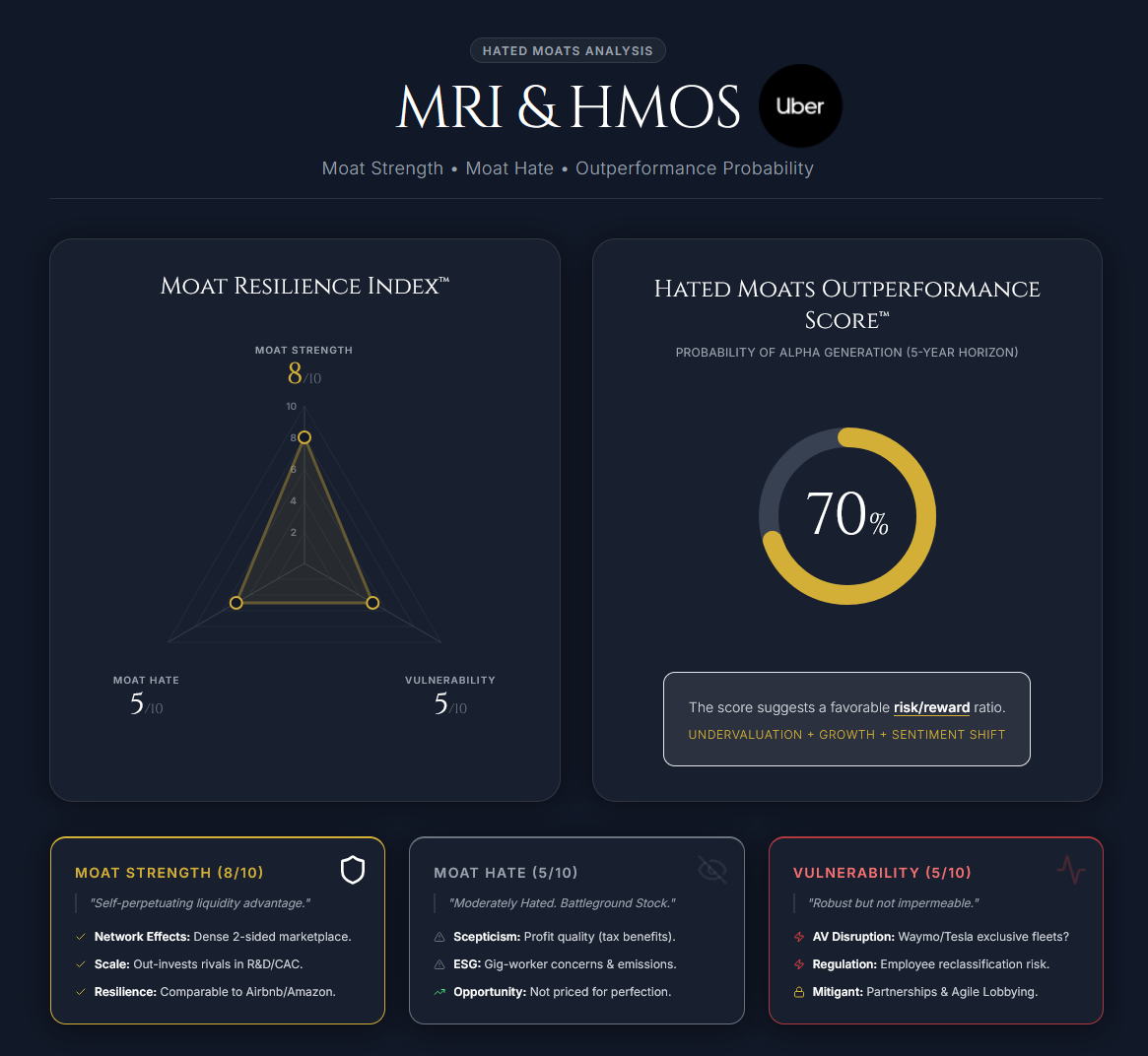

Moat Resilience Index™ (MRI)

WE evaluate Uber’s Moat Resilience Index (MRI) across 3 dimensions (Moat Strength, Moat “Hate”, and Moat Vulnerability), each on a scale of 1 to 10.

Moat Strength: 8/10

Uber’s moat is strong and strengthening as it scales, warranting an 8/10. The company benefits from one of the most powerful network effects in modern commerce. i.e. a dense, two-sided network of riders/drivers and eaters/couriers. This liquidity creates a self-perpetuating advantage. Drivers are attracted to the platform with the most riders, which in turn reduces wait times and attracts more riders. This dynamic makes it incredibly costly for new entrants to gain a foothold.

Uber’s global brand is practically a household name, and its technology (routing algorithms, dynamic pricing, and a decade of mapping data) provides a competitive edge in efficiency and user experience. Furthermore, Uber’s economies of scale allow it to out-invest competitors in R&D and customer acquisition by leveraging a single engineering team and platform across multiple verticals (Rides, Eats, Freight). We have seen this moat in action as smaller rivals like Postmates were acquired or, like Lyft, struggled to match Uber’s global footprint.

We stop short of a perfect 10 because Uber’s moat is, in a way, “soft”, so to speak. It relies on continual execution and already built network and scale rather than a hard barrier like a patent monopoly or government exclusivity. If service quality drops, users can switch apps (multi-homing). However, compared to peers, Uber’s moat is resilient, on par with Airbnb or Amazon’s marketplace. The sheer utility of having a driver or meal available on demand in thousands of cities creates a barrier to entry that is exceptionally difficult to replicate.

Moat Hate: 5/10

We define “moat hate” as the degree to which the market underappreciates or dislikes a company despite its competitive advantages. We assign a 5/10 here. i.e. moderately hated.

For years, Uber was a battleground stock, criticised for cash burn and regulatory clashes. While recent profitability has dissipated some of this sentiment, significant scepticism remains. Value-oriented investors often look at Uber warily. Its GAAP profits have been aided by one-time tax benefits, and its normalised P/E ratio remains high, resulting in poor scores on traditional value metrics. ESG-focused investors also express “hate” regarding the gig-worker model, viewing it as exploitative, or citing concerns over congestion and emissions.

There is also a psychological hangover from the past. Investors burned by the 2019 IPO or the volatility of the pandemic era remain cautious, suspecting that the newfound financial discipline might be fleeting. The recent ~20% stock pullback suggests the market is not yet giving Uber full credit for its turnaround. Uber is not yet a “beloved” compounder like Apple or Microsoft. It remains a “show-me what you showed me, but for the long-term” story. This lingering contrarian angle is a positive for prospective investors. It implies that the stock is not priced for perfection and that upside exists if Uber continues to dismantle the bear case.

Moat Vulnerability: 5/10

This metric measures susceptibility to erosion or disruption. We assign a 5/10 here, indicating a medium level of vulnerability.

Uber’s incumbency is robust. It is unlikely a standard startup could displace it. However, credible threats exist. One mentioned loudly recently is technological disintermediation via Autonomous Vehicles (AVs). If players like Waymo or Tesla perfect self-driving technology and choose to operate exclusive fleets rather than partnering with Uber, they could bypass Uber’s network entirely. This would fundamentally alter the supply side of the equation.

Regulatory risk, as we described above, is another vector of vulnerability. If major markets pass laws requiring drivers to be classified as employees, it could drastically increase operating costs and fragment the network. Consumer preference shifts, such as a move toward decentralised transport or public transit, could also chip away at demand. The fact is, low switching costs remain a factor as well. Riders and drivers often use multiple apps to find the best price or earnings. While few competitors can currently afford the subsidies required to undercut Uber significantly, the lever remains available to any deep-pocketed entrant (and if you combined a deep pocket + AVs, i.e. Tesla and Google, they could create a significant problem for Uber, if they really wanted).

A 5/10 score reflects that while the moat is resilient against direct copycats, it is not impermeable to structural shifts in technology (AVs) or regulation. Uber must remain agile (investing in AV partnerships and lobbying effectively) to keep this vulnerability in check. Personally, with the scale, cash it generates, legacy it possesses and competent management, we believe the lobbying part (regulations, laws) and partnerships (Waymo, maybe even Tesla at some point) will be executed to “well enough” stage where Uber does not lose a significant portion of its moat.

Hated Moats Outperformance Score™ (HMOS)

Hated Moats Outperformance Score is an overall measure of the company’s chances of outperforming the market over 5 years. We place this at 70%, reflecting a strong likelihood of generating alpha.

This confidence is driven by three factors. Firstly, there is undervaluation: We see ~25% upside to fair value, providing a margin of safety and a head-start on returns. Secondly, there is superior growth. Uber’s expected earnings growth (~30% near-term, settling into teens) far outpaces the mid-single-digit growth expected from the broader market. This differential is a primary driver of long-term stock appreciation and partially an answer to why it’s worth the risk compared to broad market investment. Last but not least, there’s the sentiment shift. Uber is transitioning from a “hated” cash-burner to a profitable large-cap. As it enters more indices and attracts institutional capital that requires GAAP profitability, the stock can experience a persistent re-rating.

While we acknowledge a ~30% risk of underperformance (due to the regulatory and competitive risks discussed), the odds favor Uber. Even in our base case, we foresee a double-digit CAGR for the stock, compared to the likely 5–7% returns for the S&P 500. The “Hated Moats” philosophy seeks quality companies that are temporarily unloved. Uber fits this profile perfectly. As the market continues to warm to its recurring revenue and free cash flow profile, we expect the valuation gap to close, driving outperformance.

Conclusion

Uber Technologies has transitioned from a high-growth cash burner into a disciplined, free-cash-flow-generating enterprise with a durable competitive advantage. The company’s fundamentals are on a sharply positive trajectory. We see robust revenue growth (~20% YoY recently) and broad-based, profitability has materialised with expanding margins. Uber now gushes billions in free cash flow which management is returning to shareholders via a very large buyback programme. Uber’s once-questioned business model has proven its viability. Network scale and operating leverage are turning past losses into substantial profits. Crucially, Uber’s competitive moat (its vast network of riders, drivers, and partnered merchants) appears intact and even strengthening through ecosystem effects like Uber One membership and cross-platform usage.

Despite these strengths, the market’s recent reaction (a pullback to ~$80) indicates lingering caution. We view this pullback as an opportunity. Our intrinsic value estimate is ~$106/share, suggesting the stock is undervalued by roughly 25%. In relative terms, Uber’s current valuation (~3× sales, ~20× FCF) does not look demanding for a company with Uber’s growth and improving margins, especially when compared to other platform peers. The risks we’ve analysed (chiefly regulatory and competitive/disruptive) are real but, in our opinion, manageable. Uber has navigated regulatory minefields in the past (often finding compromise solutions), and it has shown it can compete effectively, exiting un-winnable battles and doubling down where it leads. We don’t expect the identified risks to overturn Uber’s fundamental progress in the next few years, although investors should observe them closely.

We have laid out, as usually, 3 scenarios. In our Base Case, Uber continues executing and rewarding shareholders. In our Bull Case it exceeds expectations dramatically (with potentially large upside), and only in a Bear Case do we see the stock materially lagging, which we assign a lower probability. The probability-weighted outcome leans clearly in favour of reward over risk. Additionally, our Moat Resilience analysis suggests Uber’s moat is indeed resilient and the market is still adjusting to that reality. Is that a good recipe for alpha generation as perception catches up with reality? We believe it is.

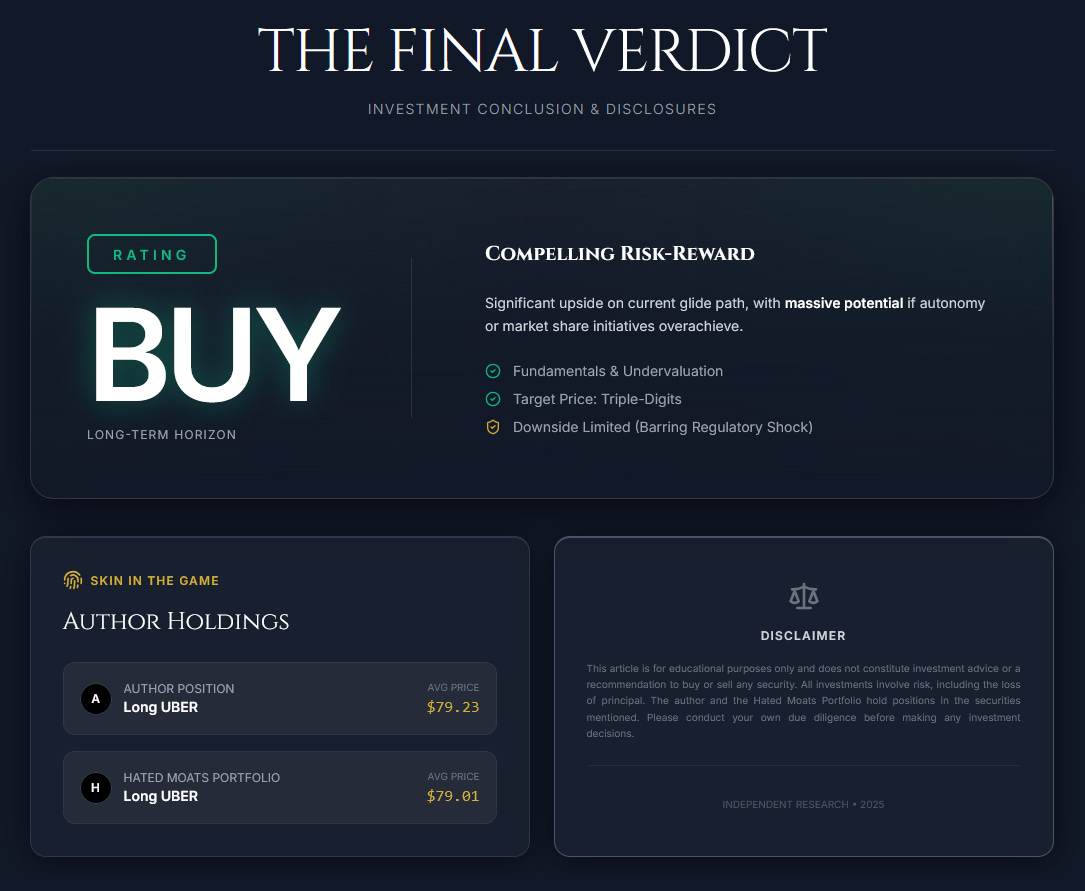

Final Verdict

Investment Verdict: BUY.

Considering all of the above, our verdict is a BUY for the long-term investor. We stop short of the most extreme “Strong Buy” label only because of the remaining external risk factors and the stock’s volatility, but our conviction is high that Uber will outperform and generate solid returns from current levels. In plain terms, Uber’s stock offers a compelling risk-reward trade-off. There is significant upside if the company simply stays on its current glide path, and potentially massive upside if it overachieves on any front (e.g., autonomy, market share gains), against a downside that appears limited barring a major regulatory shock.

Uber’s fundamentals and undervaluation make it a compelling purchase for investors seeking a combination of growth and improving profitability, with a target price in the triple-digits and a long runway for further appreciation.

Disclaimer & Our Investment

The author of this article does hold a position in the security of Uber Technologies, Inc. (UBER) with average price of $79.23 per share. UBER is also part of our Hated Moats Portfolio with avg price of $79.01 per share. This article is for educational purposes only and does not constitute investment advice or a recommendation to buy or sell any security.

Final words

Uber today presents an attractive investment proposition. A leader in a growing industry, with improving profitability metrics (e.g. Adjusted EBITDA up ~30%+ YoY, Delivery segment profitability improving sharply, and operating cash flow at record levels), shareholder-friendly actions (aggressive buybacks, signaling confidence), and a clear path to further earnings growth through margin expansion and top-line momentum. It’s rare to find a company that offers both growth and value characteristics at scale. Uber is approaching that sweet spot as it sheds its “cash burn” past and starts resembling a cash-generative platform utility.

For a time, Uber was “hated” by the market. That sentiment is evolving. However, we believe there is still some disconnect between Uber’s world-class fundamentals and its market valuation. As that gap closes, shareholders stand to benefit handsomely. With a wide moat around its business and the market’s view only gradually shifting from scepticism to acceptance, Uber exemplifies a Hated Moat turning into a beloved franchise. Our analysis indicates that those who invest at today’s prices are likely to be rewarded over the next 3-5 years, as Uber cements its status as the premier platform for on-demand mobility and delivery in the modern economy. Therefore, we confidently issue a Buy recommendation on Uber, with an expectation for the stock to outperform the broader market and deliver strong shareholder value in the coming years.

Thank you! Good balance of arguments!

The regulatory moat vulnerability analysis is spot-on. What's interesting is how Uber's turned past regulatory battles into actual strength - Prop 22 is basicaly a template they're exporting to other markets. The AV aggregation strategy is smarter than most give credit for; instead of burning capital building robotaxis, they're becoming the orchestration layer. I ran some quick math on the FCF progression and if they hit even conservative 15% EBIT margins atscale, the buyback capacity gets ridiculous. The one thing I'd push back on is the bear case probability - regulatory risk feels overweighted. Most jurisdictions are realizing killing the gig model hurts workers more than helps them.